Guide to Earning Miles: Yield Tokenization Protocols

Updated • 15 Oct 2025

Published • 15 Sept 2025

8 mins

Yield tokenization protocols open new ways to earn in DeFi by splitting yield-bearing assets into principal and yield components. Within Falcon Finance’s Miles program, they also provide consistent opportunities to collect reward points, similar to supplying liquidity to selected pools on decentralized exchanges (DEXs), or to locking liquidity in the money markets’ vaults. In this article, we will guide you through all available options for earning Miles in the yield tokenization space.

What Are Yield Tokenization Protocols?

Yield tokenization protocols in DeFi make it possible to split a yield-bearing asset into two components: the principal token (PT) and the yield token (YT). Dapps like Pendle, Spectra, and Napier, all part of the Falcon Miles program, apply this model by letting users deposit USDf synthetic dollar, sUSDf yield-bearing token, or other supported digital assets, and convert them into PTs and YTs.

This separation allows for pursuing different strategies: buying PTs for stability of fixed income, trading YTs to speculate on variable yields, or combining both for enhanced flexibility. Ultimately, these protocols bring efficiency, liquidity, and new opportunities for hedging and leveraging returns in DeFi.

Beyond PTs and YTs, yield tokenization protocols also offer liquidity provision through pools. By supplying assets, users receive LP tokens representing their share of the pool, which can be staked or used to earn trading fees and additional incentives on platforms such as Penpie and Equilibria (for Pendle).

Together, PTs, YTs, and LP tokens unlock a full spectrum of opportunities: stable returns, yield speculation, and liquidity rewards, making yield tokenization one of the most flexible and composable areas in DeFi.

How to Earn Falcon Miles in Yield Tokenization Protocols?

Even though each protocol supports different underlying assets, the core opportunities for earning Miles are consistent across yield tokenization: you can either supply liquidity to earn and hold LP tokens, or exchange and hold yield tokens (YTs) to gain direct exposure to future yield.

Be aware that, for supplying liquidity, Miles are earned only on the SY portion of the pool (more on that below).

Pendle

The first protocol where you can earn Falcon Finance’s Miles within the yield tokenization space is Pendle. There are six tasks for it:

- Supply liquidity to the USDf pool

- Hold YT tokens of the USDf pool

- Supply liquidity to the sUSDf pool

- Hold YT tokens of the sUSDf pool

- Supply liquidity to the GHO-USDf pool

- Hold YT tokens of the GHO-USDf pool

Let’s break down each of these tasks in detail.

How Does Supplying Liquidity Work in Pendle?

Liquidity pools in Pendle differ from those on traditional DEXs because each pool contains exactly two assets: the underlying asset (wrapped in its SY version) and the principal token (PT). For instance, in a USDf pool, the underlying crypto is USDf (SY), while the paired token is PT USDf.

If the USDf pool holds $10 million in total liquidity with 60% in USDf (SY) and 40% in PT USDf, then your Miles rewards will apply to 60% of the LP tokens you receive when providing liquidity. This percentage can shift over time, as it depends on the evolving balance between the two assets in the pool.

What Is an SY Token?

In Pendle and other protocols mentioned in this article, the underlying asset is supplied to pools not in its native form but as its SY wrapped version. SY is a token standard for wrapped yield-bearing assets. When providing liquidity, you can wrap the asset into SY yourself to reduce smart contract fees slightly, or let the protocol handle the conversion automatically, depositing the asset directly from your wallet and receiving LP tokens in return.

How to Supply Liquidity to the USDf Pool on Pendle?

If your goal is to farm Miles by supplying liquidity in Pendle or another eligible yield tokenization protocol, your main objective is to obtain and hold LP tokens.

