How Minting and Redeeming Mechanisms Work in Falcon Finance

Updated • 15 Aug 2025

Published • 18 Apr 2025

4 mins

A core component of Falcon Finance are the minting and redeeming mechanisms, through which users can deposit crypto funds, put them to work, and withdraw them securely. It is handled through a set of well-defined minting and redeeming processes built around a dual-token system of the USDf synthetic dollar and the sUSDf yield-bearing token. This article guides you through the journey from an initial deposit to a final redeeming in Falcon Finance, highlighting all the crucial intricacies you should know about.

USDf Minting Process in Falcon Finance

Step 1: Deposit Eligible Collateral

The first step is to deposit eligible cryptocurrencies into the protocol that will act as a collateral. Falcon Finance accepts a wide range of assets, including stablecoins such as USDC, USDT, or USDS, “blue-chip” cryptocurrencies like BTC, ETH, SOL, altcoins like AAVE, AVAX, SUI, and many more.

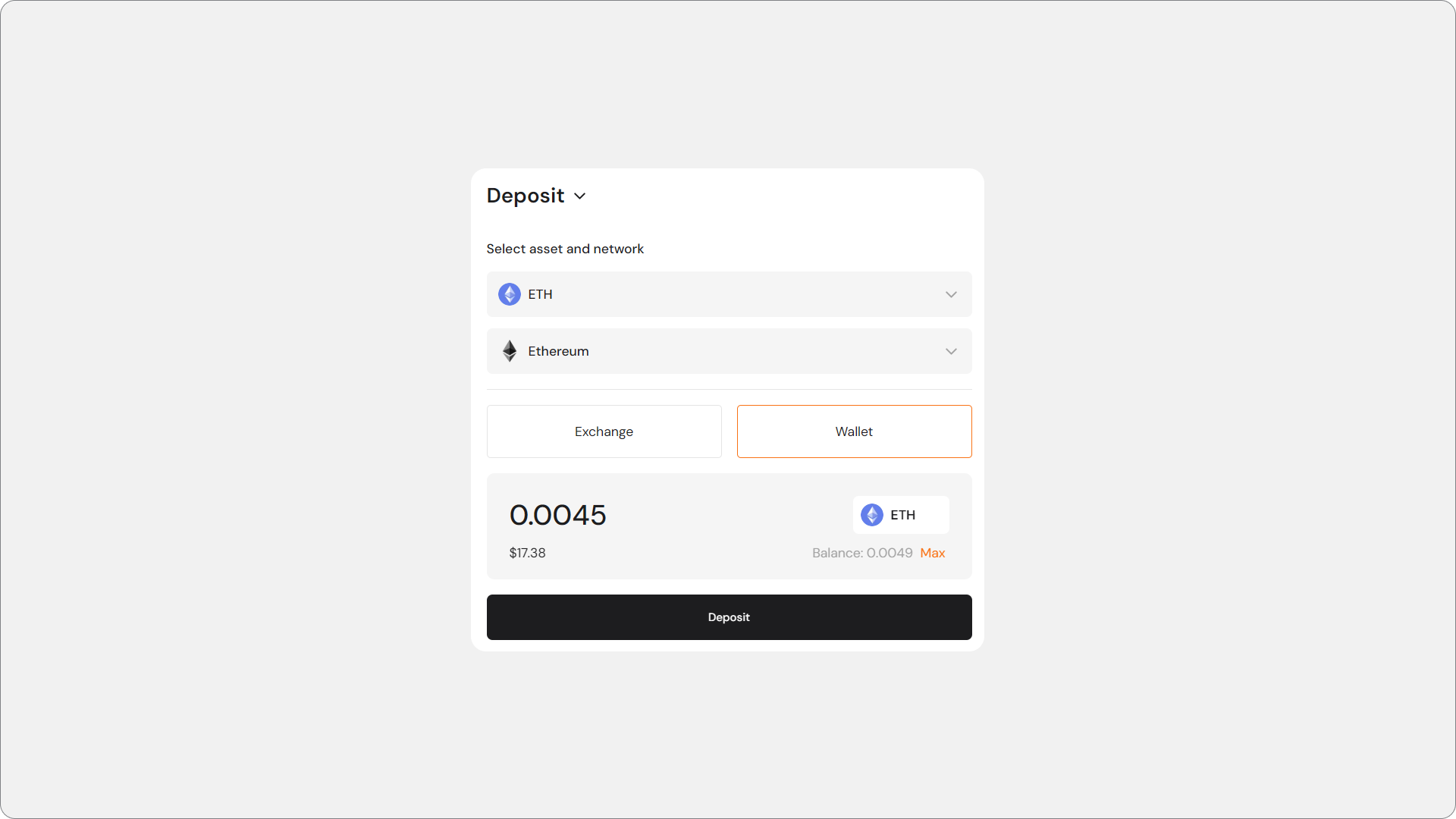

There are two ways to deposit crypto in Falcon Finance. First, connect a Web3 wallet like MetaMask directly to the application on the deposit page, give necessary permissions, proceed with choosing an asset and its amount to top up your Falcon account, and confirm a transfer.

