Falcon Finance June Update: Miles Program, Growth & Partnerships

Updated • 15 Aug 2025

Published • 2 Jul 2025

8 mins

June was a big month for USDf and the Falcon ecosystem, with strong momentum across supply growth, product upgrades, DeFi integrations, community campaigns, and AMAs that kept the conversation flying.

Here’s a quick look at what we built, launched, and learned, and where we’re headed next.

USDf & Product Updates

Two months ago, Falcon Finance opened to the public, making it easy for anyone to mint and redeem USDf. Any user can easily acquire USDf off major DEXes and stake USDf to earn competitive yields with sUSDf.

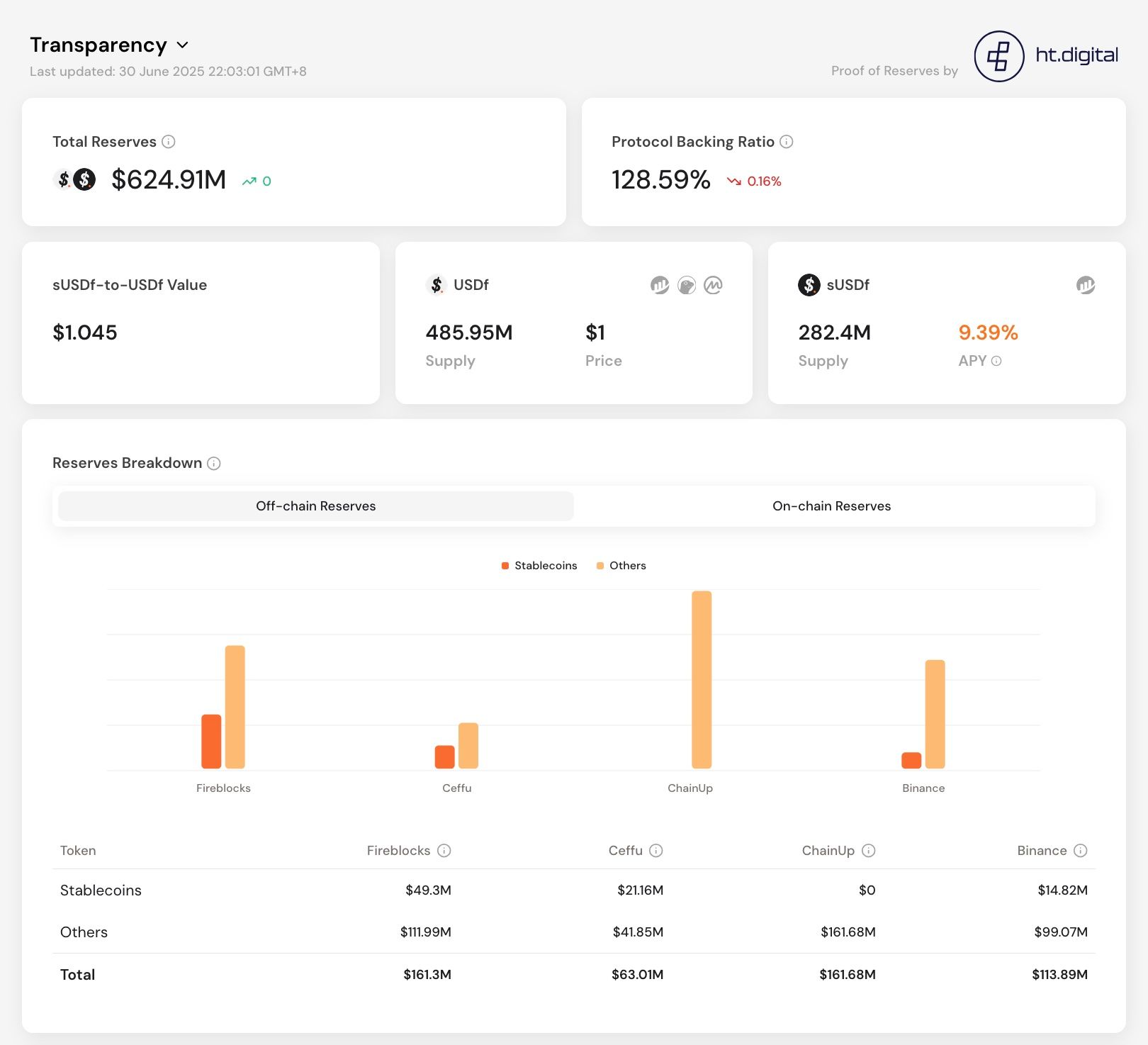

Now, let’s take a quick snapshot of USDf and sUSDf to check in on growth, yield, and overall protocol progress.