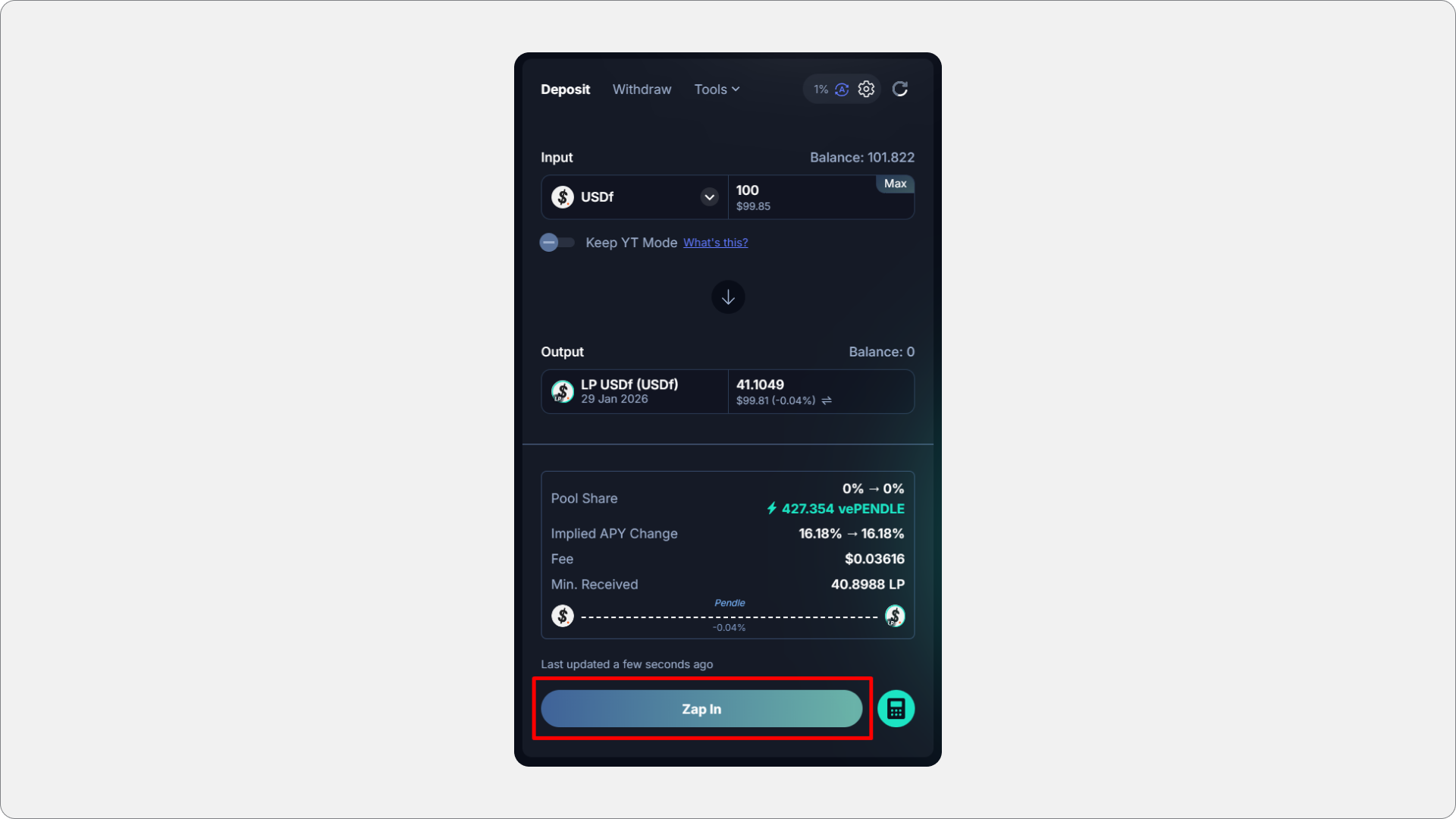

In Pendle’s USDf pool, liquidity can be added in two ways: automatic Zapping or manual deposits. Zapping is the simplest option, as the protocol handles all conversions internally with minimal tradeoffs.

The manual method, on the other hand, requires calculating the optimal ratio of USDf and PT USDf based on the pool’s structure, then swapping part of your USDf into PT USDf before depositing—an approach better suited for advanced users.

