How Falcon’s Yield Engine Performs in Today’s Market

Updated • 15 Aug 2025

Published • 13 Jun 2025

3 mins

.png)

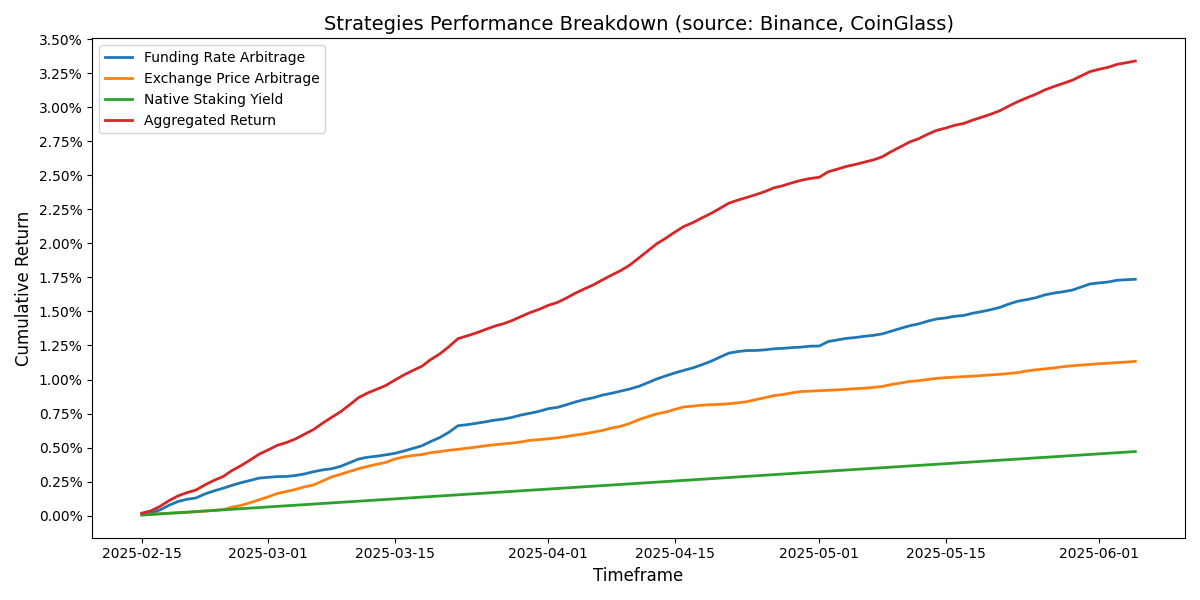

When volatility dries up and funding rates soften, most DeFi yields take a hit. But not Falcon’s. Despite a sluggish market environment, Falcon’s delta-neutral strategies have continued to deliver a consistent 8–12% APY, outperforming most staking alternatives.

In this breakdown, we explore how Falcon’s institutional-grade yield engine works, and why it continues to perform even in less favorable conditions.

Three Pillars of Falcon’s Yield Strategy

Falcon’s yield engine is built on three core strategies:

- Funding Rate Arbitrage (both negative and positive)

- Cross-Exchange Spreads

- Altcoin Staking Strategies

These components are designed to thrive across market cycles and provide sustainable on-chain yield for users.

