How Falcon Finance Turns Crypto Volatility into Yield

Updated • 22 Oct 2025

Published • 13 Mar 2025

2 mins

The crypto market has historically experienced more volatility than traditional finance (TradFi) market.

While extreme price swings can unsettle traders, Falcon thrives in volatility, seizing unique yield opportunities during both bullish and bearish conditions.

In this article, we will explore how Falcon navigates market inefficiencies to maximize returns.

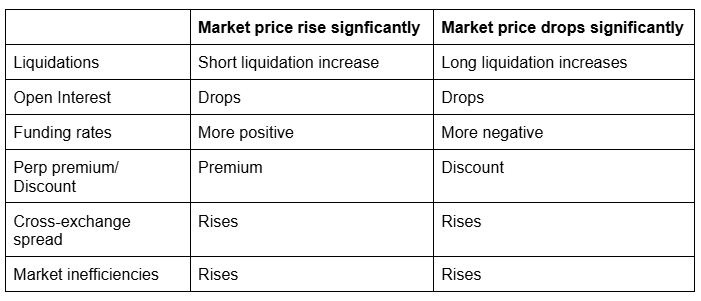

In volatile periods, there are some market inefficiencies which emerge:

- Liquidations surge, causing forced position closures.

- Funding rates diverge, creating opportunities for strategic positioning.

- Cross-exchange spreads widen, opening arbitrage windows.

These conditions pave the way for Falcon's sophisticated yield-generating strategies.

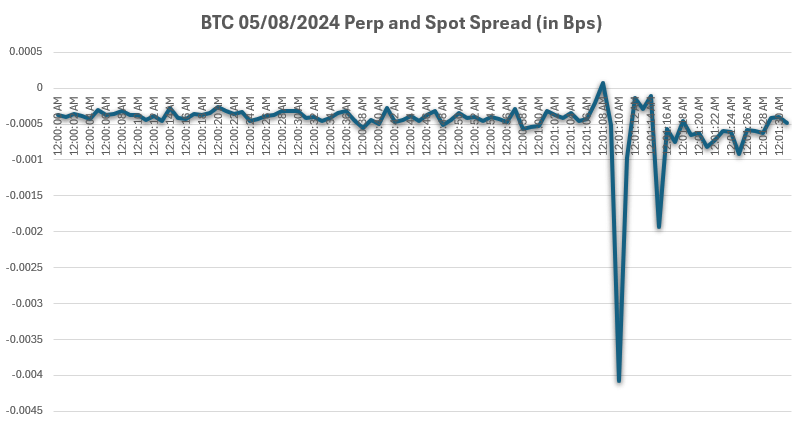

During downturns, perpetual (perp) prices often trade below spot prices due to mass liquidations. Falcon leverages these price dislocations by unwinding short positions, capturing the discount, and profiting from negative funding rate strategies—earning yield while maintaining an approach that manages and balances risk.

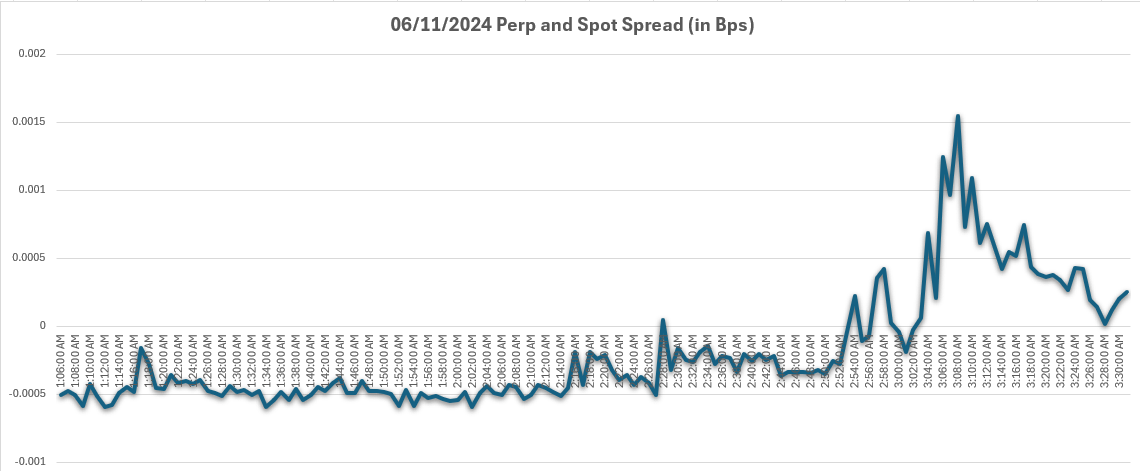

When the market surges, perp prices frequently trade above spot, which leads to a premium environment. In this situation, Falcon capitalizes on this by unwinding long positions at a premium while simultaneously earning yield from positive funding rate arbitrage. Regardless of market direction, Falcon’s adaptive strategies ensure that volatility becomes a profit engine.

Now, beyond funding rate arbitrage, high volatility also widens spreads between exchanges, creating cross-exchange arbitrage opportunities. By systematically identifying and executing trades on these pricing discrepancies, these gaps can be capitalized to capture extra yield for users.

From our track record, Falcon’s dynamic position management has been observed to capture higher funding yields in both bullish and bearish swings, thus proving to consistently outperform major volatility events by dynamically managing positions.

By capturing funding rate yields and optimizing arbitrage across exchanges, Falcon not only mitigates risk but also enhances returns during market upheavals.

To wrap up, we can see that while volatility is a double-edged sword for traders, but Falcon navigates market turbulence well and uses it as a strategic advantage. Through a blend of dynamic position management, funding rate optimization, and cross-exchange arbitrage, Falcon ensures that users benefit from both bullish and bearish swings.

In the ever-changing crypto landscape, Falcon doesn’t just survive volatility—we will continue to thrive in it.

Tags