This guide focuses on Zapping, which streamlines the process: simply go to the USDf pool’s page, connect your wallet, and ensure the exchange mode is set to Zap (default). Enter the amount of USDf to supply, approve spending, and confirm the transaction by clicking “Zap In”. The protocol will automatically perform all necessary swaps, and you’ll receive LP tokens representing your share of the pool.

The same process applies to the sUSDf and GHO-USDf pools. You can get sUSDf by staking USDf in Falcon Finance. For the GHO-USDf pool, the steps involve a few additional stages: first, supply liquidity to the GHO-USDf pool on Balancer, then depositthe resulting LP tokens in the GHO-USDf Yearn vault. Once that’s done, you’ll be able to deposit Yearn’s LP tokens (yvBal-GHO-USDf) to Pendle and receive Pendle LP tokens in return.

APY Amplifying Opportunities

Just like with tasks of earning Miles for liquidity provisioning for DEXs and DeFi money markets, you can boost your returns by locking your LP tokens in additional protocols. For example, LP tokens from the USDf pool can be further staked in Penpie, StakeDAO, Equilibria, or Beefy to amplify yield and rewards. Check the summary table below to learn all amplification opportunities for other Pendle pools included in the Miles program.

How to Buy and Hold YT Tokens in Pendle?

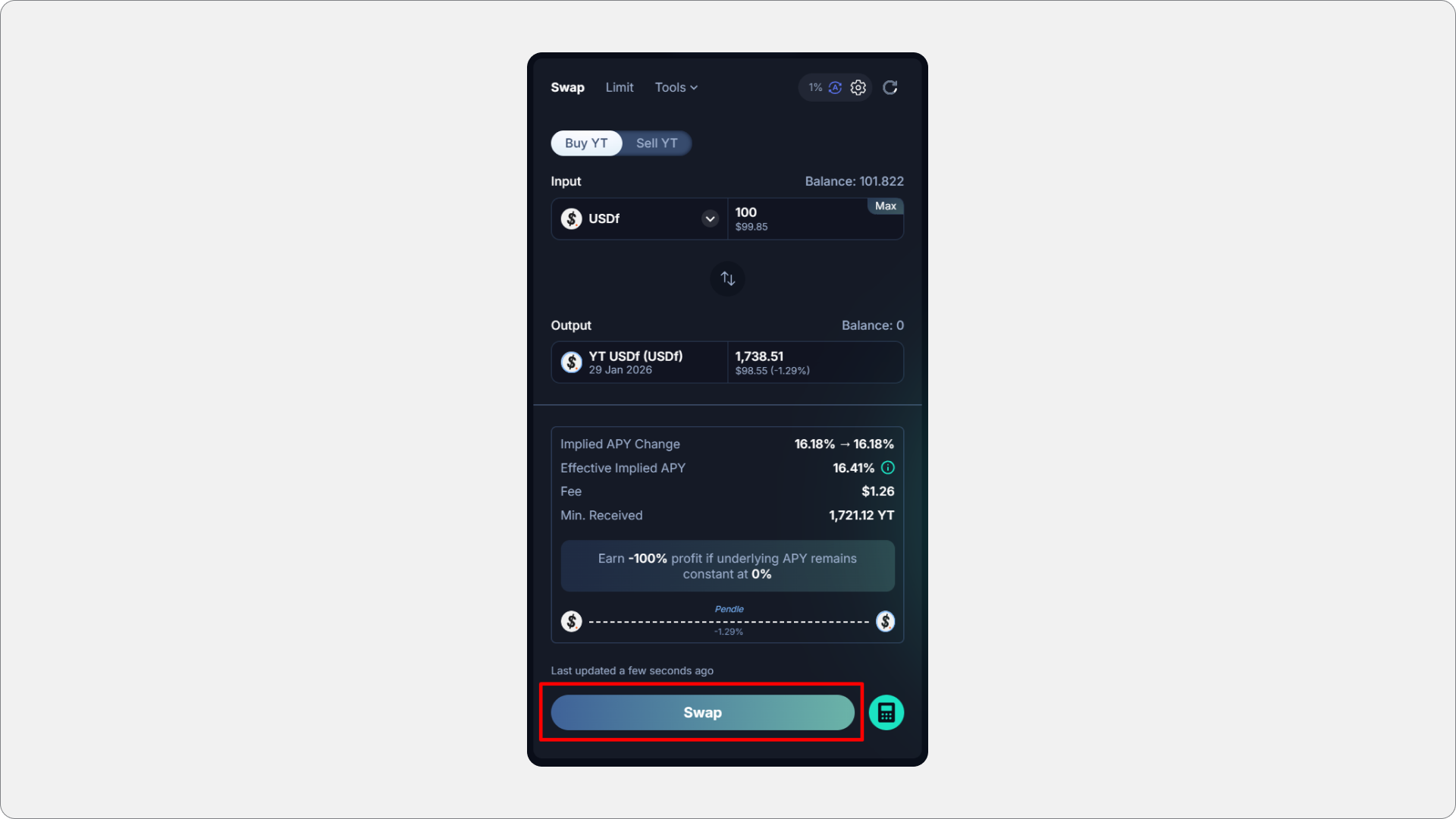

Another way to earn Miles in Pendle is by holding yield tokens (YT) from the eligible pools: USDf, sUSDf, or GHO-USDf. YT grants you the full yield generated by the underlying asset, but it also comes with negative yield risk, meaning your returns could turn unfavorable if the yield moves against your position.

Acquiring YT is straightforward: go to the PT/YT exchange page for the pool of your choice (e.g., USDf), either by clicking “Go to LP” from the liquidity pool’s page or using a direct link. From there, select Buy YT, enter the desired amount, and confirm the transaction.

