Negative Funding Rate Arbitrage: Unlocking Sustainable Yield with Falcon Finance

Updated • 22 Oct 2025

Published • 27 Feb 2025

4 mins

In the world of crypto perpetual markets, most synthetic dollar protocols focus on capturing positive funding rate opportunities. However, this approach only covers half the potential for sustainable yield generation. Falcon expands beyond traditional models by incorporating negative funding rate arbitrage into its strategy, leveraging a diverse collateral pool to unlock delta-neutral yield generation.

Let’s dive into how this works and why it presents an untapped opportunity for traders and investors alike.

First, we'd begin with explaining what funding rates are and how they are affected by market demand.

Funding rates are periodic payments between long and short positions in perpetual futures markets, ensuring that the contract price remains in line with the underlying spot market. These rates fluctuate based on market demand and can be either positive or negative:

- Positive Funding Rate: When the perpetual contract trades above the spot price, long positions pay short positions.

- Negative Funding Rate: When the perpetual contract trades below the spot price, short positions pay long positions.

This dynamic creates arbitrage opportunities that allow traders to generate consistent, delta-neutral returns by capturing funding rate inefficiencies across different markets.

Funding rate arbitrage serves a critical function in financial markets by reducing mispricing and promoting market efficiency. Falcon strategically exploits funding rate discrepancies to provide liquidity, which helps stabilize perpetual funding rates and aligns them with spot market prices. This, in turn, lowers the cost for perpetual traders and improves overall market stability.

Now, traditional synthetic dollar protocols primarily focus on blue-chip assets and positive funding rate arbitrage. However, Falcon extends its strategy by utilizing a diverse collateral pool that includes BTC, ETH, and altcoins. With this broader asset base, it allows Falcon to capture both positive and negative funding rate arbitrage across various assets, maximizing available yield opportunities.

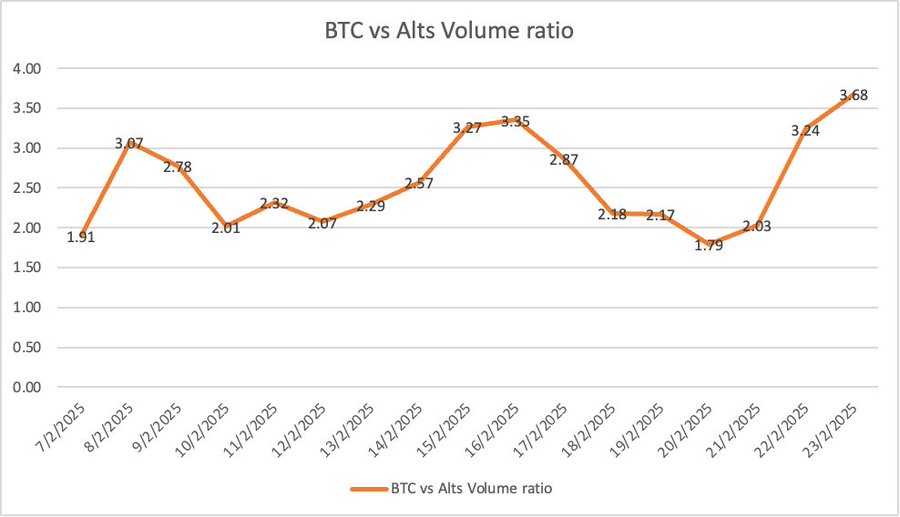

With altcoin trading volume now 3.6x that of BTC, the market offers significant opportunities for arbitrage strategies beyond traditional blue-chip assets.

Line chart titled 'BTC vs Alts Volume Ratio' displaying the volume ratio of Bitcoin (BTC) to altcoins over time

By incorporating altcoins with higher negative funding rates, Falcon unlocks unique yield opportunities that are often overlooked by traditional market participants.