.png)

- USDf supply jumped 20.7% month-on-month, crossing $500M earlier this month and now sitting at $530.47M.

- Total backing is $624.9M, with an overcollateralization ratio at 15.62%.

- sUSDf is yielding 9.39% APY, with its value steadily rising to $1.045 over the past month, reflecting consistent yield accrual and healthy compounding returns.

.png)

USDf is ranked #5 on CoinGecko yield-bearing stablecoins category, and one of the fastest-growing stablecoins and synthetic dollars, with over 159.7% market cap growth since our public launch on April 30.

.png)

sUSDf, the yield-accruing token for USDf, ranked #4 among all stablecoins on StableWatch over the past 30 days, with $2.21M in yield paid out (YPO) to stakers.

Onchain Transparency and Reporting Infrastructure

We’ve partnered with HT Digital to independently verify the data shown on the Transparency Dashboard, which provides daily updates on USDf’s overcollateralization.

Coming next:

Quarterly attestation reports will be conducted by Harris & Trotter LLP under the ISAE 3000 Assurance standard, reviewing reserve sufficiency, data integrity, and internal controls.

Mint or Swap USDf, Now Smoother Than Ever

.png)

Getting your hands on USDf just got much easier. Cleaner UI. Smoother flow. Smarter choices.

The easiest way to get USDf is simply swap on DEXs. No minimum amount needed.

For those who prefer to mint, Falcon offers 2 strategic paths:

- Classic Mint (min $10k) Need liquidity now? Mint USDf, stake for yield, and keep trading

- Innovative Mint (min $50k) Bullish but cautious? Lock collateral, get liquidity, and still benefit if price rise

Falcon Miles Pilot Season Is Live

.png)

This first chapter rewards early believers, those ready to go the distance and stack rewards that truly fly. Every action counts, every Mile is earned.

- Mint, hold, swap, or stake USDf → sUSDf

- LP on Uniswap, Curve, Balancer, PancakeSwap, Bunni

- Refer friends

$1 of value = 1 Mile, with up to 40× multipliers on select actions.

Check out the full blog for details.

Ecosystem Growth & Partnerships

A core focus of the Miles program is rewarding DEX liquidity providers and DeFi partners for helping grow the Falcon ecosystem. USDf trading pairs now hold over $32.8M in TVL across five DEXs, up 64% just one week after the Falcon Miles Pilot Season launched.

.png)

Falcon x Euler Frontier: Unlocking New Capital Efficiency

.png)

Euler Frontier is a permissionless, ungoverned lending infrastructure built to support the growth of stablecoins and their derivatives.

You can access the vaults here to supply collateral (USDf, sUSDf, or PT-sUSDf) and borrow USDC.

This integration unlocks powerful new synthetic dollar strategies:

- Stay Liquid While Earning: Supply sUSDf or PT-sUSDf as collateral and continue earning passive yield or fixed return.

- Borrow Without Selling: Use your synthetic dollars as collateral to borrow USDC for other strategies.

- Loop or Deploy: With capital unlocked, you can mint or swap for more USDf, provide liquidity, or explore Pendle strategies.

GHO / USDf Pool Now Live on Balancer

.png)

The GHO/USDf pool went live on Balancer V3, offering a capital-efficient stablecoin pair with enhanced peg stability via Balancer’s Stable Surge Hook. Liquidity providers earn triple-layered rewards: Aave lending yields, swap fees, and boosted incentives via Aura Finance (initial APY between 59–110%). All capital is actively deployed in Balancer Boosted Pools for continuous compounding. Users can participate by depositing liquidity on Balancer and staking LP tokens through Aura.

Custody Integration with BitGo for USDf

.png)

We’ve partnered with BitGo to provide secure custody for USDf, Falcon’s overcollateralized synthetic dollar. This integration gives institutional users access to trusted, regulated infrastructure to hold USDf in BitGo wallets, while setting the stage for future features such as staking through ERC-4626 vaults and fiat settlement.

Community & Campaigns

Growing with our community has been one of the most rewarding parts of our work. We ramped up efforts to engage and reward content creators, DeFi gigabrains, and ecosystem contributors through campaigns and initiatives.