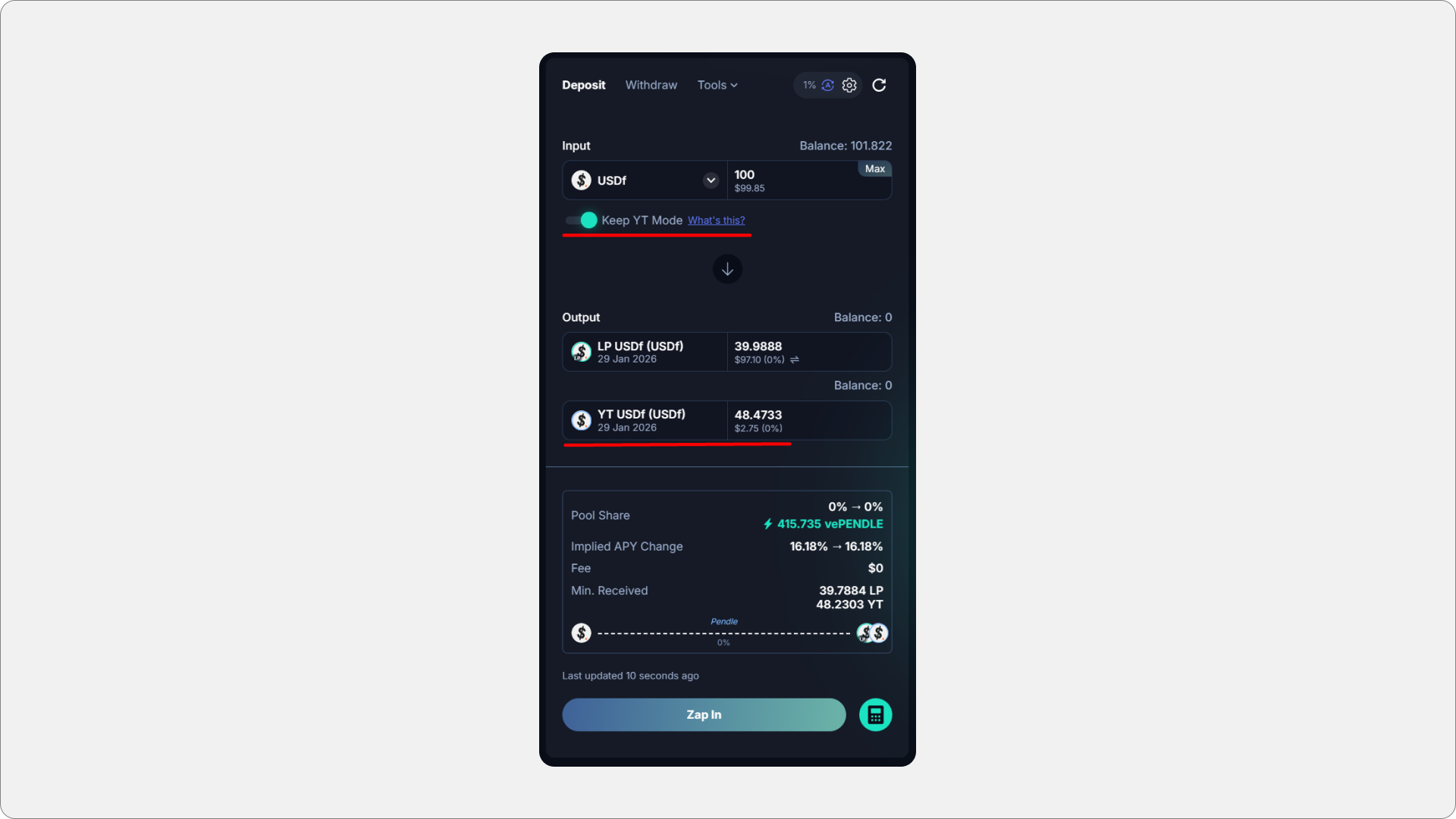

Alternatively, you can combine both strategies, supplying liquidity and holding YT tokens, to earn Miles. To do this, simply toggle the “YT Mode” option when exchanging the underlying asset for LP tokens. With this setting enabled, the protocol will automatically allocate part of your deposit into YT tokens, while the rest is converted into LP tokens, giving you exposure to both reward streams.

You can track earnings on the Dashboard page.