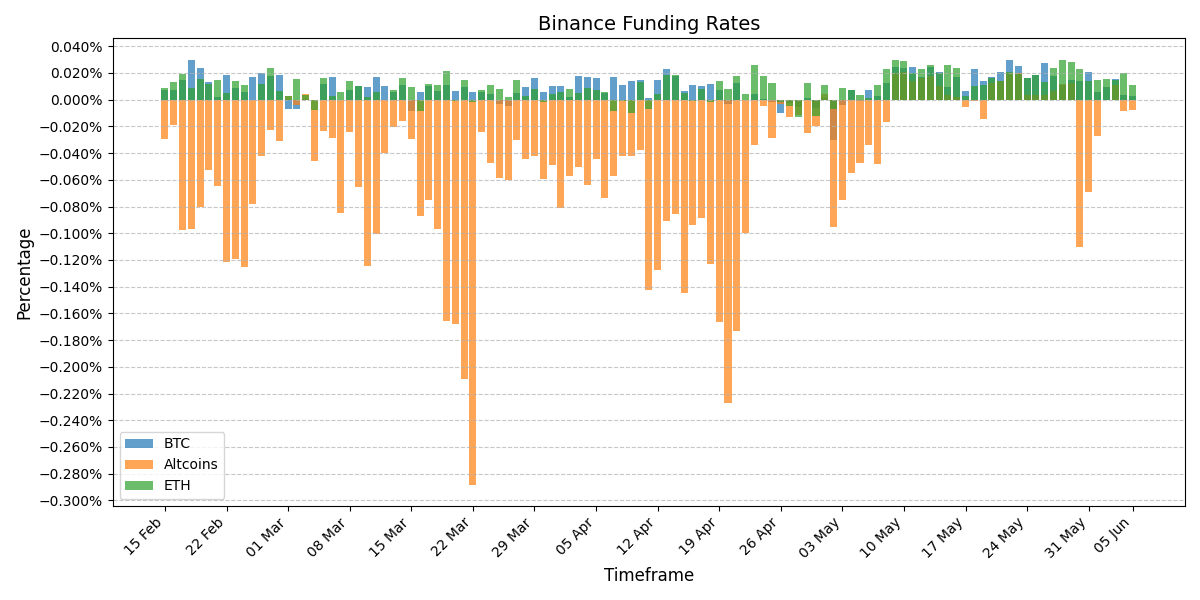

Funding Rate Arbitrage

While blue-chip funding rates (e.g., BTC and ETH) typically average around 0.025% daily, recent market conditions have seen them soften to just 0.01%.

But this doesn’t mean opportunities disappeared.

Altcoins have consistently exhibited heavily negative funding rates, reflecting strong short interest. Falcon captures these inefficiencies by positioning itself on the other side of the trade, earning yield in the process.

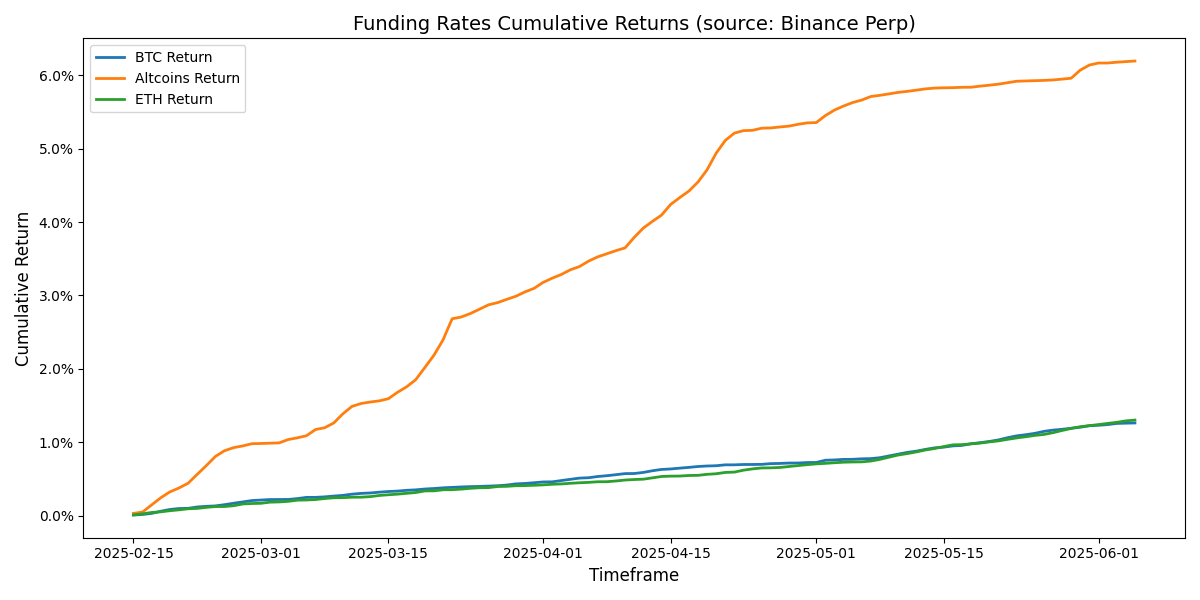

Why Altcoins Matter

Altcoins do more than diversify Falcon’s exposure – they outperform.