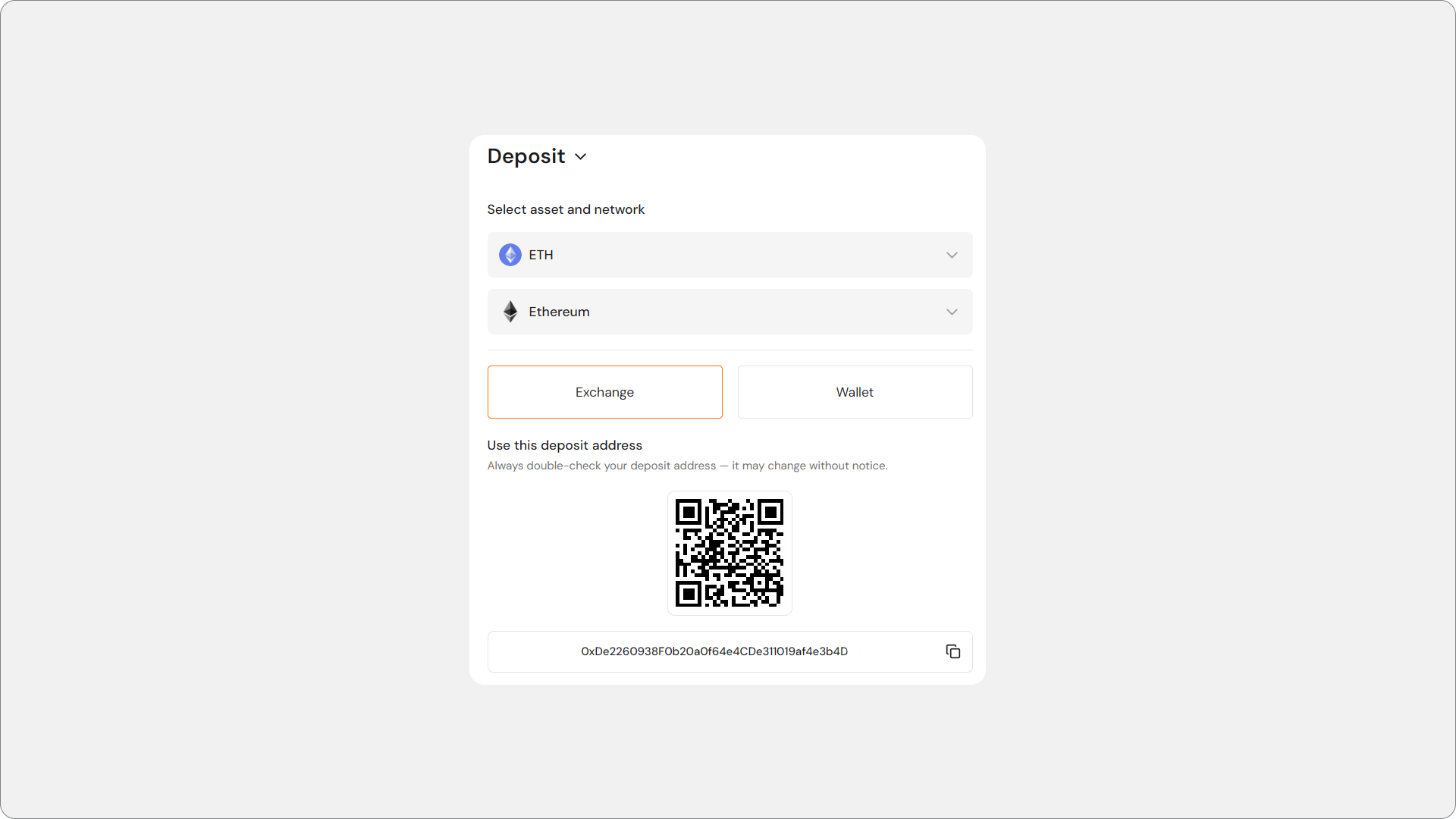

Alternatively, you can generate a unique blockchain address along with a QR code, where you can transfer your crypto directly from your centralized exchange account.