Spectra

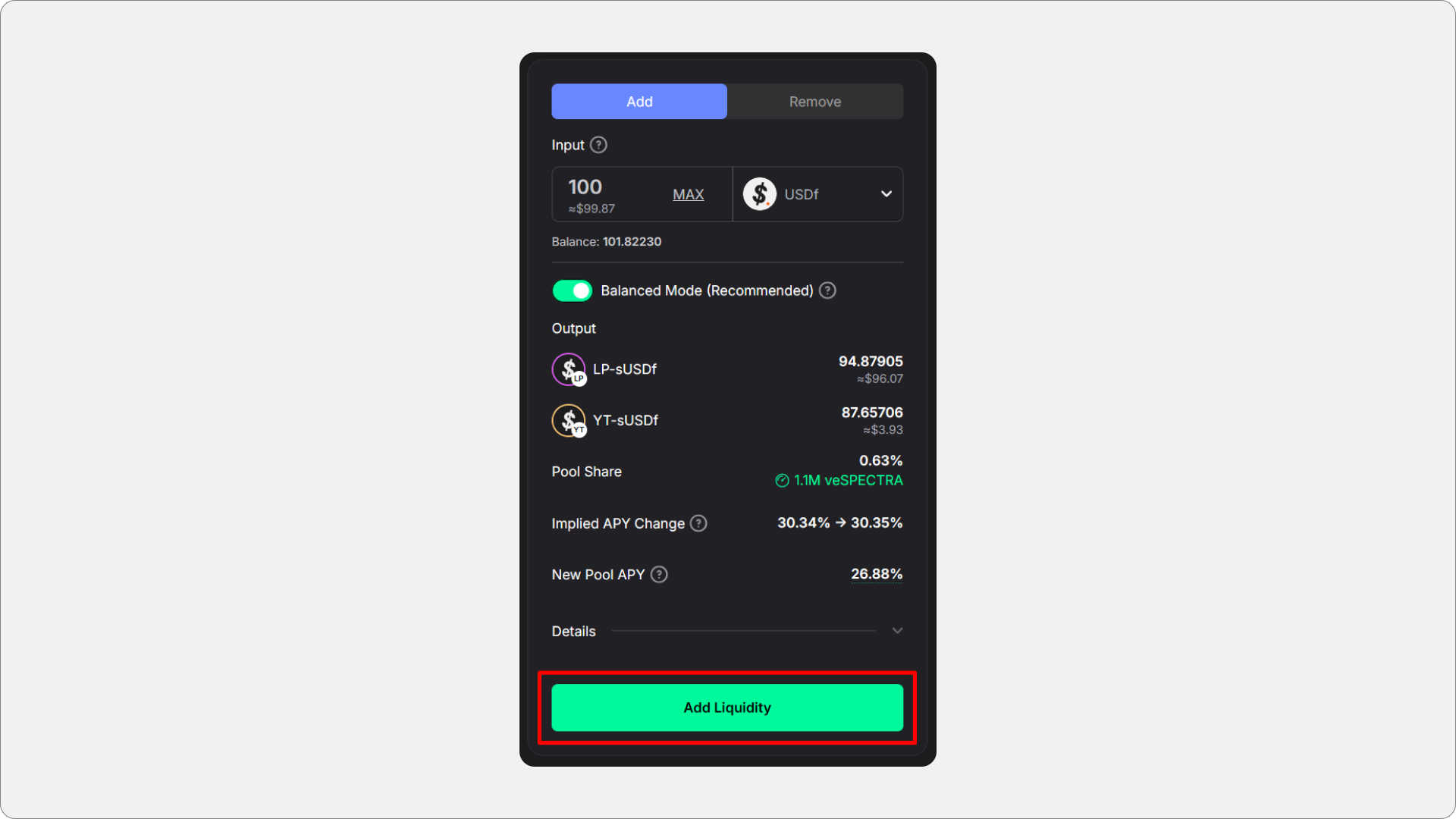

In Spectra, the eligible pool for earning Falcon Miles is the sUSDf pool, where you can gain Falcon Finance’s Miles rewards both by supplying liquidity and by holding YT-sUSDf tokens.

The process of supplying liquidity works much like in Pendle: go to the pool’s page, enter the amount you want to supply, and confirm the transaction.