Cumulative return data shows that altcoin positions have added an extra 5% in profits compared to BTC-focused strategies. This reinforces their central role in Falcon’s overall performance.

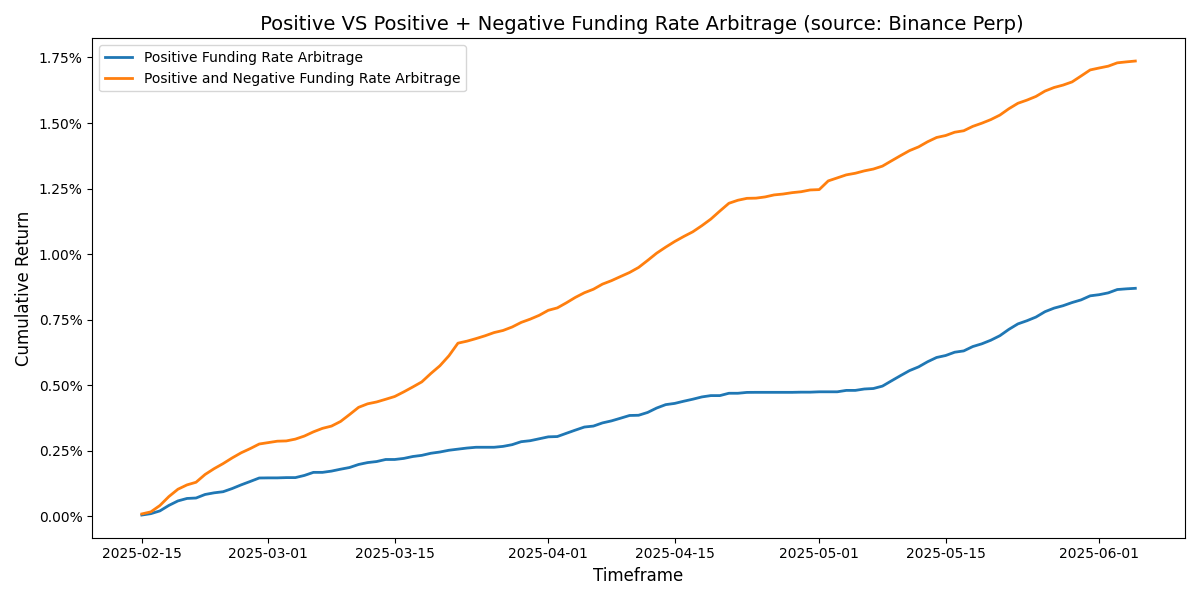

Arbitraging Both Sides of the Market

Unlike strategies that only farm positive funding rates, Falcon takes advantage of both positive and negative funding opportunities.

This dual-sided approach has proven to be significantly more effective, nearly doubling returns when compared to traditional positive-only strategies.

