Falcon Finance Launched the SPYx Staking Vault: Earn Yield on Top of S&P 500 Exposure

Published • 18 Feb 2026

4 mins

Falcon Finance has expanded its lineup of staking vaults with the launch of the SPYx vault, designed to help put onchain holdings of the most popular stock index, S&P 500, to earn additional returns onchain. Rewards are distributed regularly in USDf, Falcon’s synthetic dollar, bringing stability to the yield process.

The SPYx vault stands apart from other Falcon vaults like AIO, VELVET and ESPORTS because it targets a traditional market benchmark exposure rather than crypto-native assets. This enables SPYx token holders to earn additional yield on top of their underlying exposure.

SPYx Staking Vault’s Key Parameters

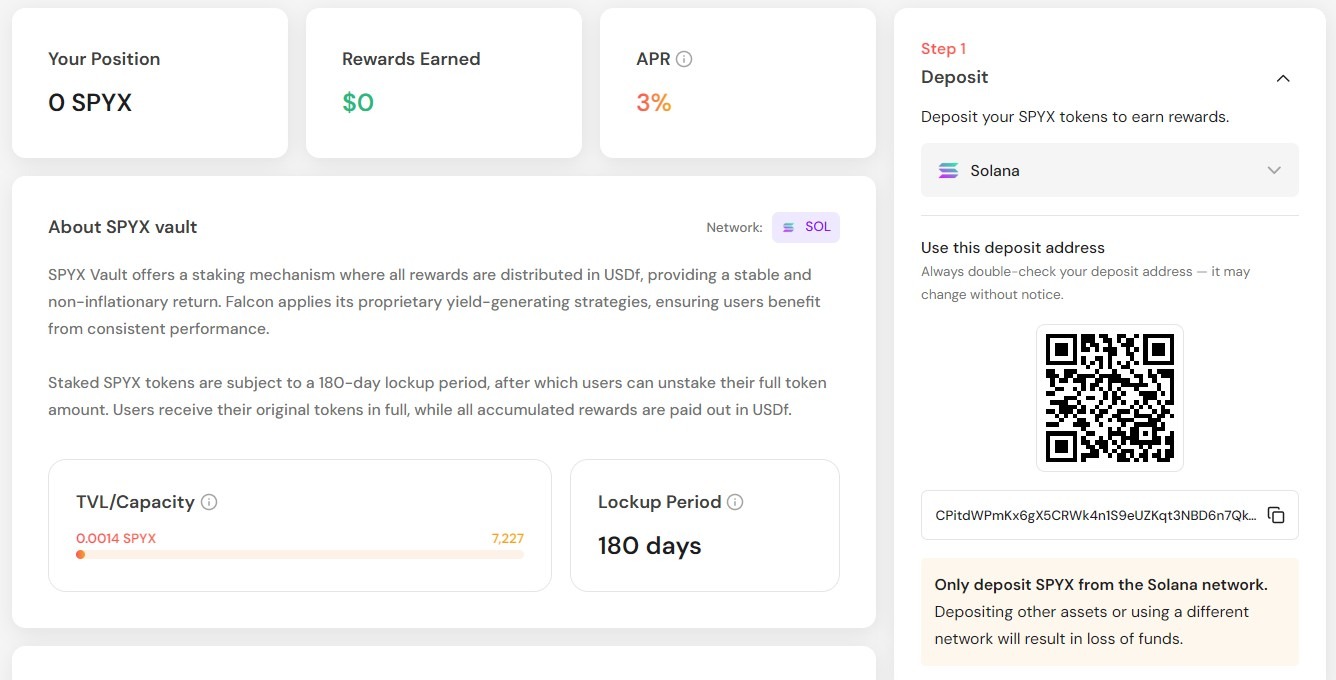

The initial SPYx vault parameters include:

- Projected APR: 3% (can vary)

- Rewards token: USDf

- Base asset: SPYx

- Lockup period: 180 days

- Network: Solana

- Access: all users that passed KYC in Falcon Finance, with expanded access in the coming weeks.

Tokenized SPDR S&P 500 ETF (SPYX) Explained

SPYx is powered by xStocks, a framework developed by Backed for bringing tokenized versions of popular stocks onchain. Backed issues tokenized products that track the value of base assets, so that they become transferable across various blockchains while operating within a compliant regulatory structure.

SPYX is essentially a tokenized SPDR S&P 500 ETF, one of the most popular exchange traded funds from State Street, with a total market capitalization of over $700 billion, as of February 2026. It’s designed to track the performance of the S&P 500 Index, which represents about 500 large U.S. companies across major economic sectors.

SPYX tokens are issued by Backed on several blockchains. Falcon Finance accepts deposits on Solana, with plans to expand to the Ethereum ecosystem as demand grows.

How the SPYx Staking Vault Works

To participate in the SPYx staking vault, first connect a Web3 wallet with your SPYx tokens to the Falcon Finance app. After connecting, the vault’s page displays a dedicated Solana deposit address where you need to transfer SPYX tokens. Once the funds arrive, the deposit is recognized and the position is staked. You can monitor your principal on the Portfolio page.

With the deposit complete, the staked assets are locked for 180 days. During this period, you maintain your underlying SPYX exposure while the vault generates rewards, which accumulate over time, paid out in USDf and can be claimed regularly. The total amount of accrued rewards is available on the vault’s page.

The SPYx staking vault’s page. Source: Falcon Finance

This structure adds a stable, non-inflationary yield layer on top of long-term S&P 500 market exposure, without requiring users to exit their position.

At the end of the lockup, the original SPYX is returned in full upon unlock.

SPYX Yield Calculation Example

Here’s a hypothetical scenario to illustrate how a 3% APR could translate into USDf rewards over the 180-day lockup:

- Deposit value (SPYX): $10,000

- Projected APR: 3%

- Lockup duration: 180 days (a bit less than half of a year)

With these parameters, estimated rewards will be:

$10,000 x 3% x (180 / 365) = ~148 USDf (~$148)

As with other staking vaults in Falcon, real outcomes can vary based on the vault’s terms and conditions and any updates to projected rates.

Closing Thoughts

With the SPYX staking vault, Falcon Finance is extending its approach to making every asset work beyond cryptocurrency, into the emerging space of real-world assets (RWAs). The thesis is simple: tokenization turns traditionally static TradFi instruments into programmable, yield-bearing building blocks. For holders who want long-term exposure to benchmarks like the SPDR S&P 500 ETF, it opens a new path to earn returns without selling the underlying assets. It means investors can keep their principal exposure to broad equity markets while adding a separate, USDf-denominated reward stream on top.