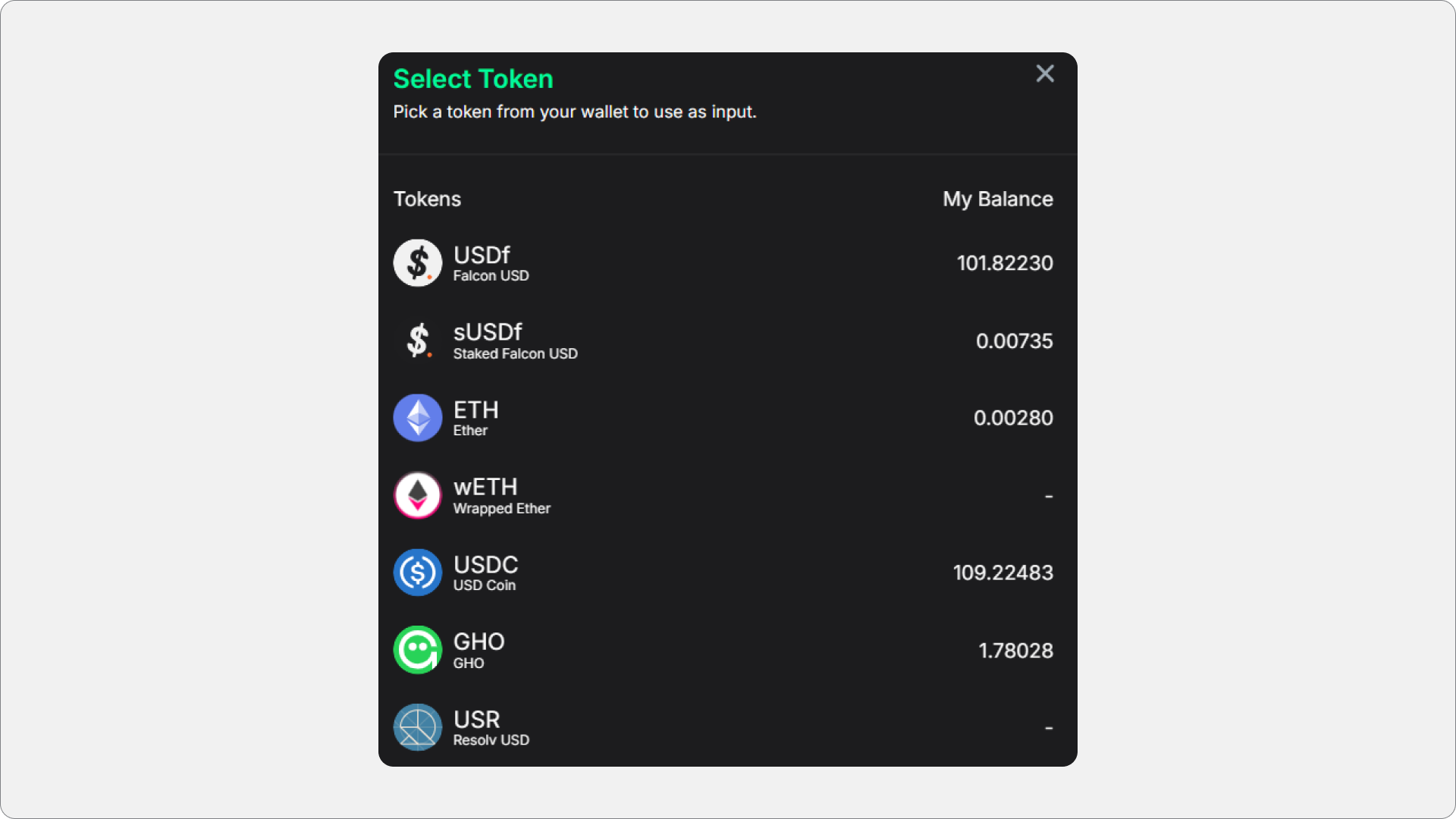

One key difference, however, is that Spectra is not limited to the underlying asset: while you can deposit sUSDf, you also have the option to provide liquidity with other cryptocurrencies such as USDf or ETH, which the protocol converts as needed.

All positions can be easily tracked on the Portfolio page.

