Guide to Earning Miles: Adding Liquidity to DEX Pools

Published • 22 Aug 2025

9 mins

Since Falcon launched the Miles program, many joined to earn rewards by using the app and benefit from its earning opportunities. However, Falcon is not limited to one application: it has partnered with multiple recognized DeFi protocols, expanding the ecosystem with more opportunities for yield generation and earning Miles.

This guide walks you through liquidity pools, participating in which earns you Falcon rewards: the list of protocols, their technical specifics and a step-by-step process of liquidity provisioning.

Liquidity Provisioning in a Nutshell

Liquidity provisioning is a true backbone of DeFi: when you add tokens to a pool on a decentralized exchange (DEX), you help other users trade. In return, you receive LP tokens and a share of fees. Most pools require depositing both tokens in the pair at similar dollar values.

To provide liquidity in a basic pool setup, you should supply an equal amount of both assets in a pair. Let’s say a pool for ETH/USDC offers to exchange 1 ETH for 4,000 USDC. Thus, to provide liquidity to this pool, you will need to supply both assets, e.g. 1 ETH and 4,000 USDC (or 0.1 ETH and 400 USDC).

Where to Check Liquidity Provisioning Opportunities for Falcon

Check the Miles page on the Falcon Finance website to see:

- Current options that qualify for Miles.

- Multipliers for each activity.

- Daily and total Miles you’ve earned, across activities.

Because there are no traditional user registrations in Falcon, and the profile is created by simply connecting a wallet, we recommend using a single blockchain address for earning Miles: it makes it much easier for you to track rewards.

USDf Pools You Can Use to Earn Miles

There are multiple liquidity pools for Falcon Finance’s USDf synthetic dollar on popular DEXs, all of which include Miles rewards with a 40x multiplier:

- Uniswap.

- PancakeSwap.

- Balancer.

- Curve.

- Bunni.

Let’s break every platform down below for a step-by-step guide on how to start earning returns on liquidity and Miles at the same time.

