Tokenized CETES Explained: Mexican Treasury Bills to Diversify Your On-Chain Portfolio

Published • 10 Feb 2026

9 mins

Summary

- Tokenized RWAs are expanding rapidly, and various asset classes start to gain traction, in particular, tokenized government debt.

- Tokenized sovereign debt keeps the same underlying exposure but upgrades the wrapper with 24/7 access, faster settlement, easier transferability, and the ability to use government bills inside on-chain workflows rather than leaving them “parked.”

- CETES (Mexico’s short-term zero-coupon T-bills) stand out for an emerging-market premium: over 7% return rate for 28-day CETES bonds vs. ~3.5% for comparable U.S. T-bills, plus national currency (peso) diversification benefits.

- Etherfuse tokenizes CETES via its Stablebonds framework, emphasizing 1:1 backing, segregated custody, and mechanics like rebase yield accrual and auto-rollover to make short bills feel like an always-on allocation.

- Falcon Finance adds utility for CETES tokens: it can be used as collateral, letting users keep exposure while minting USDf to stake and earn a share of protocol’s yield strategies.

Since January 2025, the tokenized real-world assets (RWA) market has grown by over 300%, exceeding $24 billion by late January 2026.

Growth matters — but on its own, it still doesn’t fully explain where (and why) attention is actually shifting to RWAs. While U.S. Treasuries still dominate the asset tokenization landscape, more investors, especially those holding stablecoins on-chain, are starting to look elsewhere.

In this article, we will break down the significance of the tokenized sovereign debt for investors, and explain one of the popular assets in this category, CETES: why it has caught investors’ attention, what changes when you can hold them on-chain, and how tokenized CETES can be used as collateral for increasing yield opportunities.

Tokenized Sovereign Debt: Same Asset, Better Wrapper

If you want to see where tokenized RWAs are actually headed, look at the breakdown below. While U.S. Treasuries still provide the baseline, the emerging market segment of tokenized non-US sovereign (government) bonds is rapidly gaining ground, tripling its market share relative to the leader in 2025 alone.

The market cap of tokenized non-US government debt. Source: RWA.xyz, data as of February 10, 2026.

It is because, with the emergence of tokenized real-world assets, yield alone is no longer enough. Capital flexibility is becoming increasingly important. At the same time, the tokenized government debt is dominated by the U.S. Treasuries. Lately, multiple alternatives offering more diversity began to emerge.

But why are tokenized bonds becoming popular? A traditional government bill is simple and reliable, but it’s also rigid — especially if you are not operating inside the local market infrastructure. You are typically tied to local custody, local market hours, and settlement conventions, which is fine for domestic investors but becomes friction once you need portability or composability.

Tokenization keeps the underlying exposure intact and upgrades the wrapper. The same sovereign yield becomes portable: accessible 24/7, easier to transfer, and easier to integrate into other financial workflows.

In the RWA space, sovereign debt doesn’t have to sit as a “parked” asset. A tokenized bond can be used as collateral, liquidity, or a base layer for new products — flexibility that’s hard to achieve in the traditional setup.

CETES: Mexican Sovereign Bills with Emerging Market’s Yield Premium

As tokenized real-world assets expand beyond the U.S. Treasuries, attention naturally shifts to markets where short-duration sovereign yields are still meaningfully higher. One of the clearest examples is Mexican Federal Treasury Certificates (CETES).

CETES are classic zero-coupon instruments. Unlike corporate bonds or longer-dated government debt, holders do not receive periodic interest payments. Instead, they are issued at a discount to face value and accrete to par at maturity. In other words, your return comes from the gap between what you pay today and what you receive at the end.

Yield and Peso: Why Investors Look at CETES

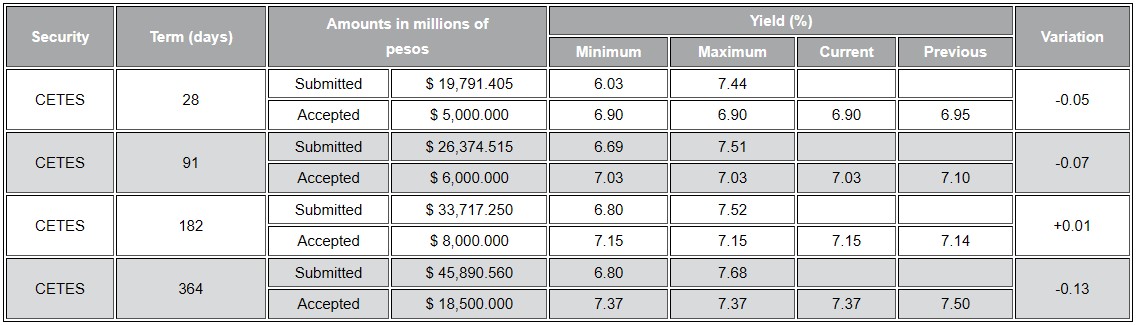

If you are holding stablecoins on-chain and looking for real carry, the first thing you notice is the spread in yield rates. In the auction snapshot used here, 28-day CETES were around 7%, versus 3.64% (4-week) and 3.60% (3-month) for comparable U.S. T-bills over the same period.