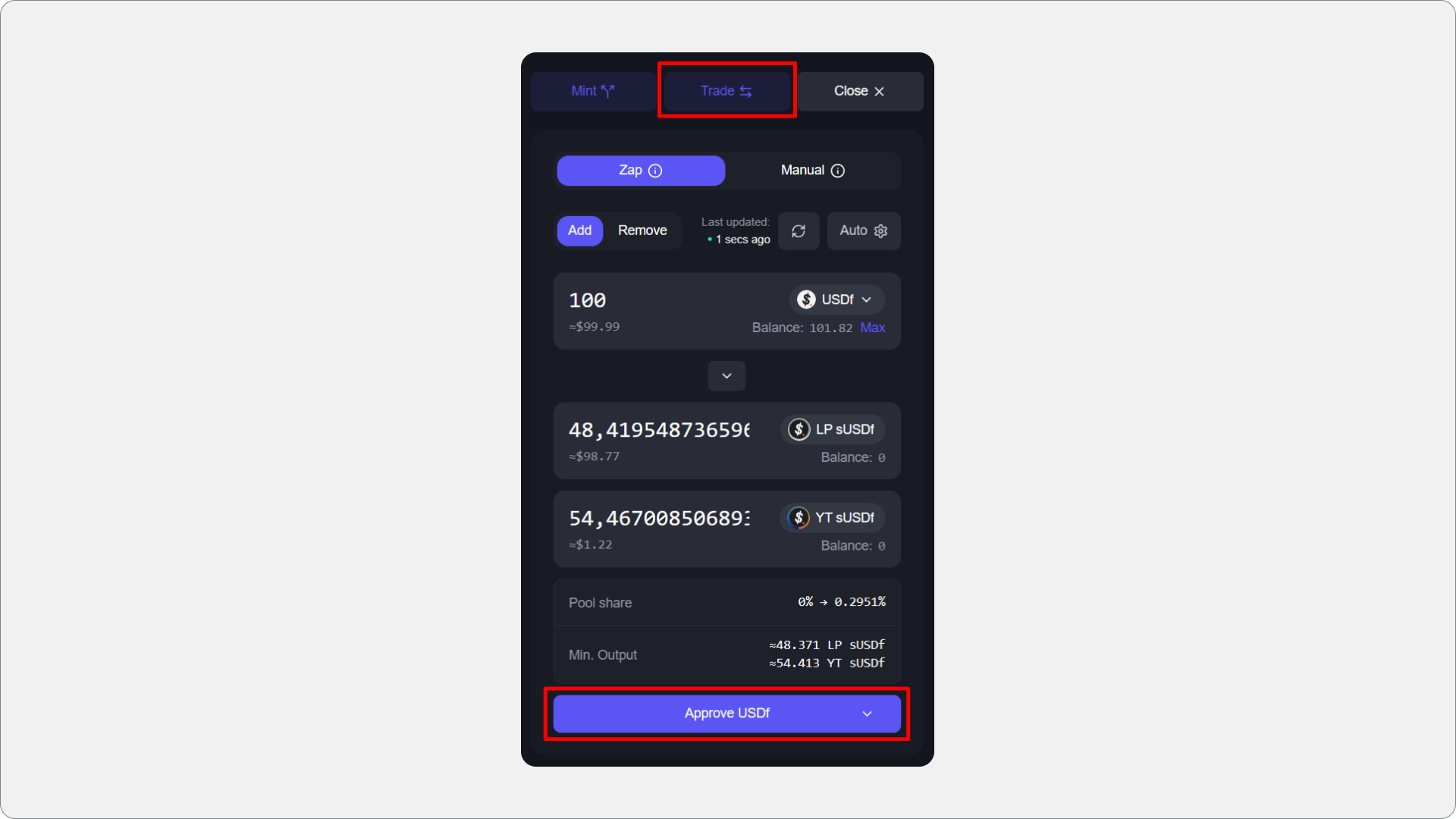

Napier

In Napier, you can also earn Miles by becoming a liquidity provider for the sUSDf pool. To do so, head to the pool’s page, enter the amount you wish to supply—whether it’s sUSDf, another supported asset, or any of over 1,200 available tokens—approve spending in your wallet, and confirm the transaction. Unlike Pendle, Napier automatically converts your deposit into both LP and YT tokens when using Zapping. If you prefer to acquire YT tokens separately, you can do so anytime by swapping them on the Trade page. Earning stats is available on the Dashboard page.

Earning Miles in Yield Tokenization Protocols: Comparison Table

Here’s an overview of all the methods covered in this article, giving you a clear comparison of the available options for earning yield and Falcon Miles across different protocols:

Protocol | Task | Max. Miles Multiplier | Yield Amplifiers |

Pendle | Supply liquidity to the USDf pool | 60x | |

Pendle | Supply liquidity to the sUSDf pool | 72x until September 29, 2025; 36x after that. | |

Pendle | Supply liquidity to the GHO-USDf pool | 60x | |

Pendle | Hold YT-USDf tokens | 60x | |

Pendle | Hold YT-sUSDf tokens | 72x until September 29, 2025; 36x after that. | |

Pendle | Hold YT-GHO-USDf tokens | 60x | |

Spectra | Supply liquidity to the sUSDf pool | 36x | |

Spectra | Hold YT-sUSDf tokens | 36x | |

Napier | Supply liquidity to the sUSDf pool | 36x | |

Napier | Hold YT-sUSDf tokens | 36x |

Final Thoughts

Yield tokenization protocols—Pendle, Spectra, and Napier—provide multiple yet comparable ways to earn Falcon Miles rewards, whether by supplying liquidity and holding LP tokens, acquiring YT tokens for direct yield exposure, or combining both strategies.

While each dApp differs slightly in mechanics and supported assets, the opportunities are broadly aligned: Falcon points on top of stable income through LPs, speculative or leveraged yield via YTs, and additional amplification through partner protocols.

Together, these methods give Falcon users a diverse but balanced set of options to grow both their on-chain yield and their Miles stash.