Step 2: Mint USDf Tokens

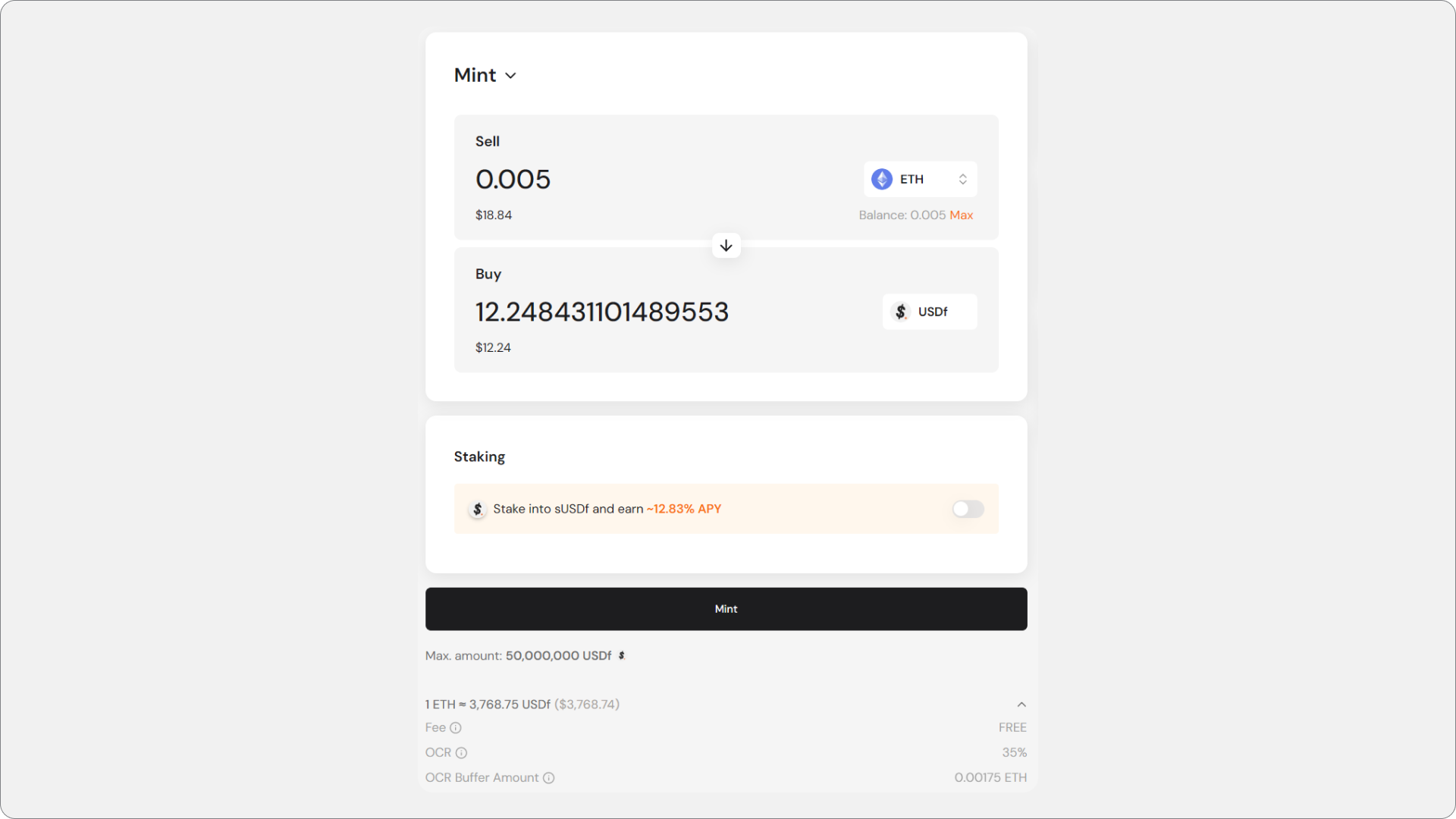

Once the collateral is deposited, you can mint USDf. There are two main types of mint available in Falcon Finance: Classic Mint and Innovative Mint.

If you decide to go with the Classic Mint, then the exact amount of USDf tokens you receive will depend on the type of collateral you provided. For stablecoins, USDf is minted at a 1:1 ratio based on the USD value. For non-stablecoins, an Overcollateralization Ratio (OCR) is applied. It means that the value of the deposited collateral is higher than the value of the USDf minted. It is necessary for creating a buffer to protect the protocol against market volatility.