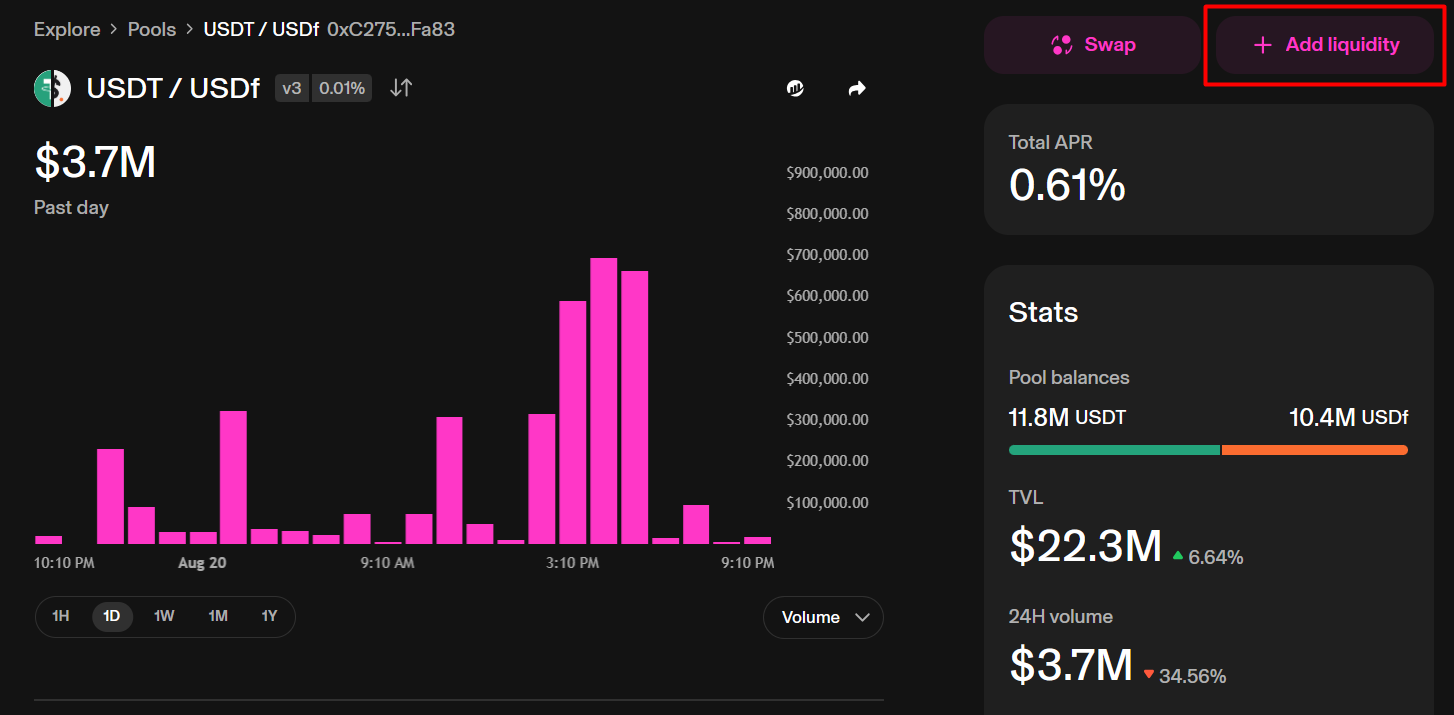

Uniswap: USDT/USDf

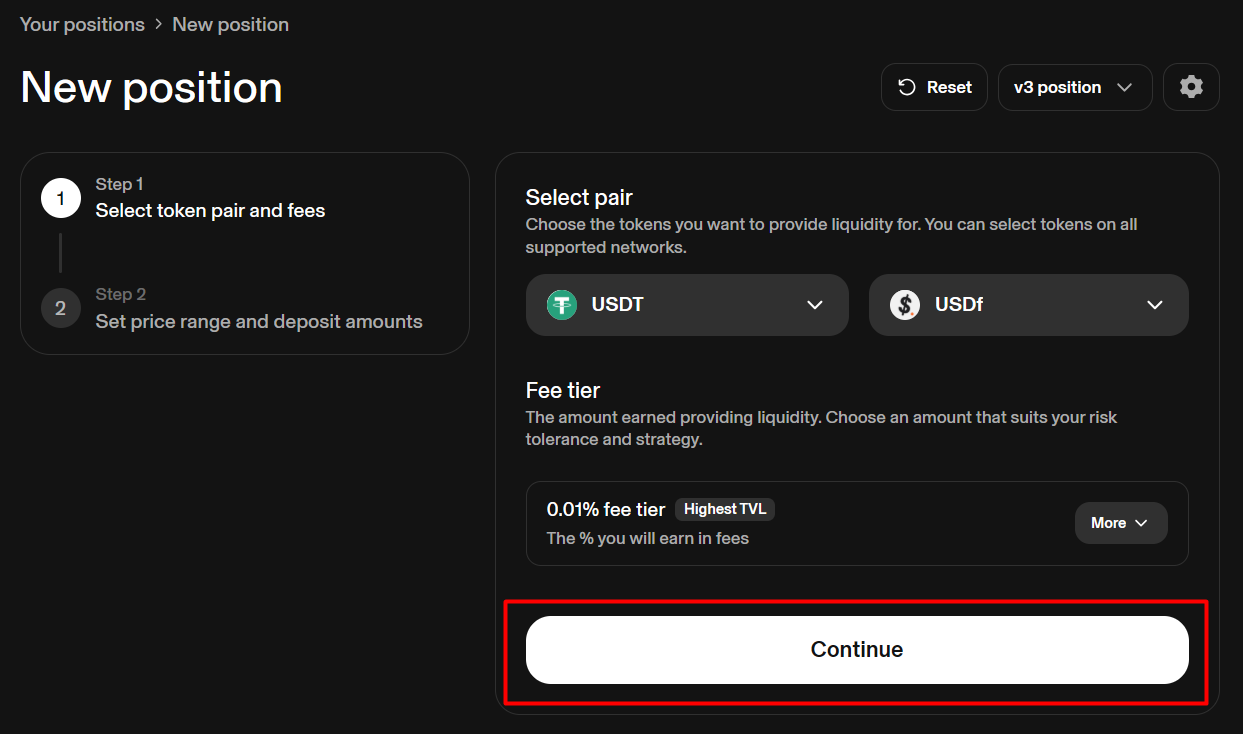

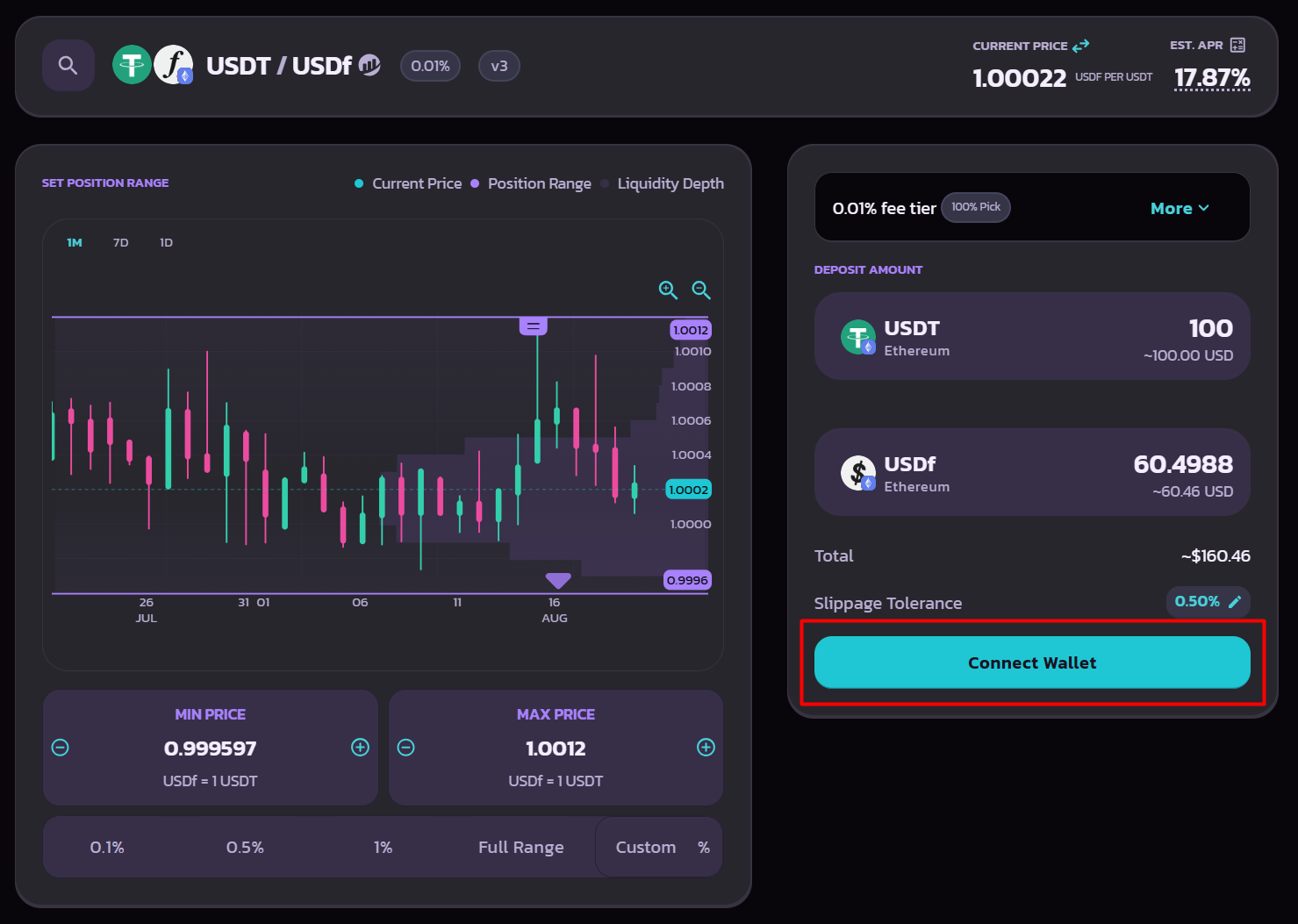

On Uniswap, the USDT/USDf liquidity pool is eligible for Miles. To begin, open the pool page and choose “Add Liquidity” in the top right.

You’ll be taken to the page for creating a new position. Defaults are applied, so choose “Continue.”