Falcon Flyers

.png)

In June, our main community initiative was Falcon Flyers, and we’re grateful for the warm response so far. A big thank you to everyone who has already joined, and the door remains open to new falcons.

We’re calling on crypto creators, storytellers, and visionaries, people who believe in building a more accessible DeFi and sustainable yield. If that’s you, apply to join the first cohort here.

Benefits include:

- Referral rewards and additional incentives, including up to 15% (vs. 10%) Miles bonus

- Recognition within the Falcon ecosystem

- Direct connection with the Falcon team

- Access to VIP events

- Exclusive Falcon swag

Media Engagement & AMAs

While IRL events were few in June, our core team joined several X Spaces and online interviews that sparked meaningful conversations. We were also quoted in crypto media, contributing commentary on key market trends.

GENIUS Act Makes Stablecoin Issuers “Key Players”

In a commentary to Cointelegraph, Andrei Grachev, managing partner at Falcon Finance, said treasury-backed stablecoins could boost institutional confidence for settlements and payments:

“If issuers start holding large amounts of Treasurys, that changes their role from niche instruments to key players in the economy.”

Coinbase Eyes Tokenized Equities Amid Regulatory Shift

In a comment to Investing.com on Coinbase’s push to offer tokenized equities, Andrei noted the move signals that these assets are entering regulated market structure: “Regulated tokenized securities will need the same support as digital dollars: liquidity depth, real-time pricing, and operational resilience.”

Ripple’s RLUSD Signals the Rise of Sovereign-Grade Stablecoins

In a comment on Ripple’s stablecoin RLUSD – now being integrated into Dubai’s land registry – Andrei said the move marks a pivotal shift in how stablecoins are perceived at the state level:

“What we’re seeing with RLUSD goes beyond just hitting a regulatory milestone, it’s actually a real-world test of whether a privately issued stablecoin can function as sovereign-grade infrastructure.”

Stablecoin Innovation Takes Shape Worldwide

In a comment to U.Today, Falcon's Partner Lingling Jiang, who is also a Partner at DWF Labs, said the entry of traditional banks into stablecoins marks more than product evolution, it’s a fundamental shift in financial infrastructure:

“When commercial banks issue stablecoins, they’re effectively creating digital versions of deposits that can move instantly, settle globally, and operate outside the usual banking rails.”

Andrei Grachev on Falcon’s Vision

.png)

Andrei joined Mario Nawfal for an hour-long interview, where he shared insights into why Falcon Finance was created and what sets it apart.

Most stablecoins mirror TradFi, either pegged to T-bills or chasing basis trades, but none capture crypto’s actual performance. USDf changes that.

You can watch the full interview here.

Stability Meets Strategy in the Synthetic Dollar Layer

.png)

USDf is a synthetic dollar you can hold for stability or stake to earn competitive, sustainable yield. In a recent AMA with Cryptic Talks, Andrei explained Falcon’s mission to build a fixed-income layer for crypto.

Falcon’s yield strategy combines CeFi and DeFi to generate delta-neutral yield at scale, using funding rate arbitrage, altcoin staking, onchain LPs, and OTC execution, with yield flowing back to USDf stakers. Here's the full recap.

Unlocking Sustainable Yield with Synthetic Dollars

.png)

Falcon Finance was recently invited to a Chinese-language X Space hosted by Bitget Wallet CN. Our Partner Lingling Jiang, who is also a Partner at DWF Labs, joined fellow guests 猴叔 and 杰克李 for a deep dive into the evolution of synthetic dollars and the challenges of delivering consistent yield in Web3.

Nearly 7,000 listeners tuned in. If you speak Chinese and missed it, you can catch the recording here.

Deep DeFi Talks with Falcon

.png)

JHsu, who leads Partnerships at Falcon Finance, also joined a series of X Spaces with DeFi gigabrains deep in the trenches, including sessions with StakeDAO and StakeStone.

In the session with StakeDAO, topics included:

- The inside scoop on the Curve wars

- How StakeDAO’s Votemarket works

- How Falcon is using incentives to grow USDf liquidity

In the chat with StakeStone, the discussion unpacked:

- The evolution of stablecoins

- Real-world use cases

- What the future holds for synthetic dollars

What’s Next?

We don’t usually do announcements of announcements, but July’s looking exciting. You can expect things like expanded Miles rewards across DeFi, from yield tokenization and money markets to bribe aggregators, plus new campaigns and rewards for content creators (yappers, perhaps?), and cross-chain deployment for USDf. More ways to earn, grow, and fly with us!