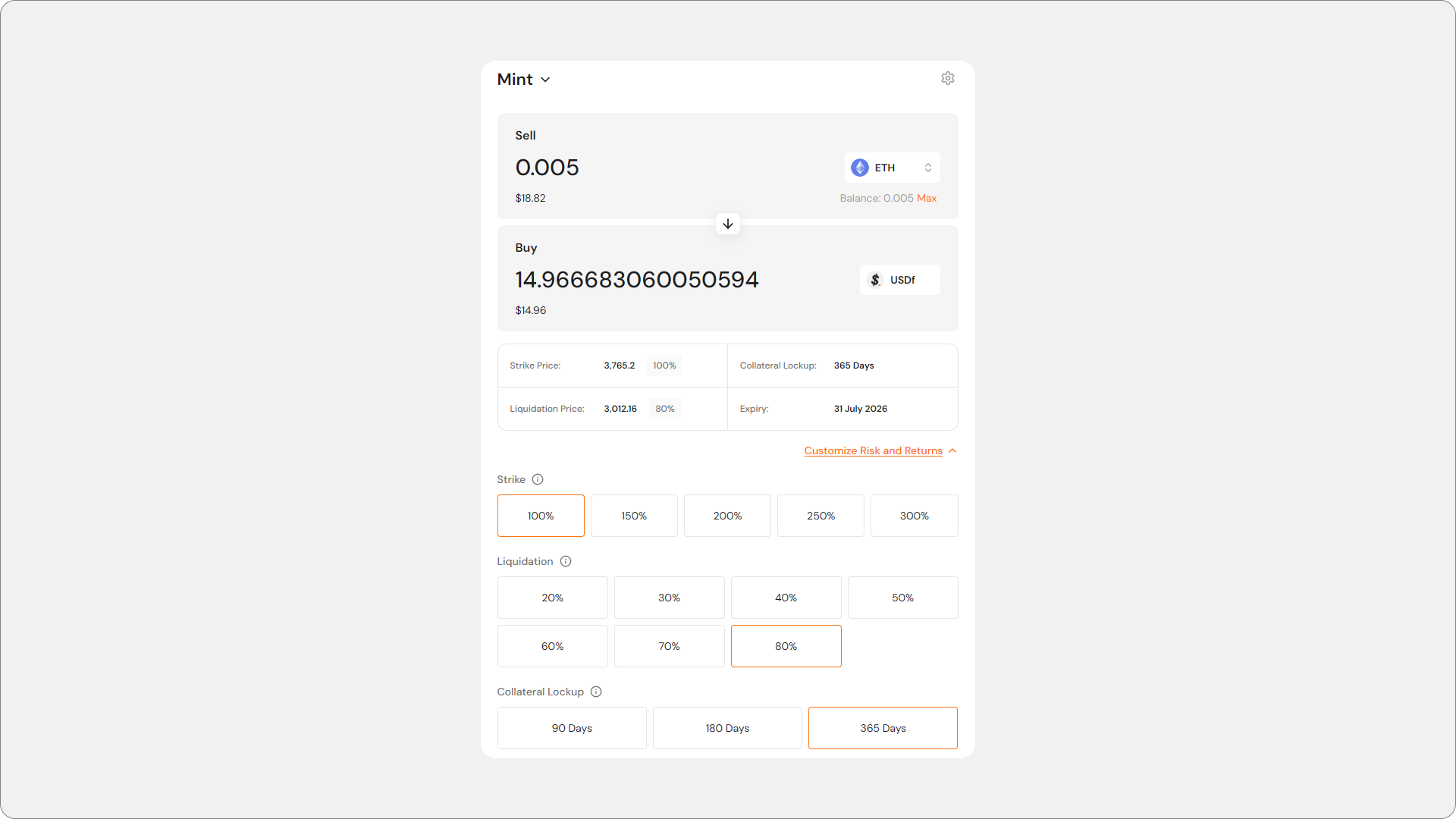

In the Innovative Mint, you get to customize the risk and minting parameters. In particular, it is possible to set strike price and liquidation multipliers, effectively managing the level of risk and return. We recommend using Classic Mint for stablecoins, and Innovative Mint for altcoins, although there are no restrictions.