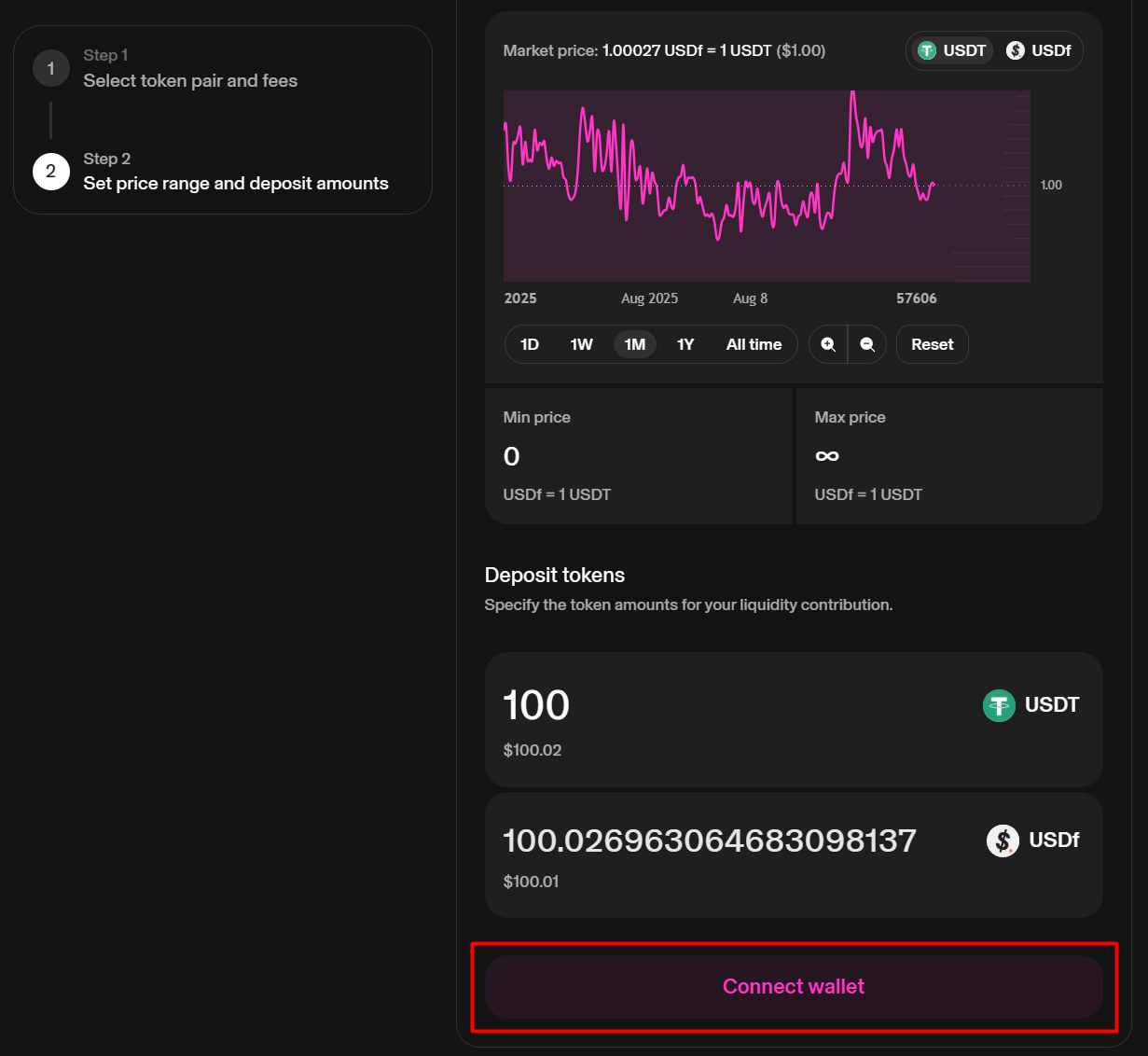

On the next page, set a price range. 40x Miles are earned for liquidity provided within the 0.95-1.05 range. Full-range liquidity earns 20x Miles. Partial ranges outside 0.95-1.05 do not earn Miles. Then scroll down to enter the amounts of both tokens you want to deposit.

Remember that on Uniswap, you need to supply both tokens, USDT and USDf, in the pool. You don’t have to calculate the ratio yourself: after you enter the amount for one token, the app automatically sets the matching amount of the other.