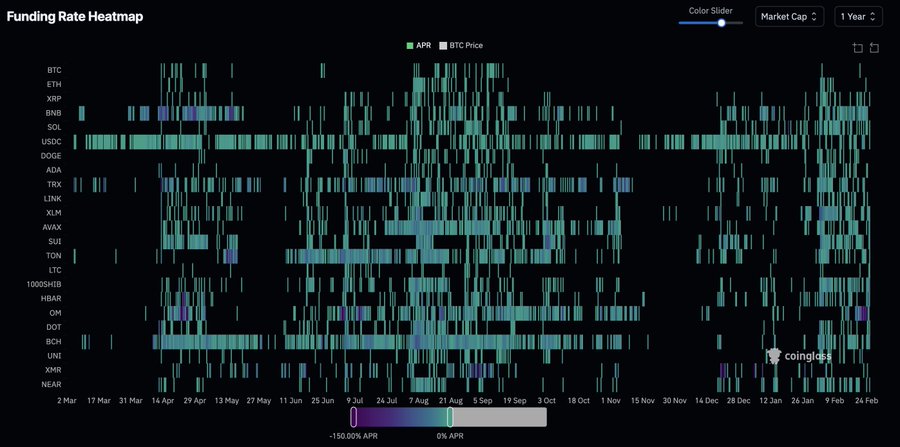

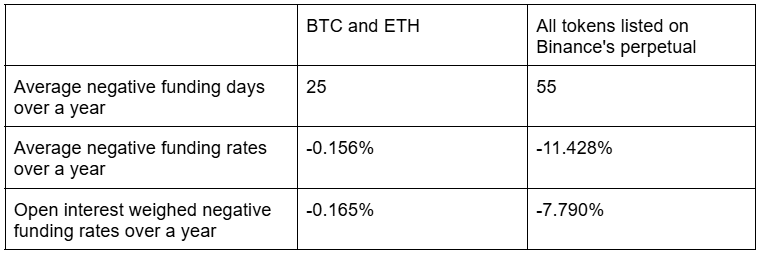

According to market data, altcoins tend to exhibit significantly higher negative funding rates and experience more frequent negative funding days compared to blue-chip assets. This creates an attractive environment for arbitrageurs who can capture these funding rate inefficiencies.

Falcon optimizes its arbitrage positions by strategically managing open interest and ensuring adequate liquidity for hedging during altcoin market downturns. This approach maintains capital efficiency and delivers competitive, sustainable yields.

Funding Rate Heatmap displaying annualized percentage rate (APR) variations across multiple cryptocurrencies over a one-year period. Data sourced from Coinglass.

Table comparing negative funding rate statistics for BTC and ETH versus all tokens listed on Binance’s perpetual futures.

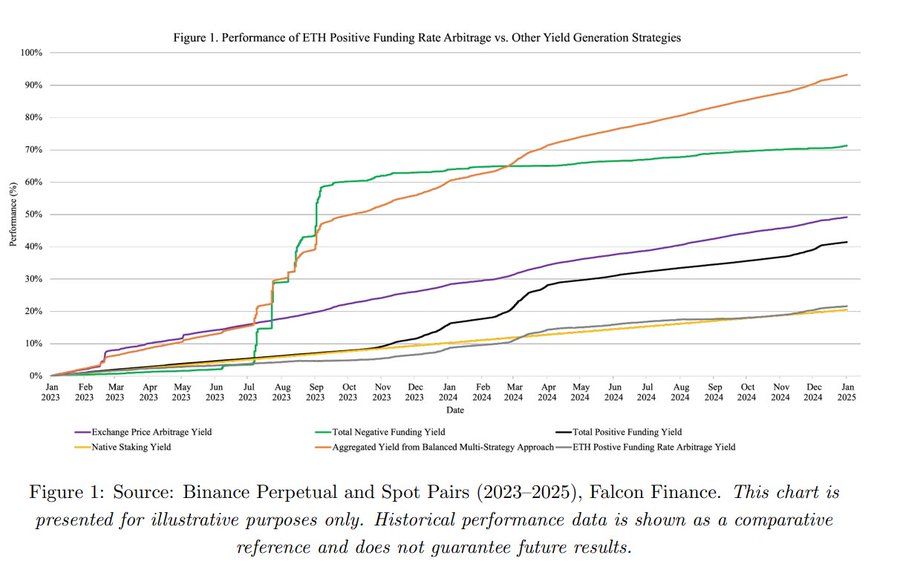

Over the past two years, negative funding rate arbitrage strategies have yielded over 70% in returns, significantly outperforming traditional positive funding rate strategies. By leveraging both funding rate opportunities, Falcon enhances yield performance and creates a more resilient yield-generation model.

Line chart showing performance of ETH Positive Funding Rate Arbitrage vs. Other Yield Generation Strategies

Additionally, Falcon integrates institutional-grade yield generation strategies, further strengthening its ability to optimize risk-adjusted returns.

Falcon goes beyond standard positive funding arbitrage and incorporates multiple institutional yield-generation strategies, including:

- Delta-neutral positive and negative funding rate arbitrage

- Cross-exchange price arbitrage

- Short-term native staking yield

By combining these strategies, Falcon ensures that yield generation remains sustainable, diversified, and resilient to market cycles. Negative funding rate arbitrage presents a highly effective, delta-neutral yield strategy that remains underutilized in synthetic dollar protocols. By strategically incorporating both positive and negative funding rate arbitrage across a diverse asset base, Falcon enhances liquidity efficiency and maximizes sustainable returns.

To learn more about Falcon’s innovative yield-generation strategies, read our whitepaper and stay tuned for more insights!

Tags