Guide to Earning Miles: Supplying Liquidity to DeFi Money Market Protocols

Published • 2 Sept 2025

6 mins

DeFi money market protocols let you put your assets to work by supplying liquidity for interest or borrowing against collateral, and with Falcon Finance’s Miles program, this activity now also earns you points, making it one of the most efficient ways to earn both yield and Miles rewards by supplying crypto to DeFi money markets.

What Are Money Market Protocols in DeFi?

Money market protocols in DeFi are decentralized platforms that allow users to lend crypto to earn interest or borrow assets against collateral. They serve as on-chain equivalents of traditional money markets but operate without intermediaries, relying on smart contracts.

While the purpose is shared, designs differ. Some protocols use pooled lending, where liquidity providers deposit assets into shared pools that borrowers draw from. Others apply peer-to-peer matching to directly connect lenders and borrowers for more efficient rates.

Risk management also varies: certain protocols isolate markets so risks remain contained within each asset, while others combine all assets into larger shared pools, improving efficiency but increasing systemic risk.

Other differences include asset listings (permissionless vs. curated) and whether protocols integrate leverage and composability, allowing borrowers to deploy funds into broader DeFi strategies.

In this guide, we’ll cover the main protocols included in the Falcon Miles program: Morpho, Euler, Silo, and Gearbox.

How Many Miles Can You Earn?

The exact amount of Miles you earn from DeFi money markets depends on your open positions and the multiplier set for each task (up to 30x). You can check protocol-specific details in the Falcon Finance app under the Miles page, where your daily earnings are displayed automatically.

Supplying USDC Liquidity to Morpho

The first name on the list of options for earning Miles fast is Morpho, an optimization layer built on top of Aave and Compound. It improves capital efficiency by matching lenders and borrowers directly whenever possible (yielding better rates), while falling back to the underlying pool for liquidity and safety.

To earn Miles in Morpho, the first option is to supply Falcon’s synthetic dollars, USDf, to either Falcon USDf Core or Re7 Falcon USDf vaults. Unlike USDC vaults, you will get Miles for almost the entire size of your position since both USDf vaults allocate almost 100% of locked liquidity to Falcon’s tokens.

The vault we recommend is Falcon USDf Core. To deposit liquidity, start by connecting a wallet. Navigate to the vault’s page, enter the amount of USDC you want to deposit in the window in the upper right corner, and confirm the transaction:

Once supplied, your USDf is automatically allocated across lending markets. You start earning yield immediately, both base APY and reward APY, plus Falcon Miles with a 30x multiplier.