Since USDT and USDf are both designed to stay near $1, you’ll usually deposit roughly equal amounts of each. For example: 100 USDT + 100 USDf, together worth about $200.

At this step, either connect your wallet or confirm the transaction. Once done, your position in the pool is created. You can track it in your Uniswap profile, along with any fees earned. You may also add more liquidity or withdraw at any time.

After you connect the same wallet to Falcon Finance, the position will show up on the Miles page. There, you can see both your daily Miles earned and the total Miles accumulated.

Yield Amplification for Uniswap

Falcon has launched an additional rewards campaign on Merkl to support liquidity in Uniswap’s USDT/USDf pool. On top of the usual trading fees, LPs can receive extra USDf tokens.

To take part in the campaign, no extra actions are required beyond adding liquidity to the pool. You only need to hold your LP tokens: connect your wallet to Merkl, and use the dashboard to view and claim the additional rewards.

USDf Pools in PancakeSwap

Unlike Uniswap, PancakeSwap offers not just one but three USDf liquidity pools:

Let’s take the USDT/USDf pool on Ethereum as an example. Like Uniswap, it requires supplying both USDT and USDf. Open the pool page and click “Add Liquidity” to start. Miles are calculated based on your LP range: 40x for liquidity in the 0.95-1.05 band, 20x for full-range, and no Miles for partial ranges outside 0.95-1.05.

On the next page, enter the amount for one token. PancakeSwap will automatically calculate the required amount of the other. When ready, connect your wallet and confirm the transaction.

How to Move USDf from Ethereum to BNB Chain

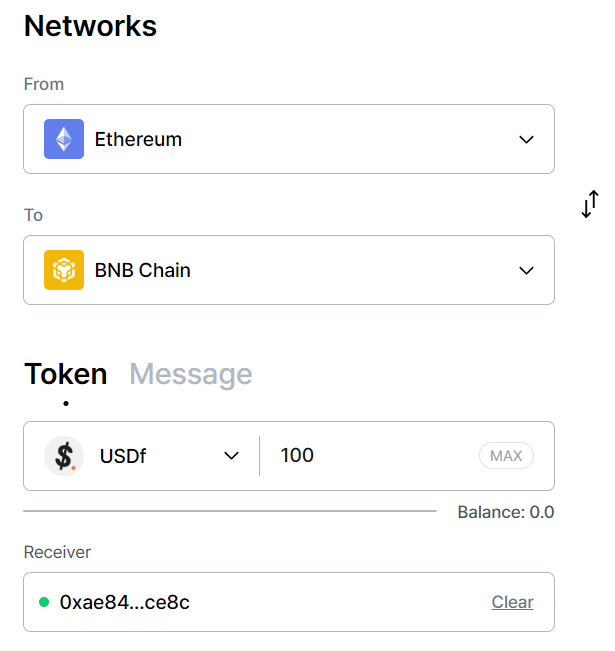

While the process for adding liquidity is the same, the USD1/USDf and USDT/USDf pools on BNB Chain require your tokens to be on BNB Chain before you can provide liquidity.

Here is the setup you should follow:

- Wallet/network: MetaMask supports BNB Chain. Enable/switch to BNB Chain in networks.

- Stablecoins: Hold USDT or USD1 on BNB Chain (available on major exchanges).

- Gas: Hold a small amount of BNB for fees.

- USDf on BNB Chain: Use Transporter

- From Ethereum → To BNB Chain

- Asset: USDf → set the amount

- Connect wallets on both sides and confirm.

Once your tokens are on BNB Chain, repeat the Add Liquidity steps for USD1/USDf or USDT/USDf on BNB Chain.

Yield Amplification for PancakeSwap

Similar to Uniswap, you can earn extra USDf tokens on Merkl by supplying liquidity to either of the pools on PancakeSwap, specifically:

To qualify for extra rewards on Merkl, you just need to make sure your position follows the eligibility rules shown on that campaign’s page. Connect the wallet address with LP tokens to the protocol, and claim the Merkl rewards on the dashboard page.

Supplying Liquidity to Balancer

Balancer hosts the USDf/aGHO boosted stable pool (Balancer V3). aGHO is a stablecoin issued through Aave, backed by collateral that users supply to the protocol.

