Velvet Capital Overview: DeFAI Operating System for On-Chain Portfolios

Updated • 24 Dec 2025

Published • 30 Dec 2025

10 mins

Summary

- Velvet Capital positions itself as a full DeFAI operating system, combining an intent-based trading engine, AI agents, and on-chain portfolio infrastructure for traders, DAOs, and asset managers.

- Its trading terminal is wallet-connected and cross-chain, using intent routing across venues and solvers to optimize execution and reduce MEV, while bundling multi-step DeFi actions into one flow.

- The Velvet Unicorn AI framework is a multi-agent system that can do research and execute actions (swaps/rebalances/vault allocations), with a roadmap toward more autonomous trading and portfolio management.

- VELVET token utility centers on locking into veVELVET for governance and fee sharing, with platform revenues swapped into VELVET and distributed to veVELVET holders (with additional discounts and incentive mechanics tied to stake).

- A dedicated vault launched by Falcon Finance lets VELVET holders to lock their tokens for 180 days to earn an estimated 20-35% APR in USDf, with rewards claimable anytime, and principal returned at maturity.

Introduction

Velvet Capital is positioning itself as a full DeFAI operating system rather than just another trading app, combining an intent-based trading engine, AI agents, and on-chain portfolio infrastructure so traders, quant researchers, DAOs and asset managers can trade, automate strategies and run decentralized vaults from one place. This article walks through what Velvet Capital is, how its products fit together, and how the VELVET token underpins the ecosystem.

What Is Velvet Capital?

Velvet Capital is a DeFAI (DeFi + AI) trading and portfolio management ecosystem powered by intents, built as a vertically integrated stack with a web app, Telegram trading bot, APIs, and an AI “operating system” for DeFi agents.

Its main product lines are:

- Trading terminal for cryptocurrencies and DeFi pool with direct connection to a wallet across multiple chains, with intent-based routing and MEV-aware execution.

- AI Framework (“Velvet Unicorn”), a multi-agent AI layer that finds new trading opportunities, runs research, and can execute trades or strategies from natural-language prompts.

- Portfolio Management, infrastructure to launch non-custodial or semi-custodial on-chain portfolios (vaults) with fees, whitelists, DeFi integrations and a full API layer.

- The toolset for custom apps and white-label solutions, so that funds, fintechs and projects could set up their own branded front-ends on top of Velvet’s stack instead of building from scratch.

Let’s break each component down in more detail.

Trading Terminal

Velvet Capital’s trading terminal is a cross-chain interface for tokens and DeFi pools that connects directly to a user’s crypto wallet, with the need for centralized deposits.