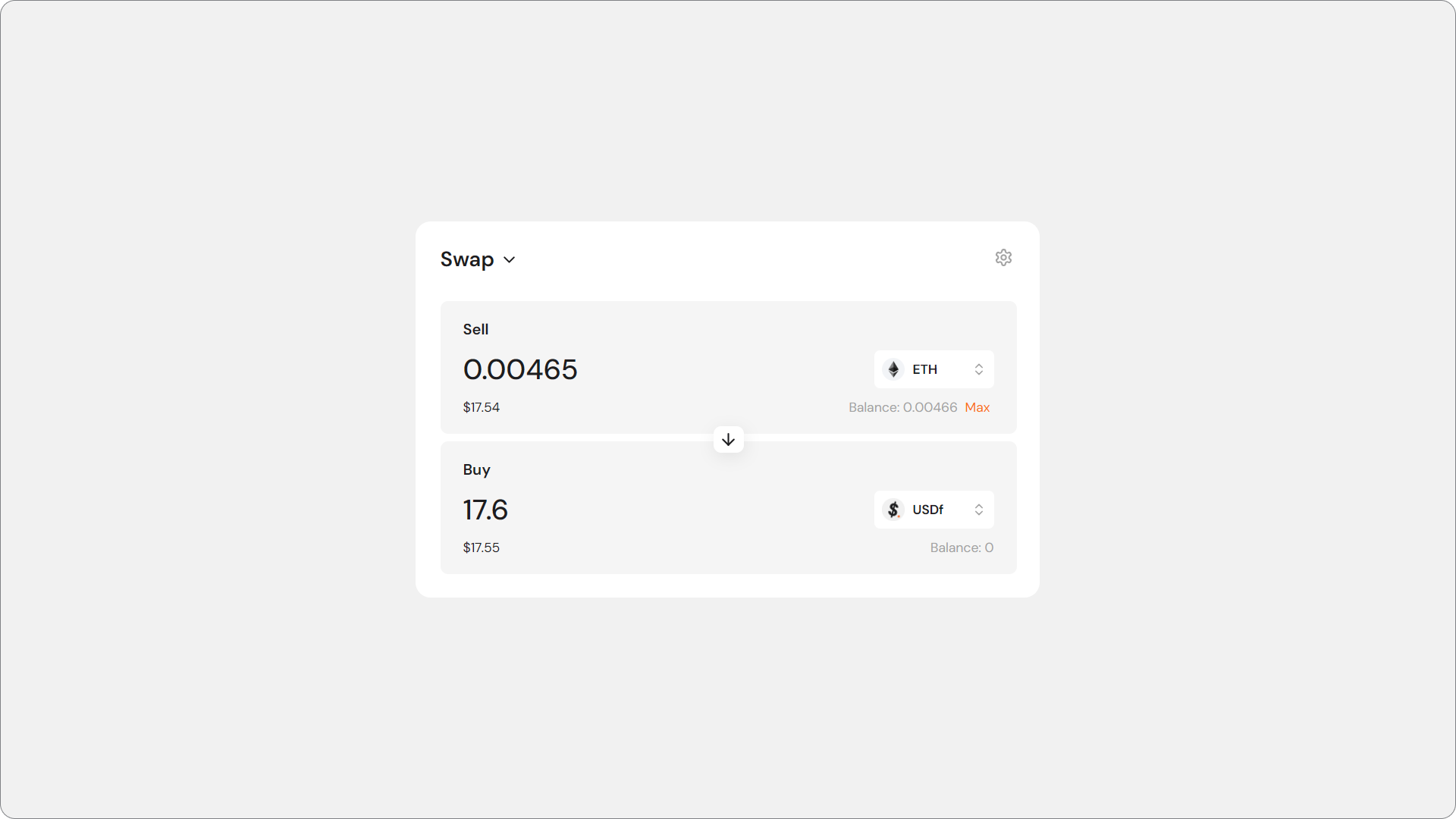

Finally, you can swap tokens from the list of supported cryptocurrencies (note that in this case, you will have to use your wallet’s balance and not crypto deposited to Falcon).

