A Guide to Transparency and Security in Falcon Finance

Published • 17 Nov 2025

9 mins

DeFi and crypto projects unlocked a world of complex financial opportunities, yet they often struggle to ensure sufficient transparency and security, becoming prone to failures: users have seen opaque protocols take excessive risks with their funds, leading to sudden losses or collapses. Being a universal collateralization layer that powers onchain liquidity and yield generation, Falcon Finance strives to solve this trust gap. It applies an approach that emphasizes open transparency, stringent protection of user funds and robust risk management. This article examines how Falcon upholds these principles to build user confidence in a volatile digital asset landscape.

Solving the Transparency Challenge

Comprehensive transparency is one of the core principles when it comes to blockchain protocols with complex financial logic, and Falcon Finance follows this principle head-on with a public Transparency Dashboard that offers insight into the protocol’s financial backing. The page contains several sections of essential data.

Protocol Backing Ratio

First, there is the current protocol backing ratio: Falcon maintains USDf as an overcollateralized asset, meaning there are more assets in reserve than USDf in circulation. This assures users that every USDf is fully backed by sufficient collateral. Furthermore, there are more crucial stats such as the total supply of USDf and sUSDf, and protocol’s current APY.

Reserve Assets Composition

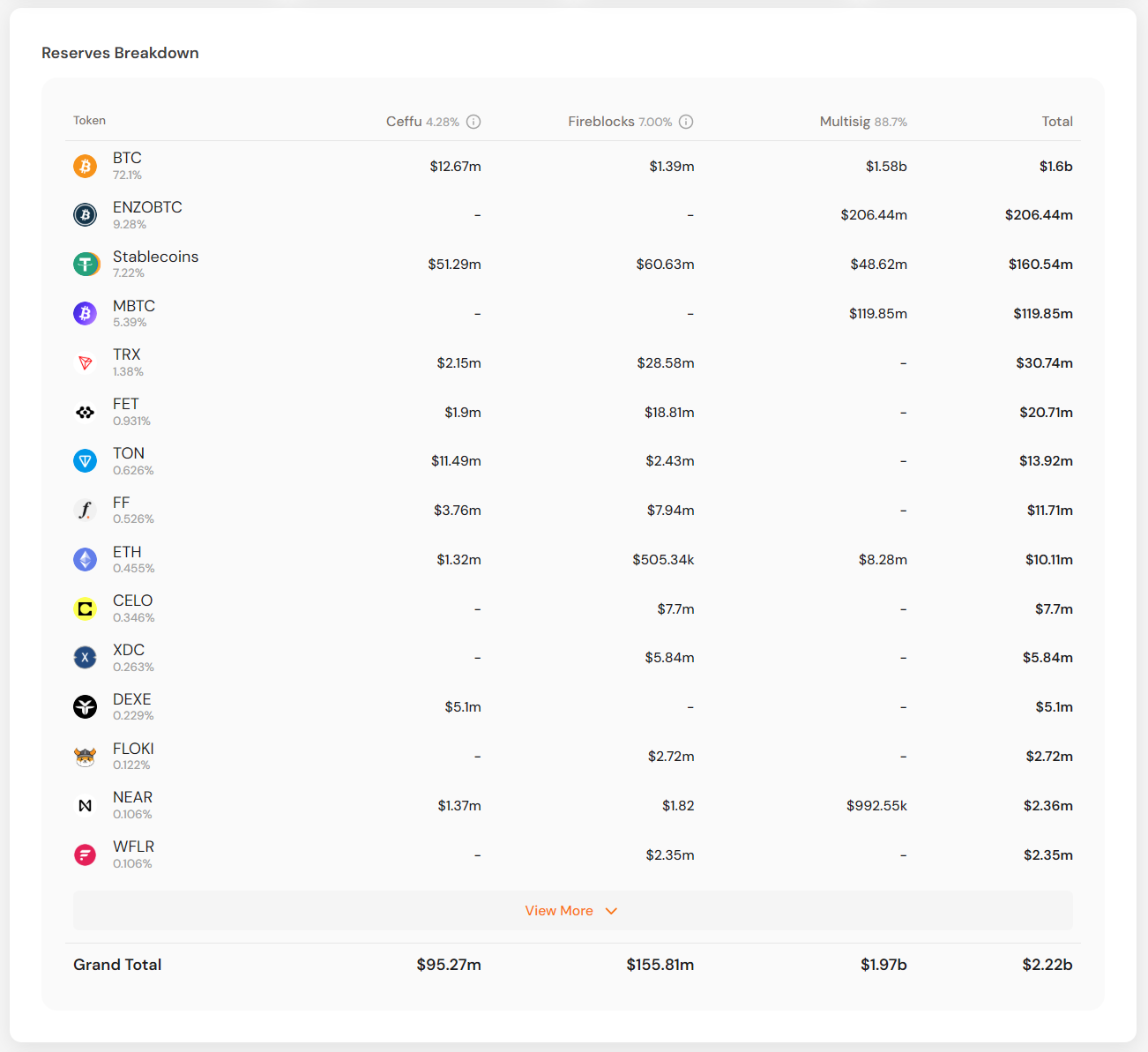

Users can view a detailed breakdown of Falcon’s reserve assets. As of November 6, 2025, the reserves comprised substantial holdings in Bitcoin, select altcoins (including ETH and SOL), and stablecoins, alongside non-crypto assets such as tokenized treasury bills (USTB). This diversified composition ensures full transparency into the assets backing USDf.

Falcon Finance’s reserves breakdown. Data as of November 6, 2025

The dashboard also details where the collateral is held. Falcon partners with regulated custodians, Fireblocks and Ceffu among others, to hold a part of its reserves, with the remainder held on multisig wallets to deploy onchain yield generation strategies. A visual breakdown shows the portion of reserves held by each custodian, giving users a clear view of how assets are secured across trusted providers.

Strategy Allocation

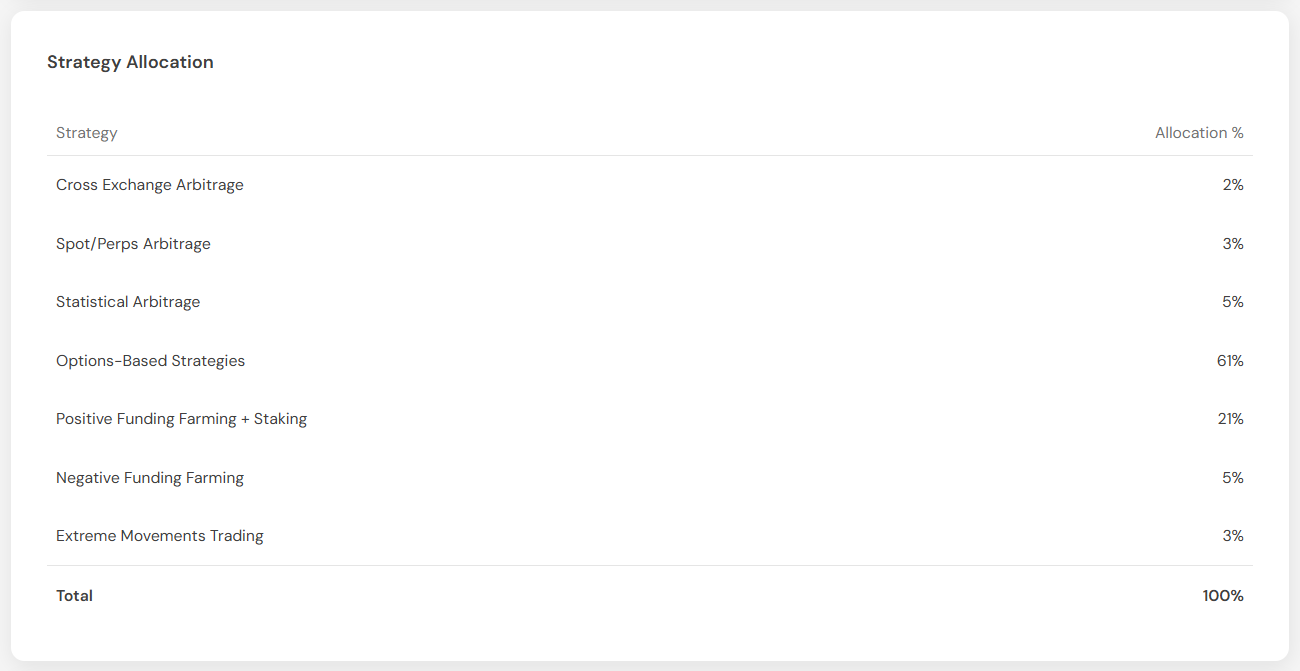

Making an extra step, Falcon Finance discloses how it deploys reserve assets in various yield strategies. Users can view the percentage of the portfolio allocated across various yield-generating strategies, including arbitrage, options-based approaches, staking, and more. Such transparency empowers the community with a clear view of Falcon’s yield generation mechanisms, extending beyond a simple breakdown of asset holdings.

