Falcon Weekly Recap: Built for Trust, Designed to Scale

Updated • 15 Aug 2025

Published • 13 Jun 2025

3 mins

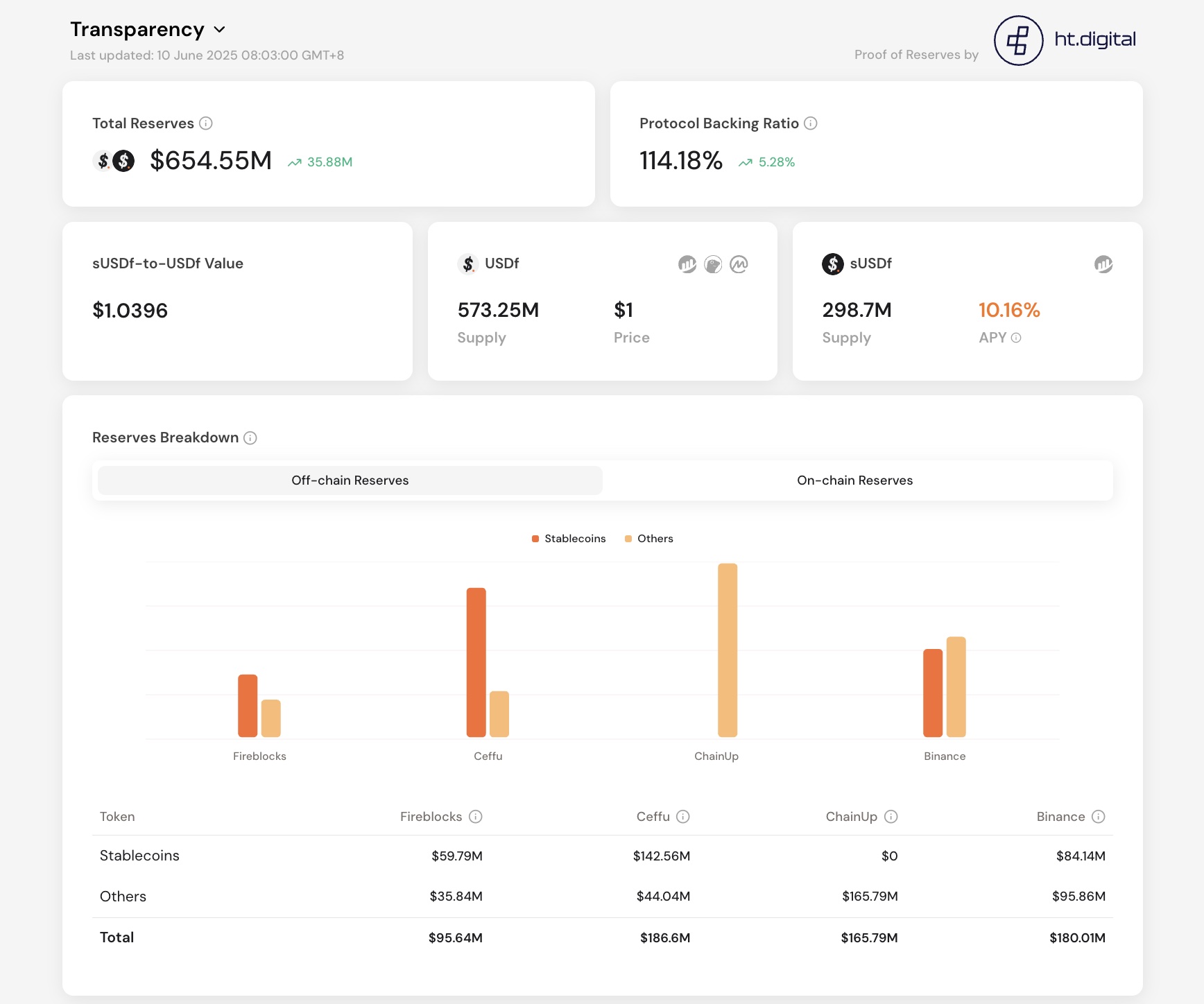

This week, we laid down deeper foundations for what matters most: trust. From USDf collateral transparency and Proof of Reserves to institutional custody and new Balancer pool, here’s everything we shipped and announced.

Building Proof of Reserves Infrastructure with HT Digital

We’ve partnered with HT Digital to independently verify the data shown on the Transparency Dashboard, which provides daily updates on USDf’s overcollateralization. HT Digital recalculates and reviews the figures each day to ensure accuracy.

Coming next:

Quarterly attestation reports will be conducted by Harris & Trotter LLP under the ISAE 3000 Assurance standard, reviewing reserve sufficiency, data integrity, and internal controls.

Custody Integration with BitGo for USDf

We have also announced our partnership with BitGo to offer secure custody support for our overcollateralized synthetic dollar, USDf. This integration will provide institutional users with trusted, regulated infrastructure to hold USDf in BitGo wallets, paving the way for future features like staking (via ERC-4626 vaults) and fiat settlement.

Together with BitGo, we’re advancing the adoption of compliant, yield-generating synthetic dollars in the financial ecosystem.

GHO / USDf Pool Now Live on Balancer

USDf is now live in a capital-efficient stable pool on Balancer V3, paired with Aave’s native stablecoin, GHO. This collaboration brings DeFi users a high-performance liquidity pool with triple-layered yield mechanics:

1️⃣ Enhanced Stability: Balancer’s Stable Surge Hook dynamically adjusts swap fees to protect the peg of USDf and GHO during market imbalances, reducing slippage and MEV risks.

2️⃣ Optimized Rewards:

- Lending yields via Aave.

- Swap fees from deep liquidity.

- Additional incentives (59–110% APY) boosted via Aura Finance

3️⃣ Zero Idle Capital: All LP funds are actively deployed in Balancer Boosted Pools, ensuring continuous compounding

How to Participate:

- Deposit liquidity on Balancer

- Maximize yields by staking LP tokens via Aura Finance

This pool represents a major step forward for USDf’s DeFi integration, offering a sustainable, high-yield opportunity for stablecoin liquidity providers.

Falcon’s Delta-Neutral Strategies Continued to Deliver a Consistent 8–12% APY

When volatility dries up and funding rates soften, most protocols' yields take a hit. Ours don’t.

Our delta-neutral strategies continue to deliver a consistent 8–12% APY, outperforming most staking alternatives even in quieter market conditions. In this article, we walk you through how our yield engine works, and why it keeps performing when others slow down.

Our engine is built on three key components:

- Funding Rate Arbitrage: capturing yield from both positive and negative funding

- Cross-Exchange Spreads: identifying and executing on price differences across platforms

- Altcoin Staking: earning from long-tail assets with smart risk management

These strategies are designed to perform in all market cycles, helping you earn sustainable on-chain yield without chasing hype or risking capital in volatile positions.

Ready to put your assets to work? Start earning with Falcon today.