Step 3: Stake USDf to Receive sUSDf

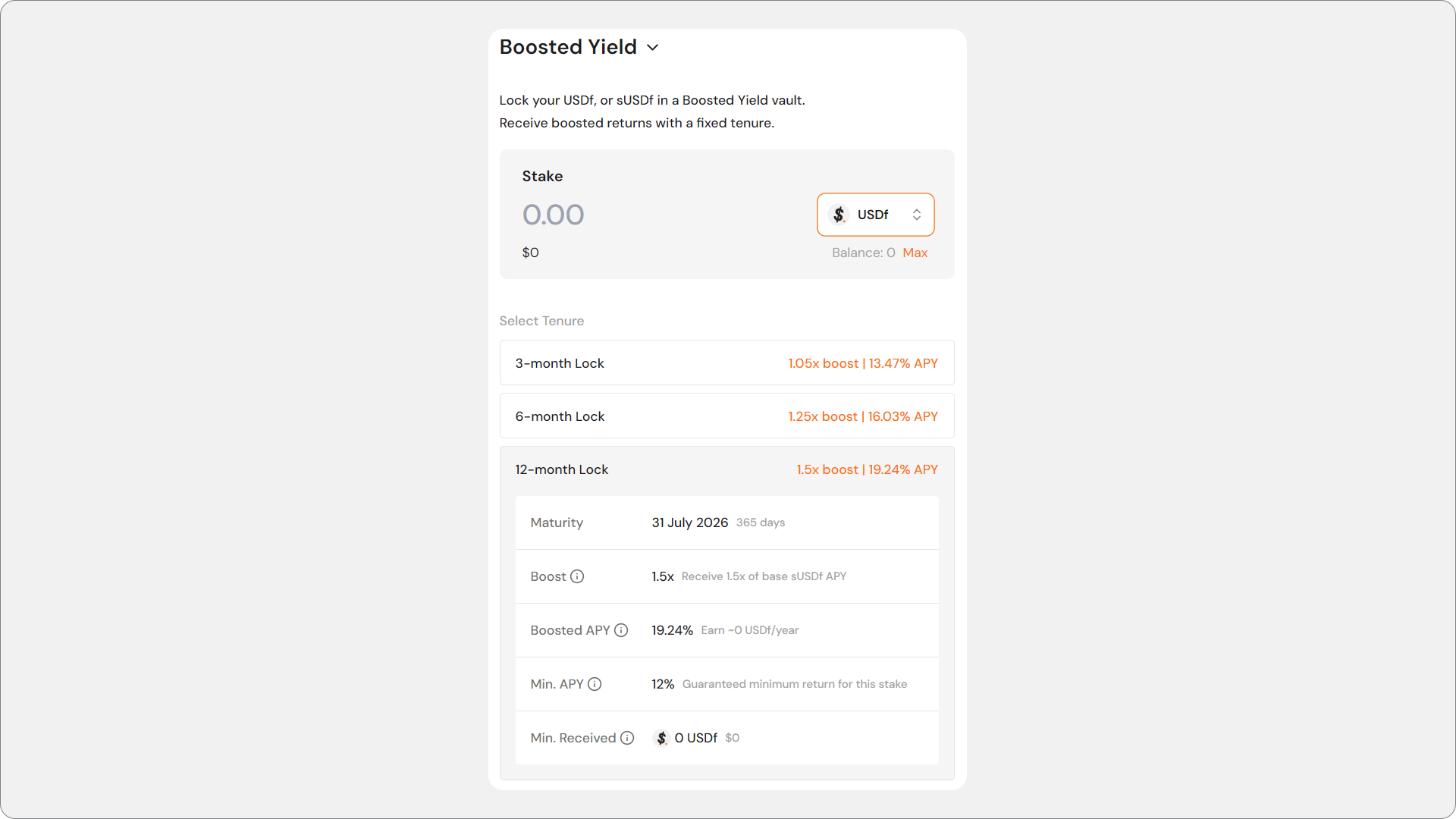

After minting USDf tokens, the next step is to stake them within the Falcon Finance app using either Classic Yield or Boosted Yield. In any way, you will receive sUSDf, the protocol’s yield-bearing token, which represents your principal plus any yield that accrues over time from the protocol’s investment strategies. Learn more in our guide into the types of staking in Falcon.

Redeem: Cashing Out Your Yields

When you are ready to withdraw your crypto capital and returns from Falcon Finance, the redeeming process allows you to seamlessly convert your yield-bearing assets back into a stablecoin of your choice, or into your initial collateral.

Step 1: Unstake sUSDf and Receive USDf

The process of redeeming starts with unstaking your funds, when you exchange your sUSDf tokens back to USDf tokens. The amount of USDf you receive is based on the current sUSDf-to-USDf value, which reflects your initial stake plus all the yield it has generated.