Falcon Finance’s strategy allocation stats. Data as of November 6, 2025

Attestations and Audits

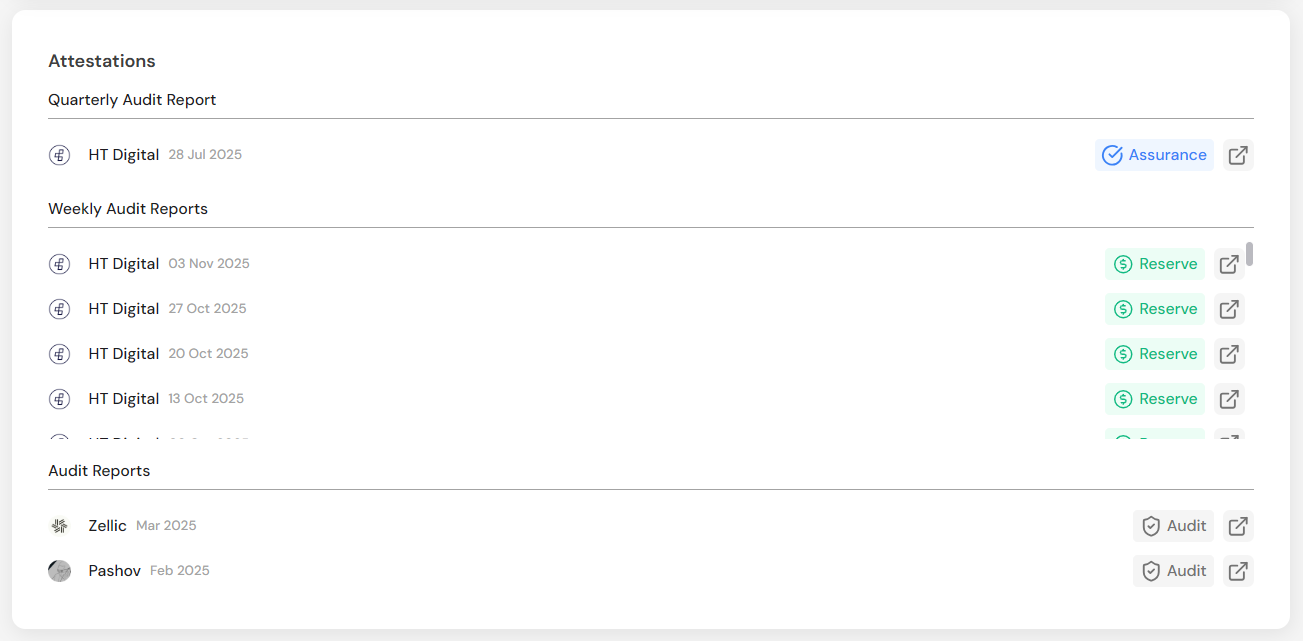

Transparency in decentralized finance can be enforced not only with public data but also through independent validation. Attestations play a critical role in reinforcing trust by verifying that a protocol’s reserves, processes, and smart contracts function as stated. By engaging reputable third parties to conduct these assessments, Falcon ensures that users and partners can confidently rely on the integrity of its systems and the soundness of its backing.

Falcon’s Transparency Dashboard features a dedicated Attestations section, where users can access up-to-date verification reports. This includes weekly reserve attestations conducted by HT.Digital, confirming that all circulating USDf tokens are fully backed, as well as quarterly assurance reports providing deeper validation of Falcon’s reserve management.

In addition, Falcon publishes independent smart contract audits performed by Zellic and Pashov, verifying the security and reliability of its on-chain architecture. Together, these reports reflect Falcon Finance’s ongoing commitment to external oversight, accountability, and transparency practices.

Attestations section on the Falcon’s Transparency page. Data as of November 6, 2025

At Falcon Finance, transparency is not merely a promise but a continuously upheld standard. The reserve data on the dashboard is updated daily to capture any changes in collateral or asset allocations. By making this information public and easily accessible, Falcon empowers users to trust the protocol while verifying its reserves at any time.

User Funds Protection Through Secure Custody

Falcon Finance prioritizes the protection of user assets, recognizing that security underpins every innovation and yield opportunity. To ensure robust safeguards, Falcon utilizes services from leading providers such as Fireblocks and Ceffu for MPC-based custody and off-exchange settlements. This setup minimizes exposure to centralized exchange risks and single points of failure, maintaining the integrity and safety of user assets at all times.

Regulated Custodians

Instead of relying on exchange wallets or unverified storage, Falcon safeguards user collateral through trusted custody service providers such as Fireblocks and Ceffu. These platforms use MPC-based wallet infrastructure, institutional-grade controls, and certification frameworks to manage digital asset custody. By retaining custody outside exchange accounts, user assets backing USDf are not exposed to risks such as exchange hacks, insolvency, or operational failure.

Off-Exchange Settlement

Falcon utilizes off-exchange settlement provided by custodian partners, Fireblocks and Ceffu, which decouples storage of assets from trading operations. Even as the protocol executes its trading and yield strategies on various centralized exchanges, the actual underlying user assets remain in cold storage at the custodian.