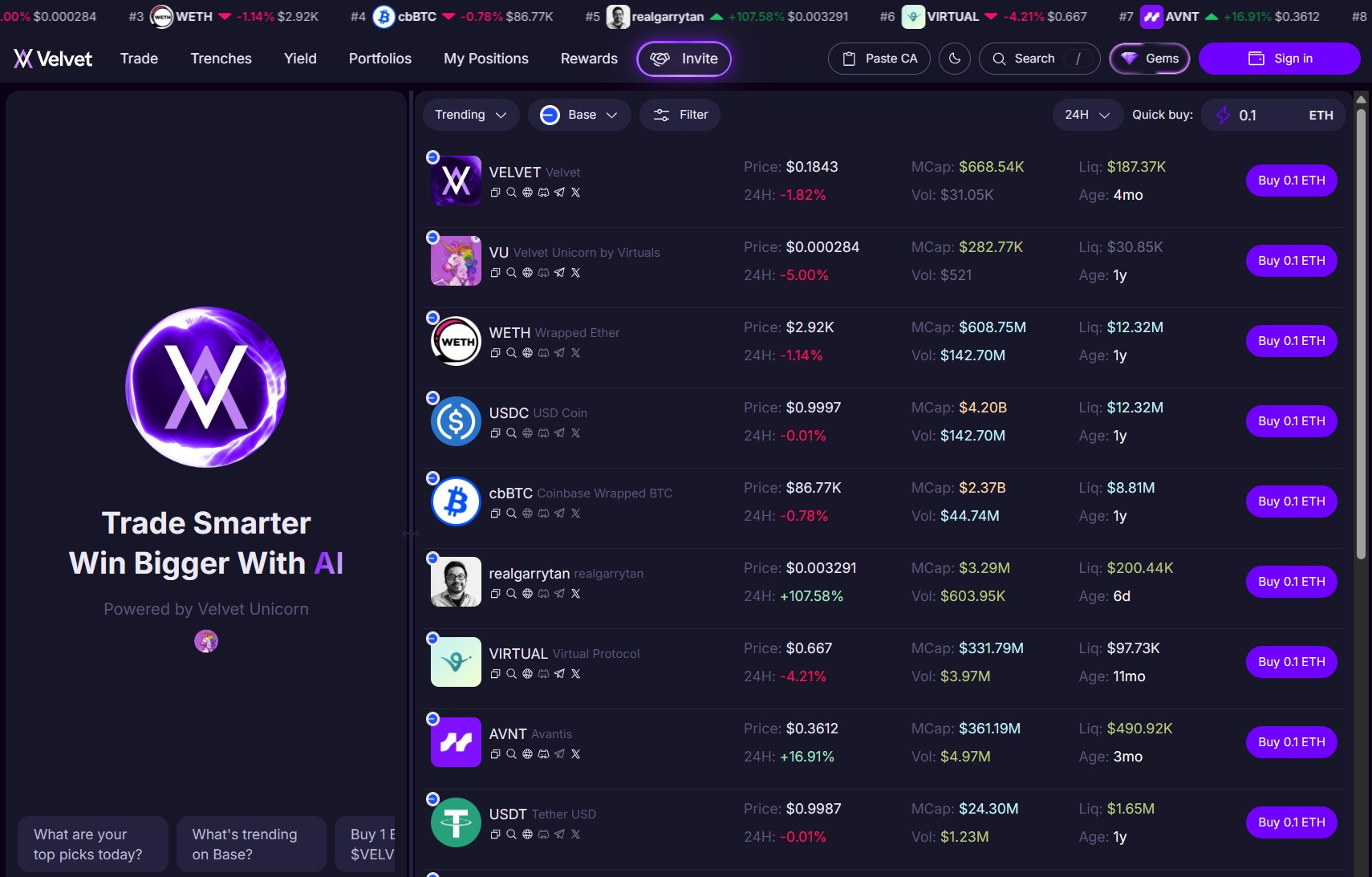

Once you pick a blockchain network (Base, Solana, Ethereum, BNB Chain, Bitlayer, with more chains planned), the app surfaces trending coins, new pairs, gainers, top-volume markets and yield pools with basic analytics. From there, you can either make a quick buy in one click, or send an asset to the detailed trade module and preview the route, size and output before executing.

Each traded asset has a detailed page with charts, on-chain analytics, transaction feeds and an embedded swap panel, so you can go from research to execution without leaving the interface.

Velvet Capital's trading terminal UI. Source: Falcon Finance

The same logic applies to DeFi pools: the “Yield” section lists integrated pools with APY, TVL and other parameters, and deposits are executed as intent-based transactions that bundle all steps (approval, swap, staking, minting) into a single flow. The terminal then gives a consolidated view of all holdings and yield positions, letting users rebalance or exit with a couple of clicks.

Behind the frontend, Velvet Capital uses an intent-based execution engine that routes orders across aggregators, solvers, market makers, AMMs and DEXes, aiming for best price and MEV protection rather than tying execution to a single venue. This same engine is what the AI layer and portfolio tools build on.

Velvet Unicorn: AI Framework

A crucial component that makes Velvet Capital a DeFAI project is Velvet Unicorn (VU), a multi-agent AI operating system tuned for DeFi. Instead of a single monolithic chatbot, Velvet Unicorn is a network of agents with various roles and models (“CEO”, “Researcher”, “Analyst”, “Trader”, DeFi executor), coordinated by larger LLM-based agents for higher-level reasoning.

The system is built around a reward-and-feedback loop: agents rewrite their own prompts based on results, using both on-chain and social data so that responses improve over time and hallucinations are reduced.

In practice, that means the assistant can:

- Answer natural-language questions like “What tokens are trending on Base?” or “Analyze the VU chart”.

- Combine on-chain metrics, social sentiment, TA, a statistical price-prediction model and risk filters into structured responses.

- Execute actions such as swaps, rebalances, vault allocations on behalf of the user, following commands in natural language, like “Trade 1 ETH into VU and rebalance my vault”.

According to project’s roadmap, AI framework will move the currently live on-chain research to intent-based execution, and finally to autonomous trading and portfolio management, where AI agents can run strategies, rebalance crypto treasuries and optimize yield with minimal human input.

Portfolio Management and API Capabilities

Velvet Capital’s portfolio layer turns the platform into infrastructure for on-chain “funds”. Users can create personal or public portfolios (vaults) where assets are held in smart contracts, depositors receive vault tokens, and a manager can trade and interact with DeFi protocols without ever taking custody of client funds. Vaults can be fully permissionless or tightly controlled via whitelists, transfer restrictions and asset whitelists, useful for compliant products or RWA structures.

Creating a public portfolio is a guided, six-step flow: basic metadata (name, symbol, description), visibility and whitelisting settings, fee configuration (management, performance, entry and exit), token supply and minimums, initial asset composition (spot tokens and/or DeFi pools), and a final review and deploy step. Once live, managers can trade and rebalance inside the vault through the same terminal experience, and claim fees that accrue in vault tokens. All portfolios are non-custodial by default, but the architecture also supports multisig-controlled or, in future, MPC-backed vaults for larger institutions that want to separate custody from asset management.