The 28-day CETES yield in the auction of February 3, 2026, was around 7%. Source: The Bank of Mexico.

Higher yield is the main value proposition: with CETES, you get short-duration sovereign exposure, while earning an emerging-market premium.

Mexico holds an investment-grade BBB rating from S&P. This is why CETES often attract global investors looking for higher returns without moving further into riskier corporate bonds.

CETES also offer currency diversification. The Mexican peso (MX) has shown strength against the dollar (USD): in the last year alone, the exchange rate between MX and USD grew from about 0.049 to 0.058, further increasing the CETES bill’s high yield rate. This allows investors to hedge against shifts in U.S. monetary policy and inflation by adding peso-denominated exposure.

Liquidity is important too. The CETES market is measured in the trillions of pesos, which makes it easier to manage positions and adjust exposure without significantly affecting the market.

Historically, the main challenge for investing in CETES Mexican Treasury bills has been access. Many non-residents face local onboarding requirements, such as tax IDs, domestic bank rails, and custody issues, making it hard to gain direct exposure.

That friction is one of the clearest reasons real-world asset tokenization matters here: the aim is not to change the asset but to maintain exposure while eliminating barriers.

How Etherfuse Enables Tokenized CETES

Etherfuse is building a tokenization layer for sovereign bonds, with a particular focus on bringing emerging-market debt on-chain. Its flagship product, the Stablebonds protocol, enables the issuance of freely transferable on-chain assets backed 1:1 by various government bonds.

The token, issued by Etherfuse, bundles two rights: a claim on the underlying instrument’s par value, and rewards sourced from the yield generated by the collateral. Etherfuse also emphasizes that the underlying assets are held with authorized custodians and kept segregated from the platform’s own funds.

