Falcon x Euler Frontier: Unlocking New Capital Efficiency

Updated • 15 Aug 2025

Published • 17 Jun 2025

3 mins

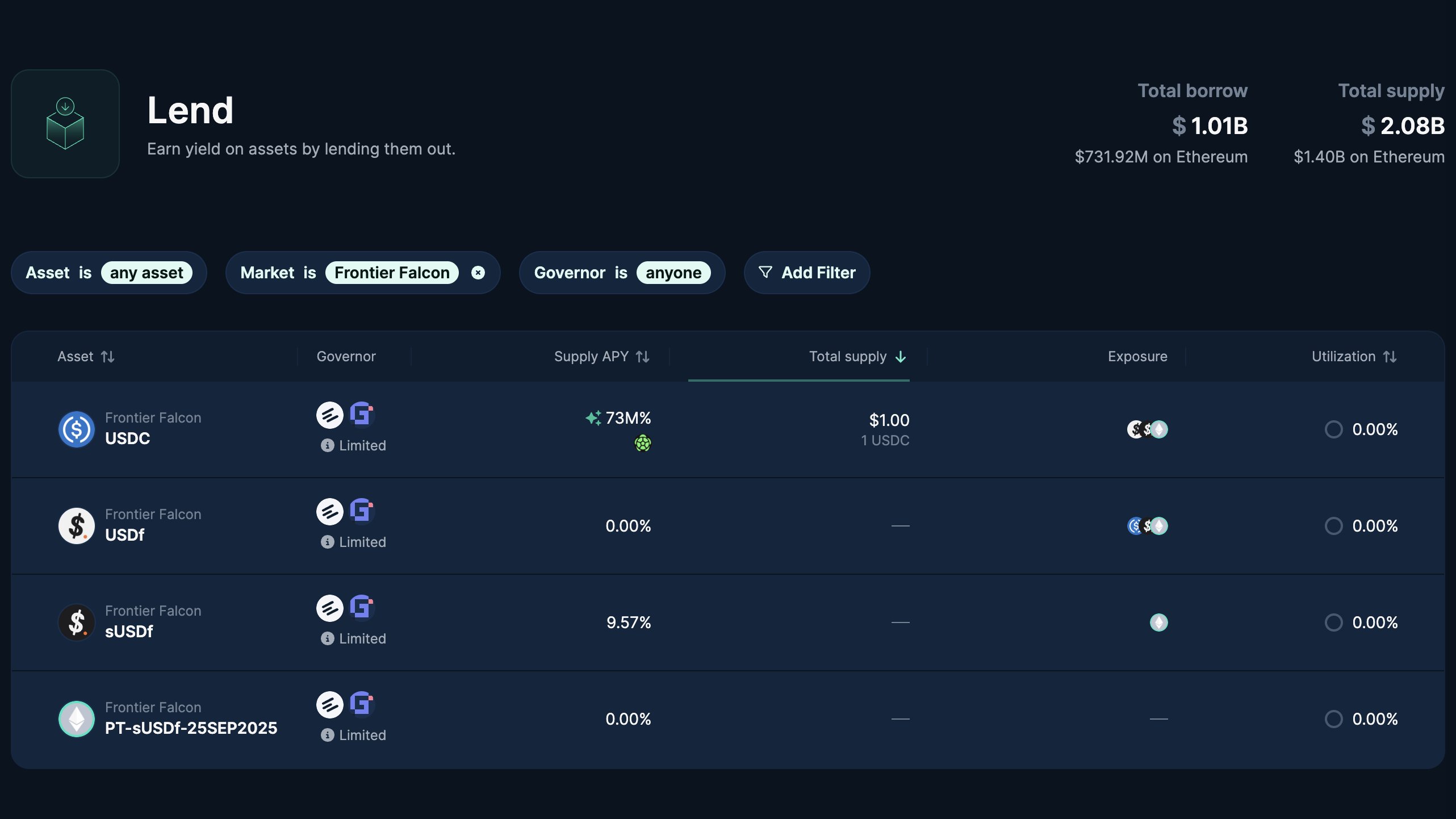

Falcon Finance's USDf, sUSDf, and PT-sUSDf are now live on Euler Frontier, a new lending infrastructure built for yield-bearing stablecoins. This integration gives you a powerful new way to earn yield, stay liquid, and use stablecoins more efficiently than ever before.

What is Euler Frontier?

Euler Frontier is a permissionless, ungoverned lending infrastructure built to support the growth of stablecoins and their derivatives.

It serves as a template for launching isolated, risk-contained markets centered around a single stablecoin, enabling:

- Support for stablecoins and their yield-bearing derivatives (like PTs)

- One borrowable blue-chip asset: USDC

- Risk-isolated vaults with LTV ratios of 91–95%

- Adaptive interest rates and robust oracle feeds

- Hybrid lending + swapping functionality powered by EulerSwap

For protocols, Frontier offers faster asset listings, incentive containment, and up to 50x lower cost of capital for DEX liquidity. For users, it enables capital-efficient borrowing and yield strategies with isolated risk.

Unlike traditional lending protocols where all assets share risk in one pool, Frontier vaults are siloed – giving stablecoin issuers and users more flexibility, safety, and control.

Falcon Assets: USDf, sUSDf, and PT-sUSDf

- USDf is Falcon’s overcollateralized synthetic dollar, minted using 20+ supported crypto assets including stablecoins and blue chips. It’s designed to be stable and composable across DeFi.

- sUSDf is the staked version of USDf. You can stake USDf to earn passive yield through Falcon’s delta-neutral strategies, recently in the 8–12% APY range.

- PT-sUSDf is the Principal Token you receive when splitting sUSDf via Pendle. It does not accrue yield, but it can be bought below face value and redeemed at full value upon maturity, locking in a predictable fixed return.

What’s Live Now?

You can access the vaults here to supply collateral (USDf, sUSDf, or PT-sUSDf) and borrow USDC.

This integration unlocks powerful new synthetic dollar strategies:

- Stay Liquid While Earning: Supply sUSDf or PT-sUSDf as collateral and continue earning passive yield or fixed return.

- Borrow Without Selling: Use your synthetic dollars as collateral to borrow USDC for other strategies.

- Loop or Deploy: With capital unlocked, you can mint or swap for more USDf, provide liquidity, or explore Pendle strategies.

Sample Strategy: Looping on Euler Frontier

- Stake USDf → sUSDf

- Supply sUSDf as collateral on Frontier

- Borrow USDC

- Mint/swap for more USDf → stake again → repeat

This strategy lets you stack both yield and Falcon Miles, all while staying liquid.

Early Vault Incentives Are Available

Incentives are now live for early explorers, thanks to our joint support with Euler via Merkl. You might notice a little extra rewards in your vault activity!

Final Thoughts

Falcon’s integration with Euler Frontier opens the door to more dynamic, capital-efficient stablecoin strategies. Whether you're looking to earn, borrow, loop, or build, this is a major step forward in how you can get more out of every dollar in DeFi.

Tags