Click “Add Liquidity” on the pool page to start creating your position:

In the next window, you will need to choose either Flexible or Proportional type of creating an LP position:

- Flexible: You deposit only one token (easier). The pool rebalances by swapping internally, which can introduce slippage or extra fees.

- Proportional: You deposit both tokens at the pool’s current weights. It’s more efficient because no internal swap is needed.

Yield Sources

In Balancer, swap fees are only one part of the yield. For the GHO/USDf pool, liquidity providers also receive staking incentives paid in GHO and BAL (Balancer’s native token). Additional yield comes directly from GHO incentives. APR can be raised further if you boost your position with veBAL tokens or deposit onto the Pendle GHO/USDf market.

Yield Amplification for Balancer

On top of Balancer’s own yield, you can increase APY and still earn Miles on Falcon by staking your LP tokens through other protocols:

USDf Pools on Curve

Another widely used protocol on the list is Curve, where Falcon offers two Miles-eligible pools: USDC/USDf and frxUSD/USDf.

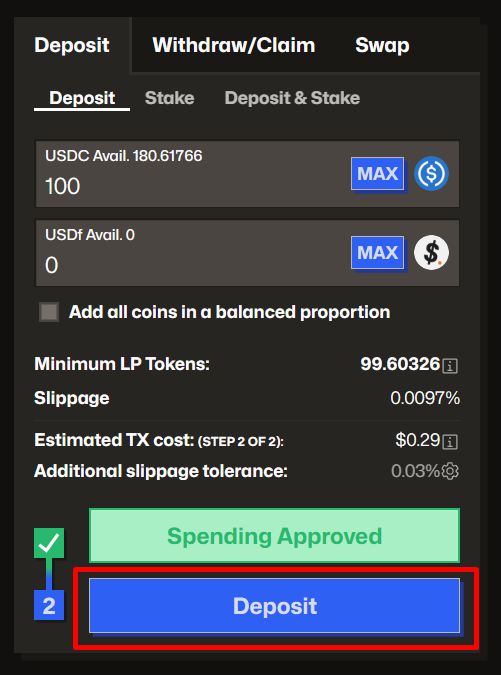

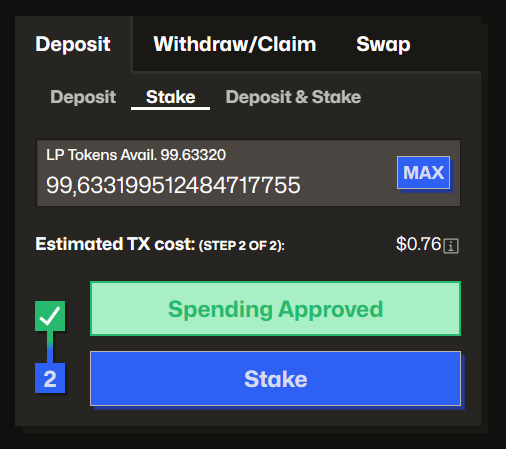

Curve’s liquidity process works much like Balancer’s. You can deposit a single token, and Curve will automatically swap part of it to balance the pool. This makes entry simple but can introduce slippage.

If you want to avoid internal swaps, check the option “Add all coins in a balanced proportion.” This lets you deposit both tokens in the right ratio, keeping the pool balanced without extra conversion.

CRV Farming

Curve lets you put your LP tokens to further use after adding liquidity. If you stake them, you’ll earn rewards in Curve’s native token, CRV. Accumulated CRV can be claimed on the same page. By locking CRV, you can also boost your APR by 2.5x.

Yield Amplification for Curve

Both USDf pools on Curve have the option of an additional yield rate increase:

- Gauges (separate for USDC/USDf and frxUSD/USDf)

- StakeDAO

- Convex

- Beefy

Earning in USDf Pools on Bunni

Bunni is a liquidity management protocol built on top of Uniswap V4, designed to make LP positions more efficient and flexible. It adds tools that extend the basic Uniswap model while keeping it composable with the rest of DeFi.