For builders and quantitative researchers, Velvet exposes a Portfolio Management API that mirrors what the UI can do: discover vaults by owner, deposit and withdraw, rebalance by selling one token and buying another, and execute trades via generated call data.

A typical flow is: query all vaults for a given address, call the rebalance endpoint to generate parameters (new token set, sell amounts, handler and calldata), and then send an on-chain transaction to the vault’s rebalance contract using libraries like ethers.js. Separate endpoints handle deposits, withdrawals and helper queries like “how many vault tokens does this user hold?”. This makes it possible to plug existing off-chain strategies into Velvet or to build fully custom front-ends on top of its infra.

VELVET Token

veVELVET

VELVET is the main token of the Velvet Capital ecosystem. It becomes most powerful when locked into its vote-escrowed form, veVELVET, which is used for fee sharing, discounts and governance. veVELVET stakers earn a mix of protocol yield and incentive emissions. Half of platform revenues (trading fees, AI inference fees, vault management fees, partner rewards and more) are swapped into VELVET and distributed to veVELVET holders, while the other half goes to the DAO treasury.

On top of that, veVELVET balances determine trading-fee discounts, boosted referral rewards, access to certain incentive programs and, in future, the allocation of VELVET emissions across vaults in a “gauge/bribe” style system where vault managers can pay to attract more rewards.

VELVET Vault in Falcon Finance

On top of the core veVELVET model, there is also a dedicated VELVET staking vault on Falcon Finance, built for long-term holders who want to keep upside exposure while earning a stable, dollar-denominated return.

The vault, live on BNB Chain, lets users lock VELVET for 180 days and earn an estimated 20-35% APR in USDf, Falcon’s synthetic dollar, with rewards calculated on the USD value of the stake rather than the raw token amount so yield isn’t affected by VELVET’s price moves.

During the lock period, USDf yield accrues continuously and can be claimed at any time, while the full VELVET principal is returned at the end; deposits are accepted until a 50 million VELVET capacity is reached. In practice, this gives committed community members a way to turn governance and long-term conviction into a productive position, layering a relatively predictable USDf income stream on top of their exposure to the Velvet ecosystem.

VU Token

A second token, VU (Velvet Unicorn), acts as the “gas” token for AI inference and agentic strategies: each call’s VU spend is split one-third burned, one-third to R&D treasury, and one-third to veVELVET stakers in the form of VELVET rewards, linking AI usage back to the main token.

VELVET Tokenomics

Tokenomics follow three design principles:

- align incentives between traders, managers, long-term backers and the DAO;

- attach tangible value to VELVET via fee sharing and buybacks;

- bootstrap usage with capped emissions that taper as organic revenue grows.

Allocation is spread across early backers (including Binance Labs, Selini Capital and other funds), community and launch rounds, DAO treasury, ecosystem and growth funds, team and advisors (with long cliffs and linear vesting), liquidity, airdrops and future listings.

Velvet Capital Roadmap

The public roadmap focuses on deepening both the DeFi and AI ends of its product suite.

On the trading and infrastructure front, upcoming work includes a DeFAI Telegram trading bot on Solana, Base and BNB Chain, upgraded execution (TWAP, limit orders and more order types), wallet and X.com tracking, copy-trading, and a chain-abstraction module for omni-chain execution.

On the portfolio and AI side, the Velvet Capital team is working on “prompt-to-strategy” individual portfolio management, expanded portfolio management and trading APIs across multiple blockchains with improved key management and dashboards, and fully automated agentic portfolios that run themselves as long as the manager maintains a veVELVET position.

Security and Audits

Velvet Capital has undergone several audits with firms such as PeckShield, Softstack (formerly Chainsulting), Resonance Security, Shellboxes, plus an open audit competition with Hats Finance, with reports published in their GitHub repository.

Real-time monitoring is layered on top: Velvet uses Forta for machine-learning driven threat detection, OpenZeppelin Defender 2.0 to manage deployments and on-chain operations with integrated Forta alerts, and Tenderly for transaction simulation and anomaly alerting.

Two active bug bounties on Immunefi and Hats Finance give white-hat researchers clear incentives to probe the system, and all contracts are open for further external review.

Closing Thoughts

Velvet Capital is trying to do more than ship another DeFi front-end: it is building an intent-driven operating system where trading, yield, portfolio management and AI agents all sit on the same rails. The trading terminal gives active users a single interface to discover tokens and pools, while the AI framework pushes research and execution into a conversational, automation-friendly layer. Portfolio infrastructure and a mature API turn Velvet into something that funds, DAOs and quants can actually build on, not just click through. The VELVET token, and its veVELVET and VU extensions, connect platform usage back to value and governance in a way that is explicitly designed around “real yield” and long-term incentives. If the team can deliver on its roadmap and keep the security bar high, Velvet Capital could become one of the core DeFAI hubs where both retail and professional users run their on-chain strategies.