How Falcon Finance Delivers Stable Yield in Volatile Markets

Updated • 15 Aug 2025

Published • 30 May 2025

2 mins

Stable yields in volatile markets require more than passive exposure. Falcon Finance delivers this through a dynamic, market-neutral yield engine designed for institutional resilience.

Unlike directional strategies that rely on prices rising or falling, Falcon applies delta-neutral approaches that extract yield from market inefficiencies. These strategies operate across centralized exchanges and DeFi markets, adapting in real time to changing volatility conditions.

Core strategies include:

- Positive funding rate arbitrage: selling perpetual contracts while buying spot assets when perps trade at a premium

- Negative funding rate arbitrage: buying perpetuals and selling spot when perps trade at a discount

- Cross-exchange arbitrage: identifying and capturing price discrepancies across trading venues

These are not theoretical trades. They activate when pricing diverges meaningfully across markets. By executing trades that close these gaps, Falcon not only generates returns but contributes to market efficiency.

The driver behind these opportunities is volatility. As market conditions become more active, discrepancies between spot prices, perpetual futures, and exchanges increase. This creates more arbitrage windows and higher potential yield for the system.

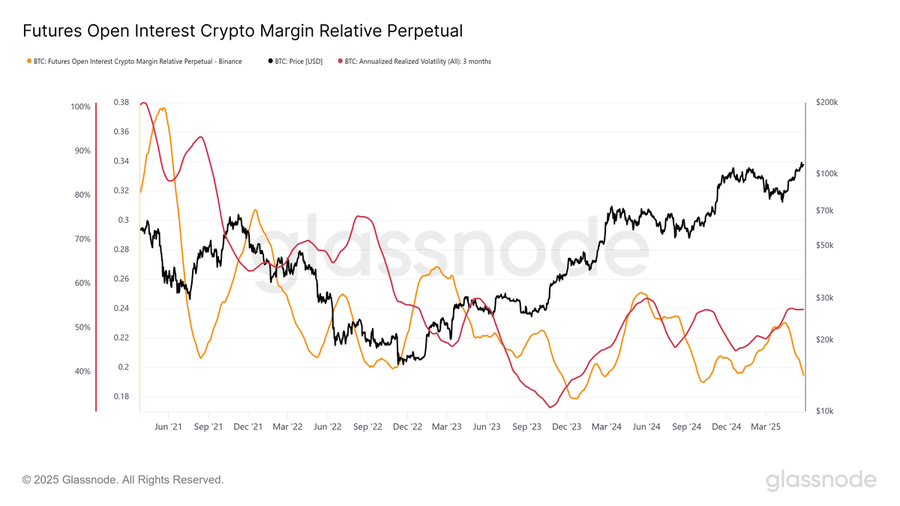

Open interest and volatility move together, creating more arbitrage windows during active markets. Source: Glassnode.

A critical signal Falcon monitors is open interest in perpetual markets. Higher open interest reflects more active positions, which increases volatility and drives funding rate spreads. This in turn expands the opportunity set for arbitrage.

The result is a performance profile that benefits from volatility. Rather than retreat in unstable conditions, Falcon’s strategies engage more deeply, converting market dislocation into value for sUSDf holders.

This is not a passive system. It is an adaptive yield engine optimized for real-time market dynamics.

With sUSDf, users gain exposure to yield flows driven by volatility-aware, compliance-aligned strategies that work in all market cycles.

Learn more at docs.falcon.finance

Tags