The Digitalization of Bullion: A Deep Dive into Tokenized Gold and How to Earn from It

Published • 12 Jan 2026

8 mins

Summary

- Tokenized gold is a blockchain token that gives direct exposure to vaulted investment-grade bullion, with regulated issuers minting tokens pegged to a fixed weight on various blockchains like Ethereum or Solana.

- The market broadly splits gold-backed tokens into 3 types: fully backed redeemable, pooled or unallocated, and synthetic or derivative designs, trading off redemption rights against flexibility and structural risk.

- The main investor upgrade is usability: on-chain gold becomes customizable collateral, enabling lending or borrowing, round-the-clock trades, quick settlement, and natively fractionalization for smaller orders.

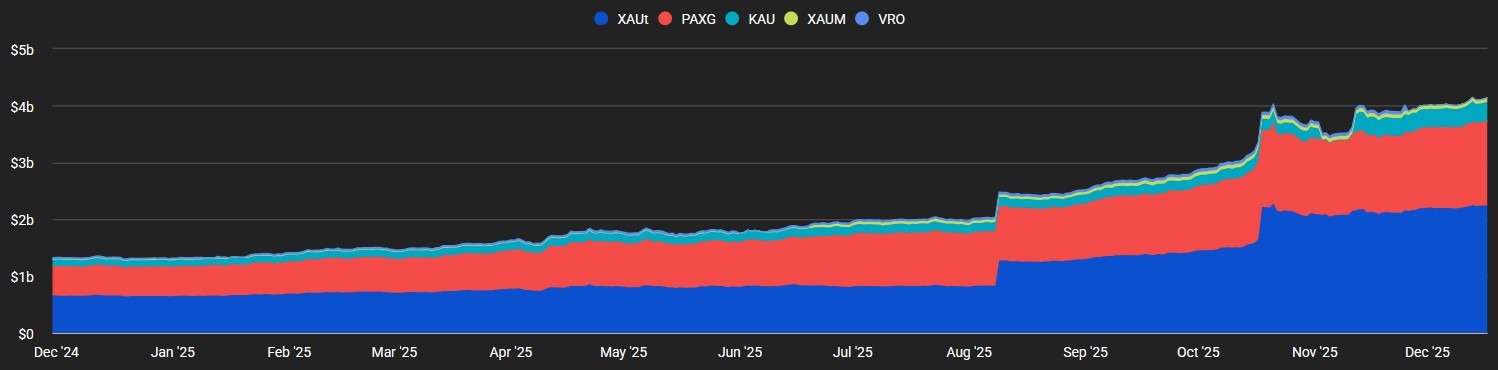

- Adoption has accelerated fast: by December 2025, tokenized gold market cap surpassed $4 billion, nearly tripling from $1.3 billion at the start of the year, with XAUt and PAXG tokens accounting for about 90% of total value.

- Tokenized gold can generate yield for holders. For example, Falcon Finance accepts Tether Gold (XAUt) as collateral to mint its synthetic dollar, USDf, and its yield-bearing token, sUSDf. It also offers a staking vault where users can temporarily lock XAUt tokens to earn regular rewards in USDf without selling the principal assets.Introduction

While gold has served as a reliable store of value for millennia, investing in it has often been fraught with friction, mostly because of its physical nature: think high-security vaults, ongoing custody fees, restrictive trading hours, and cumbersome settlement processes.

Tokenized gold aims to preserve the qualities investors value in bullion, such as its scarcity and role as an inflation hedge, while modernizing the underlying infrastructure. In this article, we will guide you through the gold tokenization trend, its benefits for investors and main differences between tokenized and physical gold.

What Is Tokenized Gold?

In essence, tokenized gold is a digital asset on a blockchain, usually a token, that provides direct exposure to physical gold. The mechanism is straightforward: a regulated issuer holds investment-grade bullion (e.g., LBMA “Good Delivery” bars) in secure, professional vaults. They then issue tokens various on blockchains like Ethereum or Solana, where each token is pegged to a specific weight of gold, such as one fine troy ounce or one gram.

For instance, each Tether Gold (XAUt) token represents an ounce of gold from a specific bar in Swiss vaults, and can even be split into fractions as small as 0.000001 ounces. Similarly, Pax Gold (PAXG) represents one fine troy ounce of gold stored in London vaults. Holders maintain legal ownership of the metal through Paxos Trust, a regulated entity.

Three Design Models of Gold-Backed Tokens

Tokenized gold products generally fall into three categories, each offering a different balance of rights and risks:

- Fully backed, redeemable tokens. This is the digital equivalent of an allocated gold account. Every token is tied to physical bullion in a vault that can, in theory, be redeemed for the actual metal or cash. Notable examples include XAUt and PAXG.

- Pooled or unallocated tokens. Here, the issuer maintains a general pool of gold rather than assigning specific bars to individual holders. While operationally simpler, it introduces slightly more structural risk as your claim is against the pool rather than a specific physical asset.

- Synthetic or derivative tokens. These tokenized gold tokens use oracles and futures to track the spot price of gold without requiring one-to-one physical backing. These are effectively gold-pegged assets designed for high flexibility within DeFi (Decentralized Finance) ecosystems.

Key Advantages of Tokenized Gold for Investors

Moving from traditional gold products to tokenized versions offers several functional upgrades.

Perhaps, the most significant change brought by tokenized gold lies in how it can be used. Gold tokenization provides programmability: on-chain gold can be deposited into lending protocols to earn yield or used as collateral to borrow other assets, like stablecoins. This turns a historically “dead” asset into an active, productive component of a portfolio.