Step 2: Redeem USDf for Stablecoins or Initial Collateral

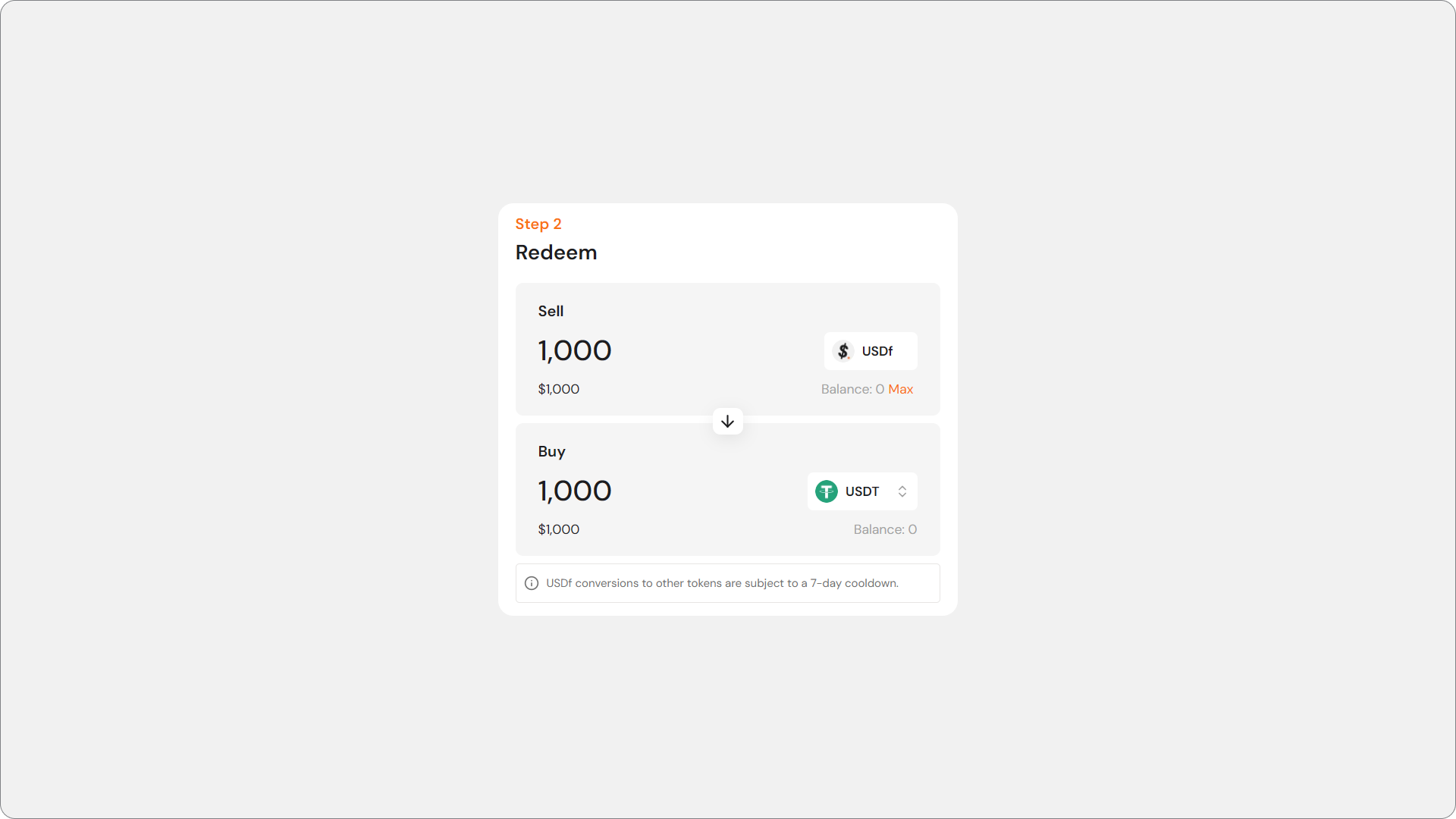

After the unstaked USDf tokens arrive in your wallet, you need to deposit them to your Falcon account. Once it’s done, you can proceed to the “Redeem” page on the platform. There, you can swap USDf for supported stablecoins (like USDT or USDC). If you originally deposited altcoins, you can redeem the entire amount of collateral, while keeping the accrued returns.

Step 3: Wait for the Cooldown Period to End

It is important to note that redemptions of USDf into other stablecoins are subjected to a 7-day cooldown period. After the redemption cooldown period ends, you will automatically receive your assets back to your Falcon account.

Conclusion

Falcon Finance sets itself apart from other synthetic dollar protocols by accepting a broader range of crypto for collateral, offering users greater flexibility and choice. Through customizable minting options and robust overcollateralization controls, the protocol ensures that protocol reserves consistently exceed the circulating USDf supply. This approach makes yield generation on Falcon not only accessible but also fundamentally secure and reliable.