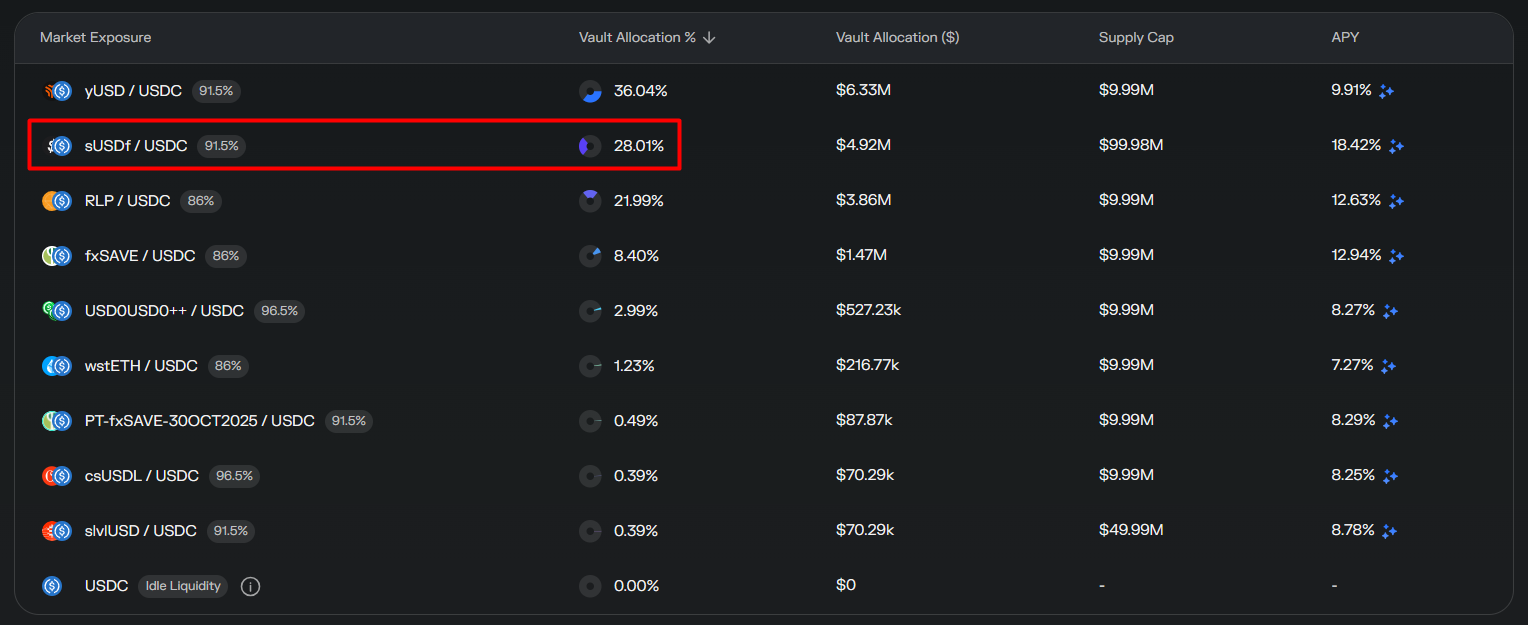

Alternatively, you can supply USDC stablecoins to either Alpha USDC Core or Re7 USDC Core vault. Do note that Falcon Miles are allocated proportionately to the amount of USDC allocated to Falcon assets (i.e. the portion of USDC supply allocated to sUSDf/USDC).

Among the vaults listed above, the best option for farming Miles is Alpha USDC Core, which allocates around 30% of USDC supply to sUSDf:

Despite this, it is best to actively monitor positions as allocations are always changing depending on the curators.

Earning Miles with Euler

Euler is a permissionless and modular lending platform that allows the creation of customizable vaults with composable collateral structures. It combines capital efficiency with advanced safeguards such as risk-tiering and controlled liquidations.

There are three vaults in Euler where you get Miles for depositing liquidity:

- Frontier Falcon USDf vault (30x Miles multiplier).

- Frontier Falcon USDC (30x Miles multiplier)

- Frontier Falcon sUSDf (2x Miles multiplier).

How to Supply Liquidity in Euler

Depositing USDf into the Frontier Falcon USDf vault in Euler is straightforward:

- Connect your wallet.

- Go to the vault’s page.

- In the window in the right corner, approve the terms of use, then enter the amount of USDf to deposit, hit “Supply” and confirm the transaction on-chain.

In return, you receive vault tokens that represent your share of the pool, start earning the vault’s supply APY, and can later withdraw your funds along with accrued interest at any time, subject to liquidity availability.

Supplying USDC to Silo

Silo is a lending protocol built around isolated silos, each containing exactly two assets: a unique token and a bridge asset (e.g., ETH or a stablecoin). This structure prevents risks in one silo from spilling into others, maximizing security while still allowing permissionless deployment of new markets.

You can earn Miles with a 30x multiplier in Silo by supplying USDC stablecoins into the Varlamore Falcon USDC vault. To make a deposit, simply enter the amount of USDC you want to supply on the vault’s page, and confirm the operation.

.png)

Your yield comes from base interest plus reward incentives split between USDf and xSILO, a liquid staking token representing staked SILO, Silo’s native token. Additionally, you accumulate Falcon Miles and can track both your rewards and position value directly in the dashboard.

Supplying USDC to Gearbox

Gearbox is designed for active traders and yield farmers, offering composable leverage through Credit Accounts. These isolated smart contract wallets hold your collateral, borrowings, and allow leveraged strategies across DeFi platforms like Curve. Meanwhile, lenders in Gearbox earn passive yield by supplying assets.

In Gearbox, you can earn Miles with a 30x multiplier by supplying USDC liquidity:

- Go to the pool’s page.

- Enter the amount to supply, confirm the terms of use

- Approve spending of USDC

- Confirm the transaction by clicking the button “Supply”.

In return, you earn base interest from lending, plus additional incentives in USDf and GEAR (the protocol’s governance token), alongside the Miles rewards.

Final Thoughts

In DeFi money markets, the mechanics of supplying liquidity and borrowing may differ in design, but from a user’s perspective they each offer comparable opportunities: stable ways to earn interest on your assets while stacking Falcon Miles rewards.

Whether it’s Morpho’s optimized pools, Euler’s modular vaults, Silo’s isolated silos, or Gearbox’s leverage-enabled Credit Accounts, each protocol provides a slightly different route that leads to a similar outcome—a balanced mix of yield and high Miles multipliers.

This diversity ensures you can choose the platform that best fits your preferences, while still benefiting from reliable returns and consistent Miles points accumulation.