Tokenized gold also gives 24/7 market access. Unlike ETFs that only trade during exchange hours, tokenized gold is tradable at any time on global exchanges. Transfers can settle on-chain in seconds or minutes, bypassing the typical T+1 or T+2 cycles of traditional finance that take more than a business day for settlement.

High gold prices can make buying full bars or even ETF shares difficult for smaller accounts. Tokenization enables native fractionalization of gold, i.e. ownership of tiny fractions (up to six decimal places for XAUt), making it easier to dollar-cost-average (DCA) into this precious metal.

Furthermore, by moving on-chain, gold reduces operational costs and complexity. While owning physical gold requires managing insurance, storage, and logistics, tokenized gold has these tasks delegated to professional custodians, providing a “cleaner” way to own gold without the burdens of physical handling.

Finally, tokenized gold is much more transparent than the physical storage and TradFi products. Because blockchains are public, they allow anyone to see the total supply and transfer history of gold-backed tokens. Leading issuers also provide regular custody attestations, and in some cases, even allow users to map their tokens to specific numbered gold bars.

Market Adoption and the Leading Tokenized Gold Projects

By December 2025, the market for tokenized gold reached a significant turning point, with its total market capitalization surpassing the $4 billion mark, according to data from The Block. This reflects a rapid acceleration in adoption, as the sector has nearly tripled from its $1.3 billion valuation at the start of the year. While several projects have emerged, the market remains highly concentrated: Tether Gold (XAUt) and PAX Gold (PAXG) together represent nearly 90% of the total value in this space.

Gold-backed tokens market capitalization. Source: The Block, data as of December 18, 2025

The “Big Five” of Gold Tokens

The current landscape of tokenized gold is represented by five projects that cater to different investor needs, from institutional-grade transparency to daily spendability. Here is their overview table:

Project | Issuer | Unit of Backing | Primary Vault Locations |

Tether Gold (XAUt) | TG Commodities (Tether) | 1 troy oz | Switzerland |

PAX Gold (PAXG) | Paxos Trust Company | 1 troy oz | London |

Kinesis Gold (KAU) | Kinesis Monetary System | 1 gram | Worldwide |

Matrixdock Gold (XAUm) | Matrixdock (Matrixport) | 1 troy oz | Singapore and Hong Kong |

VeraOne (VRO) | VeraOne / AuCOFFRE Group | 1 gram | Geneva (Free Ports) |

Let’s have a closer look at each project:

- Tether Gold (XAUt). As the market leader, XAUt is issued as both an ERC-20 and TRC-20 token, ensuring deep liquidity across major exchanges and DeFi platforms. The project’s scale is significant; Tether now holds more than 300,000 ounces of bullion in Swiss vaults to back the circulating supply.

- PAX Gold (PAXG). Often considered the most “ETF-like” digital gold asset, PAXG is a regulated token overseen by the New York Department of Financial Services (NYDFS). Each token corresponds to a specific, serialized London Good Delivery bar, and holders maintain direct legal ownership and redemption rights.

- Kinesis Gold (KAU). Unlike passive investment tokens, Kinesis focuses on gold as a “spendable” currency. Each KAU is backed by one gram of gold, and users can spend their holdings via a Kinesis card. Uniquely, the system offers a yield to holders, sourced from a share of the platform’s global transaction fees.

- Matrixdock Gold (XAUm). This institutional-grade offering focuses on transparency for professional investors. Backed by 99.99% LBMA-certified gold in high-security Asian vaults, Matrixdock provides rigorous reserve reporting and has integrated Chainlink infrastructure to enable seamless cross-chain movement.

- VeraOne (VRO). Targeting the European market, this French-issued token emphasizes security and conservatism. Each unit represents one gram of gold stored in Geneva’s Freeport. It is designed as a stable, metal-backed alternative for savers who prefer the historical stability of gold over fiat-pegged stablecoins.

How to Earn Yield for Tokenized Gold

While physical gold bars remain static in a vault, tokenized gold can be integrated into advanced digital products and protocols, transforming an “unproductive” asset into a source of active income.

In its path toward becoming a universal collateralization layer, Falcon Finance allows for using tokenized gold, in particular Tether Gold (XAUt), for various operations within its app.

Firstly, XAUt can be used as a collateral asset in Falcon Finance: this allows investors to deposit their XAUt tokens to mint USDf, Falcon’s synthetic dollar. Once minted, USDf can be staked within the Falcon ecosystem to earn a share of Falcon’s diverse strategies.

Secondly, Falcon Finance launched a dedicated XAUt staking vault: users stake their XAUt gold-backed tokens for a 180-day lockup period to earn an estimated 3-5% APR in USDf. While XAUt remains locked, investors retain ownership. Rewards are distributed every seven days in USDf, providing a steady stream of income without requiring active management.

Risk Implications

While the technical “rails” are new, tokenized gold still carries inherent risks.

First, investors remain exposed to issuer and custody risk, i.e. the possibility that the vault operator or the company itself fails. Additionally, the use of smart contracts and bridges introduces technical risks that are not present when holding a physical bar of metal. Regulatory landscapes are also still evolving as authorities pay closer attention to large-scale on-chain reserves.

Final Thoughts

The transition of gold into a digital, programmable asset marks a fundamental shift. By stripping away the physical friction historically associated with bullion, tokenization has effectively converted gold from a static asset into a dynamic instrument of capital efficiency. In the current landscape, the value proposition for the sophisticated investor lies not merely in price exposure, but in the composability of that exposure, where gold can simultaneously serve as a macro hedge and a productive collateral base within global liquidity.