Falcon opens mirrored positions on centralized exchanges to replicate exposure without moving the collateral itself. In practice, this means Falcon Finance can open and manage positions on centralized exchanges without ever transferring the underlying collateral from its secure custody storage. This structure minimizes counterparty and operational risk by removing exposure to exchange hacks, withdrawal freezes, or insolvencies. Even in the event of a trading venue failure, all user assets remain safely held off-exchange under the custody framework, ensuring that security and solvency are never compromised.

MPC Key Management

Falcon has also integrated Fireblocks and Ceffu for advanced Multi-Party Computation (MPC) technology.This system distributes cryptographic keys across multiple secure nodes, ensuring that no single server or custodian holds the complete private key required to move funds. By decentralizing key management, Falcon eliminates any single point of failure that could compromise user assets. The use of Multi-Party Computation (MPC) adds a layer of security, making unauthorized access virtually impossible.

The combination of off-exchange custody, Multi-Party Computation (MPC), and trusted custodial partners forms a robust framework that ensures user assets remain under the highest level of protection. Even during active positions for yield generation, all assets remain fully segregated from centralized exchanges’ wallets and securely under the user’s ownership and control.Multi-Layered Risk Management

Effectively managing risks is another area where Falcon Finance differentiates itself. The protocol uses a multi-layered risk management framework that spans everything from day-to-day market volatility to once-in-a-lifetime crisis events.

Decentralized Governance and Controls

Falcon’s architecture is designed so that no single actor can unilaterally compromise the system. Administrative actions (like moving funds or changing parameters) require multiple approvals via a multisignature scheme. This prevents insider misuse and removes single points of failure in governance. All major decisions and storage operations are distributed among trusted parties, lowering the risk of human error or malfeasance.

Debtless Positions

Falcon’s design avoids exposing individual users to debt or margin risk when they mint USDf. If a user’s posted collateral falls too much in value below the defined liquidation threshold, Falcon will liquidate that collateral to protect the system, but the user keeps the USDf they already minted. In other words, users are never on the hook to repay a loan in USDf. The worst-case scenario is losing the collateral they put up. This no-debt model prevents the cascade of liquidations and debts that often occur in lending protocols during market crashes, while also simplifying risk for users: once you mint USDf, you won’t face sudden margin calls.

Risk Monitoring and Control

Beyond these structural safeguards, Falcon’s risk management extends to active monitoring and response systems. The platform treats extreme market events such as a sudden 90% altcoin crash or a stablecoin depeg as critical scenarios to manage swiftly.

Falcon’s trading engine is built on a delta-neutral and options-based framework. If an extraordinary price swing starts to threaten those balances, Falcon has automated controls in place to react immediately:

- Unified real-time monitoring. All of Falcon’s trading strategies feed into a unified risk system that continuously watches the net exposure. The moment an imbalance appears (for instance, if an altcoin’s price spikes rapidly), the system detects it and can take action.

- Automatic thresholds. Falcon pre-defines thresholds at which it will cut exposure in unstable conditions. For example, if an altcoin used as collateral suddenly surges beyond a certain percentage, the protocol’s algorithms will automatically sell some of the altcoin, and close perpetual futures positions to reduce the exposure. This prevents the situation where a rapid price move leaves the system under-collateralized.

- Liquidity flexibility. To make sure it can act fast, Falcon keeps a portion of every position in liquid form. At least 20% of altcoin holdings are maintained on exchanges to allow instant liquidation if needed. Likewise, Falcon negotiates for minimal lock-up periods on any staked assets, so it can withdraw and sell quickly during turbulence. This flexibility ensures the protocol isn’t caught off-guard by rigid lockups when swift action is required.

- USDf peg stability. Falcon Finance also has specialized monitoring for the risk of a stablecoin in its reserves depegging from $1. If an unusual deviation in a stablecoin’s price is detected, Falcon can respond in one of two ways: either immediately unwind its exposure to that asset (taking only a small loss of a few basis points if done early), or maintain a fully hedged position and wait for the peg to recover. The choice depends on the situation, but in both cases Falcon’s priority is to avoid large losses from a depeg event.

The protocol’s philosophy is not to guess when the next crash or spike will happen, but to always be ready for it. In doing so, Falcon maintains stability and protects users through all market conditions.

Setting a New Standard for Trust

The challenges of transparency and security have caused many to proceed with caution, or avoid the digital asset space altogether. Falcon Finance proves that a yield-generation and collateralization protocol can deliver sustainable, competitive returns while staying transparent, principled, and secure. With real-time dashboards, independent audits, robust custody architecture, strict risk management, and well-tested strategies, Falcon has built an ecosystem grounded in sound design.

In the end, its approach also offers a blueprint for the future of onchain finance, showing that user trust must be earned with verifiable data and resilient design, not promises.