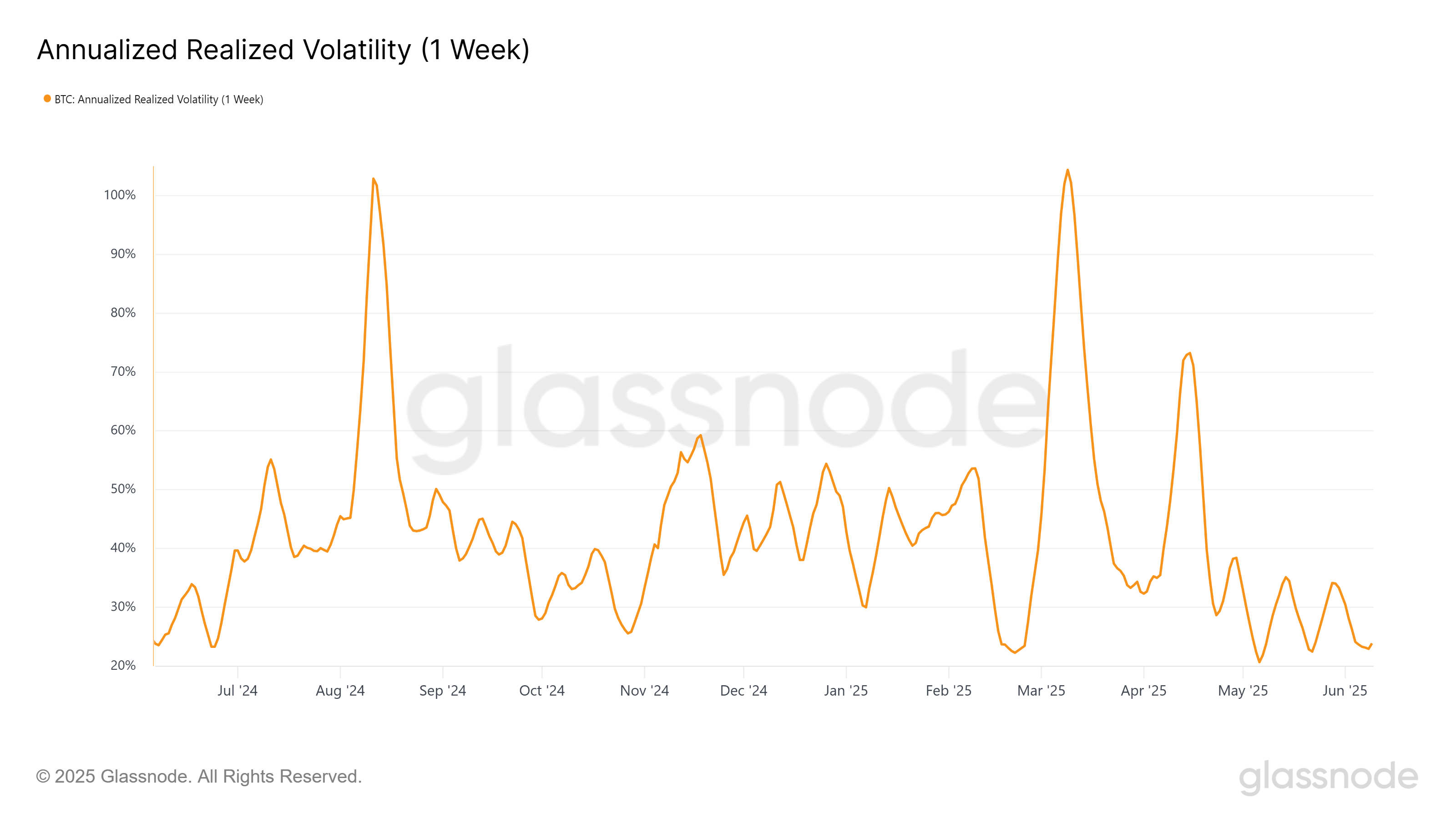

Cross-Exchange Arbitrage: A Volatility-Driven Engine

Falcon’s yield engine also benefits from cross-exchange arbitrage. When volatility rises, so do the spreads between exchanges, opening up arbitrage windows.

Historically, short-term volatility tends to mean-revert around the 20% level. Falcon’s research shows a strong correlation between volatility spikes and arbitrage opportunities.

As markets normalize, we expect this to be an increasingly important contributor to yield.

The Outcome: Resilience Through Strategy

By combining these strategies, Falcon has built a resilient and adaptive yield engine.

Even in soft or sideways markets, the engine continues to produce consistent returns — which compound over time to significantly boost user yield.