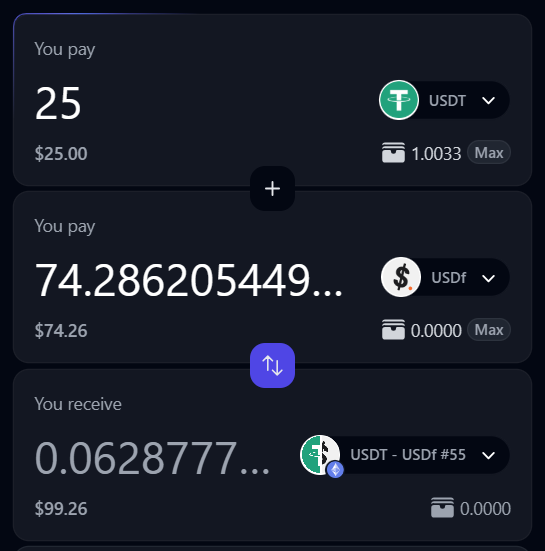

When adding liquidity to Bunni’s USDT/USDf pool, you can skip the advanced settings. The process is similar to other protocols, but one key difference is that you typically supply both tokens in proportion to the pool’s current balance.

Example: If the pool is 25% USDT and 75% USDf, then to create a $100 position you would need to deposit 25 USDT + 75 USDf. This proportional deposit keeps the pool balanced and ensures your position is accepted.

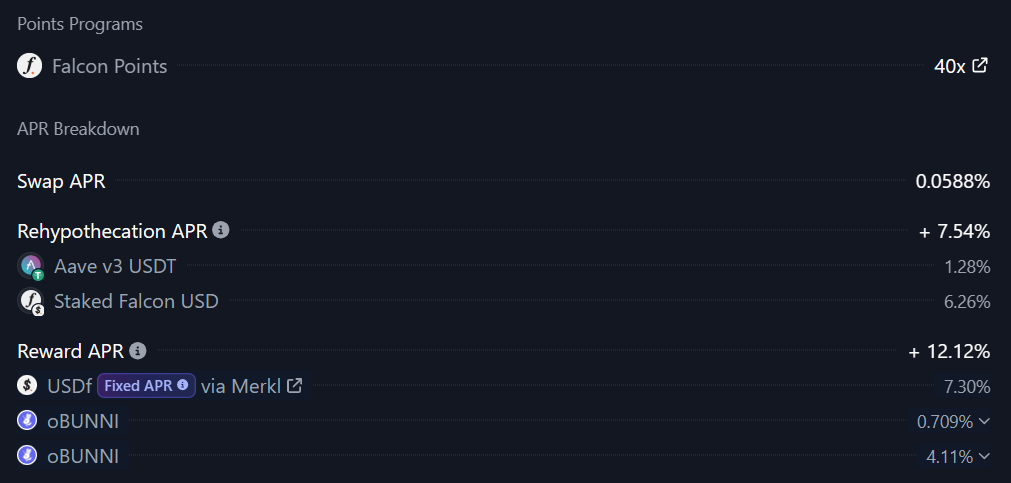

The Bunni pool generates returns from several sources: swap fees, rehypothecation, rewards (in USDf and oBUNNI). On top of these, every position in this pool also qualifies for 40x Miles on Falcon.

Yield Amplification for Bunni

You can earn extra USDf tokens from holding Bunni pool’s LP tokens via Merkl: follow the rules on the campaign’s page, connect your wallet to the app and check the dashboard to claim rewards.

Quick Overview of Liquidity Pools with Falcon Finance Miles Rewards

Below, you can see a wrap-up of all the important information about the pools listed in this article:

Name | Pool | Max. Miles Multiplier | Yield Amplifiers |

Uniswap | 40x | ||

PancakeSwap | USDT/USDf (Ethereum) | 40x | |

40x | |||

USDT/USDf (BNB Chain) | 40x | ||

Balancer | 40x | ||

Curve | USDC/USDf | 40x | |

frxUSD/USDf | 40x | ||

Bunni | USDT/USDf | 40x |

Final Thoughts

Every USDf pool highlighted in this guide offers two layers of value: protocol-level returns and Falcon Miles rewards. Whether you choose Uniswap, PancakeSwap, Balancer, Curve, or Bunni, your liquidity earns fees or incentives from the protocol while also qualifying for 40x Miles.

That means each position grows in two ways at once—through yield and through Miles—making these pools both a way to support liquidity and a way to build your Falcon progress.

Stack Miles, grow your returns, and lead the way for the flock!