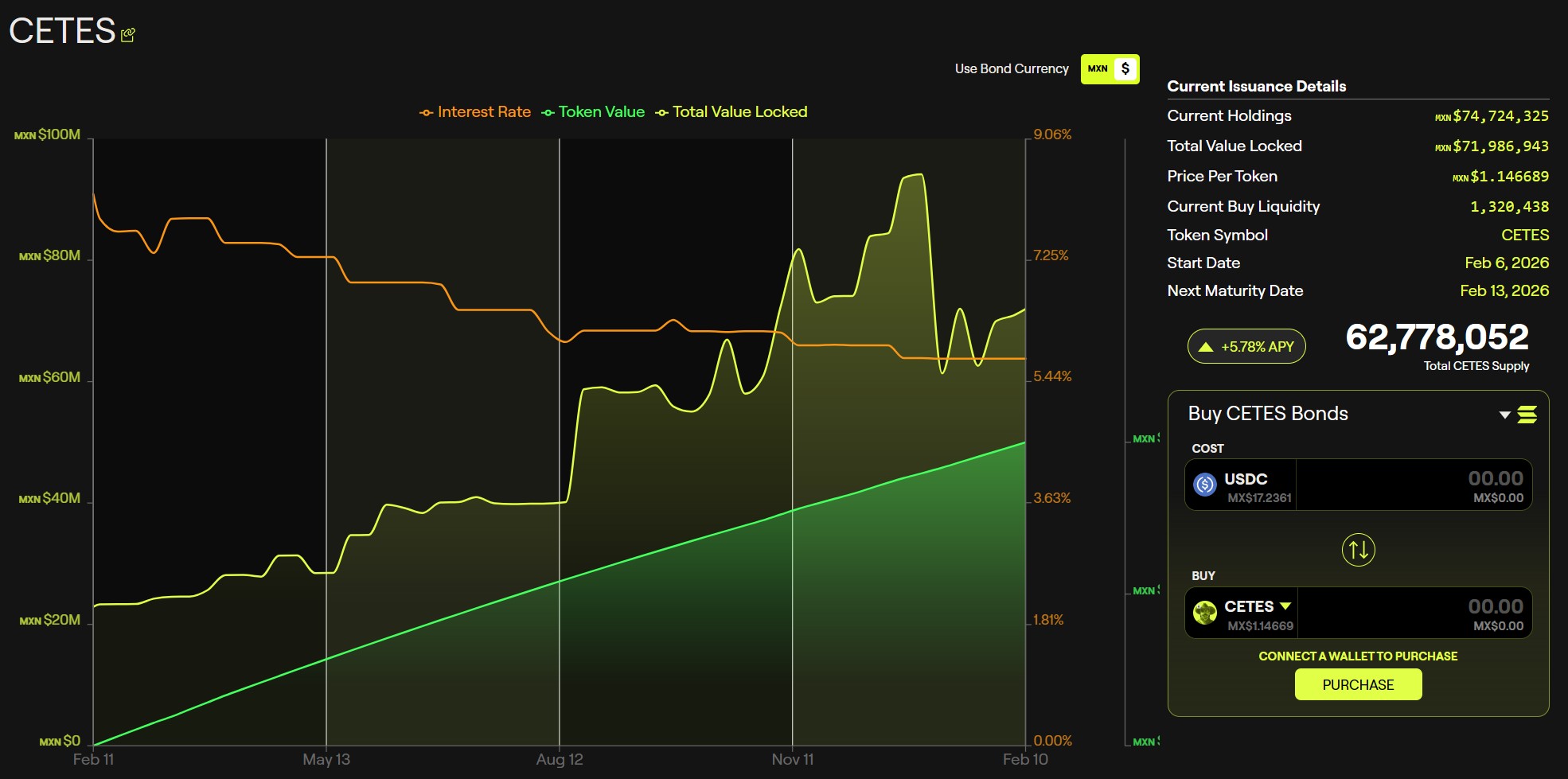

With the ongoing expansion of RWAs, capital inflows in Etherfuse are also surging rapidly. In just one month, by late January 2025, Etherfuse’s TVL had reached$18 million, according to DeFiLlama, while total holdings on the platform’s official website are set at almost $30 million. Most of the liquidity is concentrated in Stablebonds backed by the U.S. Treasuries, with CETES tokens ranking second.

Inside the CETES Token

The CETES token is pegged to the value of Mexican Treasury bills, representing a right of ownership to a share in a pool of these securities. Collateral custody is handled through regulated infrastructure. The bonds are held in accounts at INDEVAL, Mexico’s central securities depository.

Etherfuse emphasizes that these assets are not held in the platform’s own wallets: access to the depository is provided through licensed local institutions, and client assets are kept segregated from the company’s capital.

Core Benefits of Tokenized CETES

Tokenized CETES change how short-duration sovereign debt behaves, not just how it’s held. Three things make the difference.

Firstly, yield accrues to the holder gradually — users don’t have to wait until maturity to realize returns. A rebase mechanism handles this automatically: the number of tokens in an investor’s balance increases, reflecting the yield accumulated by the underlying asset.

Secondly, the protocol supports auto-rollover. Since tokenized CETES are backed by short-dated instruments, Etherfuse reinvests proceeds from matured issues into new ones. The position starts to feel less like a term instrument and more like an always-on allocation — a perpetual yield stream rather than a fixed-maturity holding.

That stream, as with classic CETES, is generated through the discount mechanism. Note that users receive only net yield — after platform fees, taxes, and operating costs. That is why the APY of a tokenized bond differs from The Bank of Mexico’s auction yield rate (5.78% vs 7.07%).

Finally, settlement is simply smoother in an on-chain format. Instead of relying on bank hours and multi-step brokerage processes, transfers can be executed directly on-chain and confirmed quickly, which matters when you are managing collateral or rebalancing.

How to Purchase Tokenized CETES

The primary venue for buying CETES is the Etherfuse app. This is where primary issuance happens: a user deposits stablecoins, and the smart contract mints the corresponding amount of tokens.

An Etherfuse app's UI where users can mint CETES tokens with USDC. Source: Etherfuse

Although built on decentralized infrastructure, this is a regulated product. To transact with the token on the issuer’s platform, users must complete KYC. Furthermore, the platform restricts access for U.S. citizens and residents of sanctioned jurisdictions. At the time of writing, the Etherfuse app operates on an invite-only basis.

However, on the secondary market, CETES tokens trade without such restrictions. For example, Etherfuse assets on Solana are readily available in Orca pools and accessible via Jupiter.

How Falcon Finance Brings Additional Utility to the Tokenized CETES

Falcon Finance added tokenized CETES as collateral in December 2025: by accepting tokenized sovereign bonds from outside the U.S., it moved away from a purely dollar-centric model. There is a practical reason: users maintain exposure to Mexican sovereign debt while freeing up dollar liquidity to use elsewhere on-chain.

When CETES is deposited to Falcon Finance as collateral, the underlying return doesn’t get stripped out or rerouted. It stays with the token and shows up over time as a higher NAV, rather than being converted into USDf.

From a user’s point of view, this setup is simply more flexible. A relatively low-risk sovereign asset can sit as collateral, while the USDf minted against it is, for example, staked in Falcon Finance for earning a share of protocol’s yield strategies.

Final Thoughts

Integration of CETES into Falcon Finance reflects broader shifts in how tokenized government bonds and other sovereign securities can be used in a new economy. Easier access to instruments such as Mexican Treasury bills via their tokenized version also means moving away from a purely U.S.-centric model toward a more globally diversified approach, effectively hedging against a weak U.S. dollar.

That is why it’s becoming increasingly difficult to ignore what tokenization actually makes possible. Instruments that were previously hard to access due to bureaucracy or structural barriers — including Mexican government bonds — can now be used more freely and flexibly across products and markets worldwide.

For investors, the implication is fairly straightforward. They gain access to a wider range of use cases, more ways to generate returns, and additional tools for managing risk — options that simply are not available when working with traditional financial instruments.