Additional Yield Opportunities

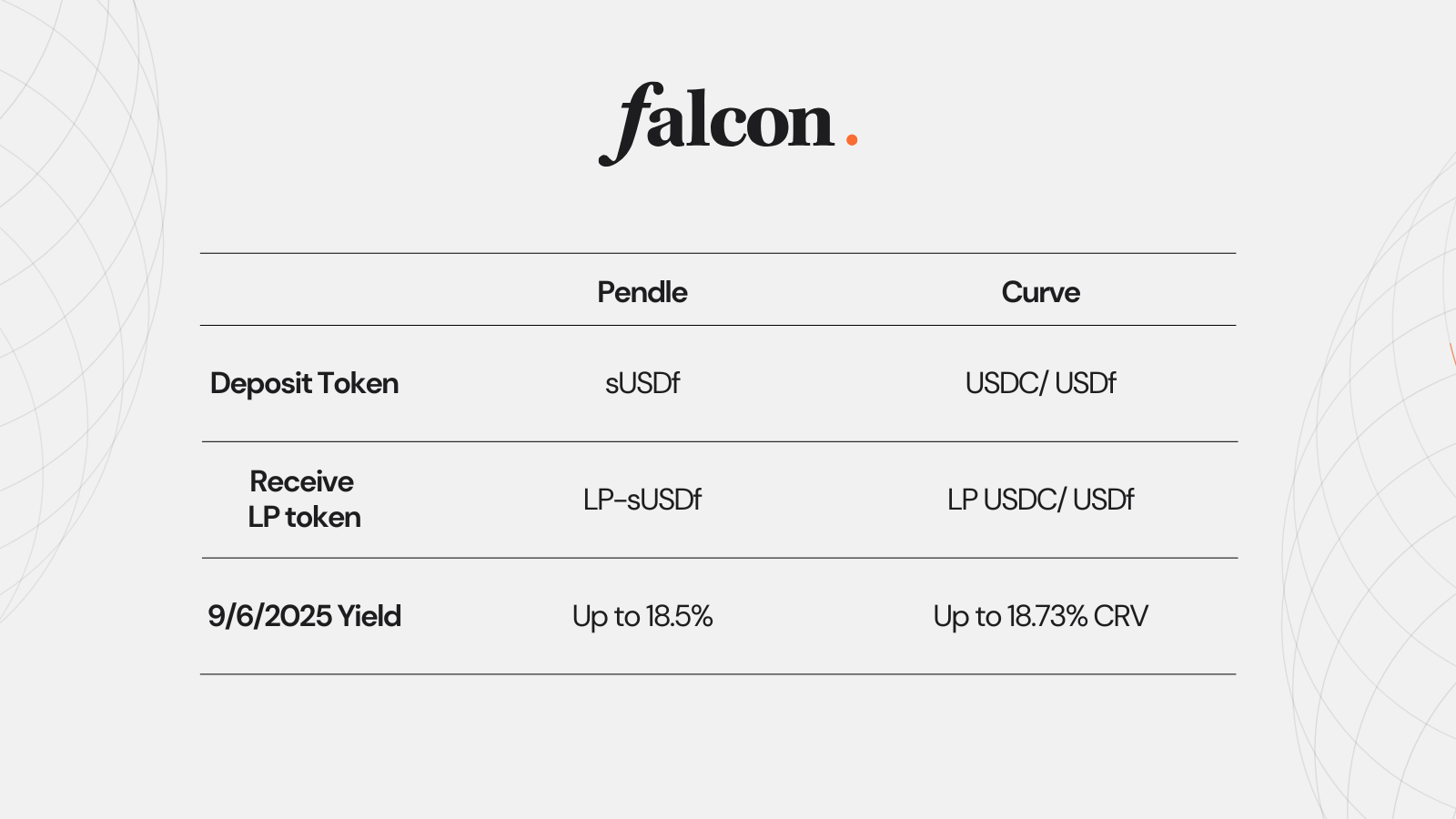

Beyond Falcon’s core strategies, USDf and sUSDf holders can tap into additional yield layers across DeFi:

- sUSDf holders can boost returns by providing liquidity on Pendle

- USDf holders can access yield via Curve and its CRV incentives

In Summary

Falcon’s delta-neutral approach works across market conditions by combining funding-rate arbitrage, cross-exchange spreads, and staking yield – all under one engine.

With integrated DeFi opportunities layered on top, users can earn sustainable returns backed by real on-chain performance.

Tags